Newly hired Long Island Power Authority Chief Financial Officer Tamela Monroe has arrived during a busy period for the public utility as it tackles aggressive infrastructure goals while grappling with financial challenges posed by the COVID-19 pandemic.

Monroe, a utility veteran dating back to the early 1980s, was approved as LIPA CFO in late July and is slated to officially take over the financial leadership position on Sept. 1. She is working closely with interim CFO Mujib Lodhi and is also operating as a senior advisor to LIPA CEO Tom Falcone as part of the transition period.

“LIPA has ambitious goals and it will be an honor to serve as chief financial officer to lead these initiatives,” said Monroe, who started at LIPA after spending nearly two years at the Colorado Springs Utilities as chief planning and finance officer. “LIPA has become a first-class utility and I’m looking forward to continuing that good work.”

Prior to leading finances at the Colorado Springs Utilities, Monroe spent 36 years at the Omaha Public Power District in Nebraska. She directed the power organization’s financial services business operations in her final year in Omaha as senior director.

Monroe’s first week at LIPA coincided with the agency holding a $602 million bond sale on Aug. 4 to fund its 2020 capital program. The utility, which services about 1.1 million customers in the New York City region, is financing a large pipeline of capital initiatives through bonding including a $176 million underground cable project and a $242 million investment for new smart meters.

Goldman Sachs led LIPA’s bond early August transaction, which included $488 million of Series 2020A revenue bonds and Series 2020B mandatory tender revenue bonds. The offering also included a refinancing featuring $114 million of Series C federally taxable revenue bonds that Monroe said produced $28 million of net present value savings.

The bond issuance resulted in $5.7 billion of orders from more than 100 instituitional investors, according to Monroe. The $238 million Series 2020A revenue bonds were priced with yields ranging from 0.18% for 2022 maturities and 1.68% for debt maturing in 2040.

“The bonds were very well received,” Monroe said. “That overwhelming investor demand allowed LIPA to record the lowest interest rates in every bond maturity and with all-time credit spreads on almost the majority of those maturities.”

Monroe said LIPA is committed to carrying out long-term infrastructure projects despite deferring $60 million of capital spending the next two years due to the COVID-19-induced recession. The underground transmission line that is being constructed in Nassau County to meet national reliability standards is on track for completion by the end of 2020 and will be funded nearly entirely through bonding.

LIPA is also embarking on green energy infrastructure projects as part of a mandate from New York Gov. Andrew Cuomo for half of the state’s electricity to be made up of renewables by 2030.

“With the pandemic we tried to optimize investment, but these major investments are going forward,” Monroe said. “There are a variety of projects planned across the grid..”

LIPA’s debt is rated A2 by Moody’s Investors Service and A by S&P and Fitch Ratings, with stable outlooks. The utility achieved the highest credit ratings in its 34-year history following three one-notch

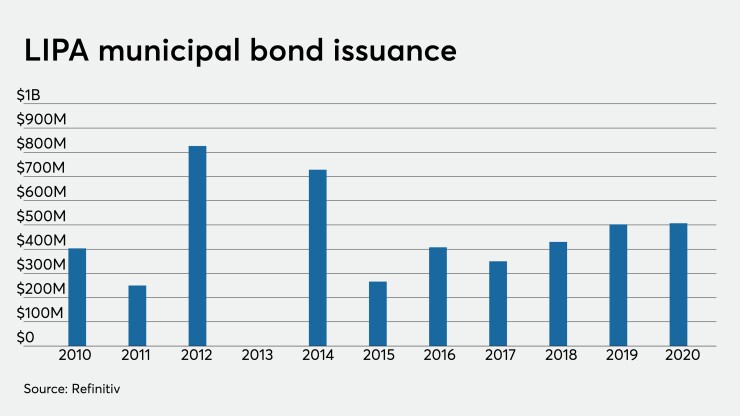

Last year’s credit boost came on the heels of LIPA refinancing more than half of its $7.6 billion in previous outstanding debt through the issuance of triple-A-rated bonds from its Utility Debt Securitization Authority, which netted around $492 million in present value savings. LIPA now has an estimated $10.8 billion of outstanding debt, according to Fitch. It has sold about $4.5 billion of bonds since 2010, according to Refinitiv.

“They have had a period of deleveraging the last five to six years and they have seen some improvements in that time,” said Fitch analyst Dennis Pidhenry.

Pidhenry added that LIPA is better positioned than other utilities to weather the pandemic’s closure of many non-essential businesses, since residential customers account for 56% of its revenues.

LIPA, which was formed in 1986, became the retail supplier for Nassau and Suffolk Counties as well as the Rockaway Peninsula of Queens through its 1998 acquisition of the Long Island Lighting Company. Investor-owned PSEG Long Island took over LIPA’s operations six years ago following the LIPA Reform Act of 2013 signed by Governor Cuomo in response to the agency's performance struggles after Superstorm Sandy battered the Northeast in October 2012.

Tropical Storm Isaias also caused widespread damage across the New York City metropolitan area Tuesday with more than 100,000 PSEG Long Island customers still left without power as of Friday. Pidhenry said any negative fallout from PSEG’s response will not likely impact LIPA’s credit conditions, but he noted that it may halt its recent momentum of seeing improving customer satisfaction levels.

“That comes with the business,” said Monroe of getting hit with a tropical storm early on in her LIPA tenure. “You are always going to have weather events. We’re focused on restoring power quickly and will review lessons learned after the storm.”

Monroe stressed that Falcone's leadership was a big drawing card of her decision to take move the move to Long Island and said there have been productive meetings with him via Zoom early on while LIPA’s Uniondale headquarters is closed. Falcone, a former Morgan Stanley Banker who was promoted to CEO from CFO four years ago, has spearheaded an aggressive debt refinancing and instituted modest rate increases since arriving at LIPA in 2014.

“With nearly four decades of utility experience, she will continue to build upon LIPA’s record of investing in customer service, clean energy, and reliability while keeping electric bills flat,” Falcone said in a statement about Monroe. “Her knowledge and experience with strategic planning, oversight, financial markets, regulatory agencies, and more make her the perfect choice to lead LIPA’s financial future.”