Buyers’ sentiment barely budged as new issuance flooded the muni market on Tuesday.

One New York trader classified the primary market as a ''lower rate trading hell" as munis were mixed.

“There are still balances from last week’s deals, the street is heavy, bid/asks are widening and people are tired of basic non-performance,” the trader said. “The demand is still lacking and the January effect has not materialized.”

He added that the care level of investors has diminished.

“I would say anyone who is participating is a reluctant participant,” he said. “With all the cross-currents, I don’t see anything happening to change that in the short-term.

Citi priced the Massachusetts Department of Transportation’s $442.925 million of metropolitan highway system revenue refunding bonds on Tuesday. The bonds are rated Aa2 by Moody’s Investors Service, AA by S&P Global Ratings and AA-plus by Fitch Ratings.

RBC priced the Pennsylvania Housing Financing Agency’s $201.615 million of single family mortgage revenue bonds on Tuesday, featuring alternative minimum tax and non-AMT bonds. The deal is rated Aa2 by Moody’s and AA-plus by Fitch.

Citi also priced the Utah’s $129.175 million of general obligation bonds. The deal is rated triple-A by Moody’s, S&P and Fitch.

Sibert Cisneros and Shank priced Miami-Dade County, Fla.’s $230.85 million of water and sewer system revenue bonds for retail investors on Tuesday. The deal is rated Aa3 by Moody’s, AA-minus by S&P and A-plus by Fitch.

In the competitive arena, Wake County, N.C., sold a total of $268.66 million of GO refunding and GO public improvement bonds on Tuesday.

Citi won the GO refunding bonds with a true interest cost of 1.78%. Bank of America Merrill Lynch won the GO PIBs with a TIC of 2.76%. The deals carry top-tier ratings of triple-A from Moody’s, S&P and Fitch.

Citi priced the State of Arizona’s $426 million of refunding certificates of participation. The deal is rated Aa3 by Moody’s and AA-minus by S&P.

Though municipals were off to a good start in 2019, they could be due for a breather after a strong fourth quarter in 2018, Anthony Valeri, investment strategist at Zions Bancorp.

“Current municipal bond prices largely reflect an economic slowdown and the Fed pausing on rate hikes,” Valeri said in an interview Tuesday.

“There’s limited fuel to propel prices meaningfully higher from here absent significant deterioration in economic data, which we don’t expect,” he added.

Municipal valuations relative to Treasuries have become more expensive since the start of the year, which is another reason to expect some moderation, according to Valeri.

However, he said the change is modest and valuations relative to taxable bonds are not excessive.

Higher yields, compared with a year ago, should support performance and still keeps the municipal bond market performance on track to improve versus 2018, Valeri said.

“The 30-day calendar, at roughly $9 billion, is about average and not likely to disrupt the market, especially with investors slowly returning to absorb supply as Fed rate hike risks recede,” Valeri added.

Tuesday’s bond sales

Secondary market

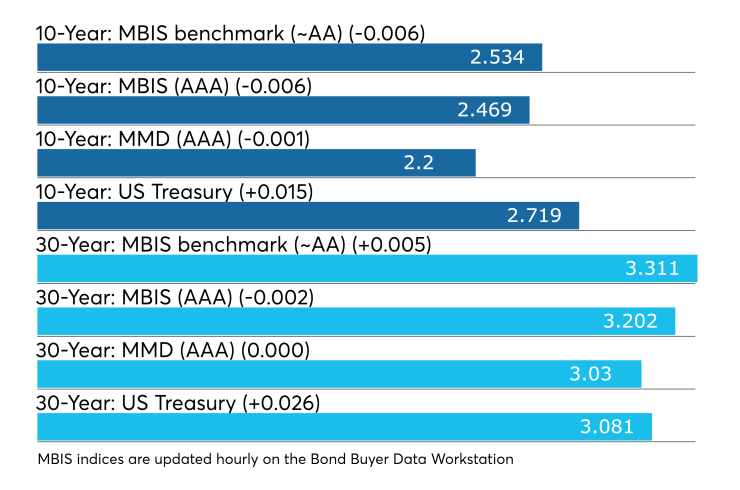

Municipal bonds were mixed Tuesday, according to a late read of the MBIS benchmark scale. Benchmark muni yields fell as many as two basis points in the three- to seven-year, nine- to 13-year and 20- to 24-year maturities. The one-, two-, eight-, 14- to 18-year and 25-year to 30-year maturity saw yields rise by no more than a basis point. The remaining three maturities were unchanged.

High-grade munis were mostly stronger, with yields calculated on MBIS' AAA scale falling as much as two basis points in the three- to seven-year, nine- to 15-year and 17- to 30-year maturities. The one- and two-year maturities saw yields rise by less than a basis point and the eight and 16-year maturities were flat.

Municipals were mixed on Municipal Market Data’s AAA benchmark scale, which showed the yield on the 10-year muni general obligation lower by one basis point, while the 30-year muni maturity was unchanged.

On Tuesday, the 10-year muni-to-Treasury ratio was calculated at 81.2% while the 30-year muni-to-Treasury ratio stood at 98.4%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasury with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasury; if it is below 100%, munis are yielding less.

Previous session's activity

The Municipal Securities Rulemaking Board reported 37,934 trades on Monday on volume of $7.838 billion.

California, New York and Texas were the municipalities with the most trades, with the Golden State taking 15.969% of the market, the Empire State taking 11.982% and the Lone Star State taking 10.396%.

Treasury to sell $40B 4-week bills

The Treasury Department said it will sell $40 billion of four-week discount bills Thursday. There are currently $30.005 billion of four-week bills outstanding.

Treasury also said it will sell $30 billion of eight-week bills Thursday.

Gary E. Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.