CHICAGO – Only two of Illinois' nine public universities – the flagship University of Illinois and Illinois State University – retain investment grade ratings after a fresh round of downgrades from Moody’s Investors Service.

The credit blows Friday to all seven universities rated by Moody’s dropped two more into junk territory and gives Illinois another black mark.

The University of Illinois' main borrowing credit is now rated A1, making it the lowest rated among comparably sized flagship schools nationally, the rating agency said.

The actions – which impact $2.2 billion of outstanding debt – resolved a credit review launched April 17 and follow the rating agency’s downgrade of the state’s general obligation rating early this month to Baa3. The outlook on all seven universities remains negative.

Moody’s does not rate Chicago State University or Western Illinois University. Other than Illinois, Moody’s rates only three other public universities at the speculative grade level, the lowest of which is University of Puerto Rico at Ca, said spokesman David Jacobson. Other flagships have at times been rated at the A1 level or lower.

S&P’s recent downgrades also put Illinois’ flagship U of I – now rated A-minus -- at the bottom of state flagship schools. West Virginia University is the next lowest at A with all others rated at A-plus or above, S&P said Monday. No state flagship university currently rated by S&P has ever been rated below A-minus.

Moody’s lowered U of I’s $1.1 billion of auxiliary facility system revenue bonds and $258 million of certificates of participation to A1 from Aa3; $47 million of south campus bonds to A2 from A1; and $85 million of health system bonds to Baa1 from A3.

“The downgrades reflect U of I's still material reliance on the state of Illinois (Baa3 negative) for operations, including on-behalf payments for employee benefits, and incorporates uncertainty regarding longer-term funding prospects from the state,” Moody’s wrote.

The flagship has better withstood late and reduced aid due to its own liquidity cushion bolstered by $4.3 billion in cash and investments and diverse revenue streams that include research funding.

“While U of I has demonstrated ability to grow student related revenues based on its still strong reputation, prolonged budget challenges will more materially impair its strategic positioning and longer term financial health,” Moody’s wrote.

The health services downgrade additionally incorporates expected pressures on pledged revenues from Medicaid reimbursement and cash collections from insurers due to state liquidity pressures.

Moody’s dropped Illinois State’s $74 million of auxiliary bonds to Baa2 from Baa1 and $48 million of COPs to Baa3 from Baa2. “As the state's budget impasse continues, the university's strategic positioning will weaken absent ability to invest in programs and facilities,” analysts wrote.

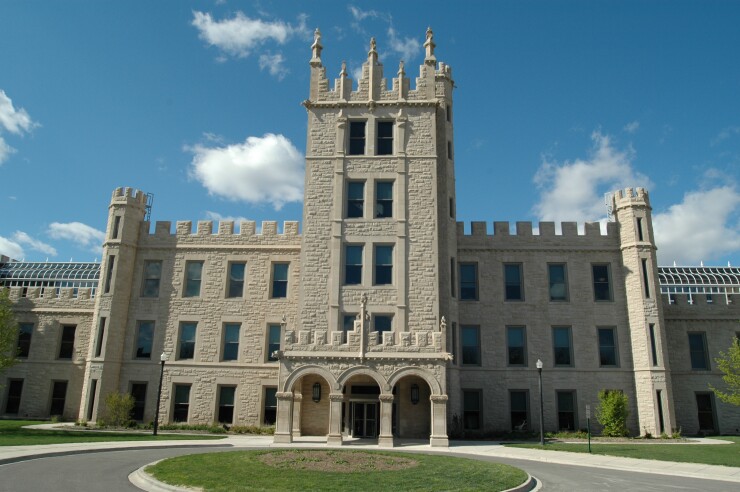

Moody’s latest actions punished Northern Illinois University and Southern Illinois University with multi-notch downgrades that left their ratings in junk. Northern’s auxiliary bonds were lowered to Ba2 from Baa3 and its COPs to Ba3 from Ba2. Southern’s auxiliary bonds sunk to Ba2 from Baa2 and its COPS to B1 from Baa3.

Governors State University, Eastern Illinois University, and Northeastern Illinois University all feel deeper into junk territory. Governors’ auxiliary bonds were lowered to Ba3 and its COPs to B1. Eastern was lowered to B2 and Caa2, respectively. Moody’s lowered Northeastern’s COPs to B3. It does not rate the school’s auxiliary bonds.

The universities’ woes extend beyond the shortage in fiscal 2016 and 2017 state funding that dried up in the current fiscal year Jan. 1. U of I received just 30% of what it expected in fiscal 2016 and 50% in fiscal 2017 which ends this month.

The schools rely on the state for about 40% of their operating funds, although that’s lower for the flagship school.

The state’s massive $15 billion bill backlog has so severely strained liquidity that “even if a state budget is successfully passed, the timing of payments to the university is highly uncertain given the state's payables,” Moody’s wrote in the flagship’s report. The concern, however, was cited in all the school reports.

S&P dropped the flagship and ISU to A-minus from A after it lowered the state earlier this month to BBB-minus. The rating agency caps the ratings for public universities to three notches above the state rating.

That action followed S&P’s move in April hammering the ratings of six schools that pushed an additional two in junk. All remain on credit watch with negative implications.

Neither Moody’s nor S&P rate Chicago State University. S&P does not rate Northern but it is rated by Moody’s. Western Illinois University is rated by S&P but not Moody’s.

The universities have all warned of the dire, long-term impact of the funding drought on their balance sheets, reputations, and ability to attract students as the impasse progresses and they are forced to cut programs and staff, drop school days, and raise tuition.

COPS are payable from state-appropriated funds and budgeted legally available funds but they are especially at risk as they represent an unsecured obligation that a university board can terminate if revenues are not available.

The auxiliary revenue bonds are typically secured by a pledge of net revenues of the auxiliary system as well as pledged fees and tuition and sometimes parking, dining, residential, athletic, and research facilities.