After several years of sluggish revenue growth, U.S. states enacted cautious budgets for fiscal 2018, according to the

State general fund spending is forecast to total $830.2 billion in fiscal 2018, a 2.3% rise from spending levels for

Overall, 26 states passed budgets with general fund spending growth under 2% in fiscal 2018 while the median growth rate for all 50 states was 1.7%, the survey showed. Five states forecast general fund revenue declines in fiscal 2018, although 15 states enacted general fund spending declines.

In fiscal 2018, state resources remained tight as lawmakers continued to deal with the impact of recent weakness in tax collections. Some states also worked to restore structural balance after revenue shortfalls over the past several years, the survey showed.

“Enacted budgets reflect substantial limitations and caution on the part of policymakers as states contend with the effects of two consecutive years of sluggish revenue growth and particular spending pressures,” NASBO said. “State general fund spending is projected to grow 2.3% in fiscal 2018 compared to fiscal 2017 spending levels, the lowest spending increase since fiscal 2010 when state spending declined during the Great Recession.”

Only 11 states enacted general fund spending increases more than 4%, a modest threshold by historical standards, according to NASBO, which added that most of those states were in the faster-growing regions of the Southeast and West.

Several states with faster spending growth, including Connecticut, Illinois and Kansas, approved tax hikes to help address long-term fiscal challenges and rising spending demands.

Some energy producing states budgeted for spending declines.

The slow revenue growth was coupled with rising spending requirements for areas such as pensions, healthcare, and education, which limited budget flexibility for states. Many states continued to strengthen their reserves while others turned to their rainy day funds to address budget shortfalls.

Lackluster revenue performance in fiscal 2017 was the primary cause for 22 states making mid-year budget reductions, the most since fiscal 2010, NASBO said. The reductions totaled $3.5 billion.

Most states can’t end their fiscal year with a deficit, though a few are allowed to do so under certain conditions. Shortfalls arising during the fiscal year are addressed by reducing appropriated spending.

Most of the states making mid-year budget cuts also reported that general fund revenue collections came in below projections.

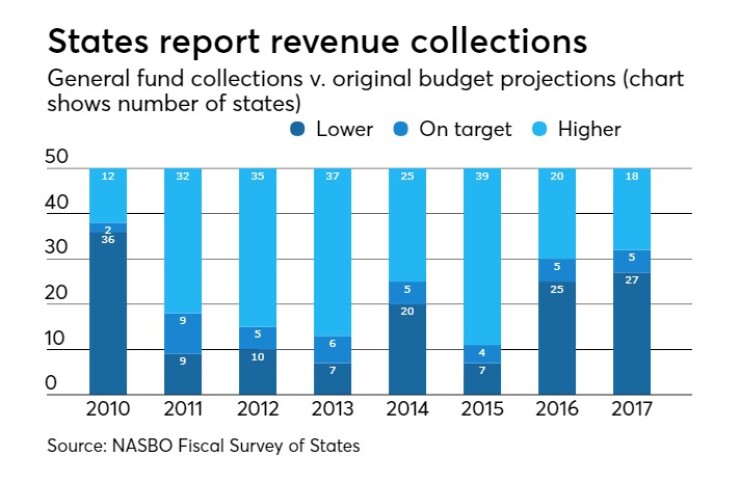

For the second year in a row, more states saw revenues come in below than above original forecast, with 27 states reporting that preliminary actual general fund revenue collections came in under budget projections in fiscal 2017.

Most states reported collections below the original budget estimates for personal income, sales, and corporate income taxes. For sales and corporate income taxes, this is the second consecutive year that collections were below budget for most states.

Most states reported their general fund revenue collections coming in on target or above budget forecast in early fiscal 2018.

Looking ahead, the survey found that fiscal 2018 budgets expect revenues to improve alongside moderate economic growth. Strength in the stock market may help state revenues and pension funds, however, fixed costs for pension contributions and healthcare continue to grow faster than revenues, according to NASBO.

Variation in fiscal conditions across states will also persist, tied to differences in demographic trends, economic performance, and state policies.

“States also continue to face uncertainty with respect to the federal budget and tax policy changes that can have numerous implications for state budgets in both the short and longer terms,” the report said.

During a conference call on Wednesday, NASBO president-elect Michael Cohen said there were plenty of reasons for states to remain cautious in their budgeting practices.

The federal government’s attempts to change healthcare and push for tax code changes were cause for concern, said Cohen, director of the California Department of Finance.