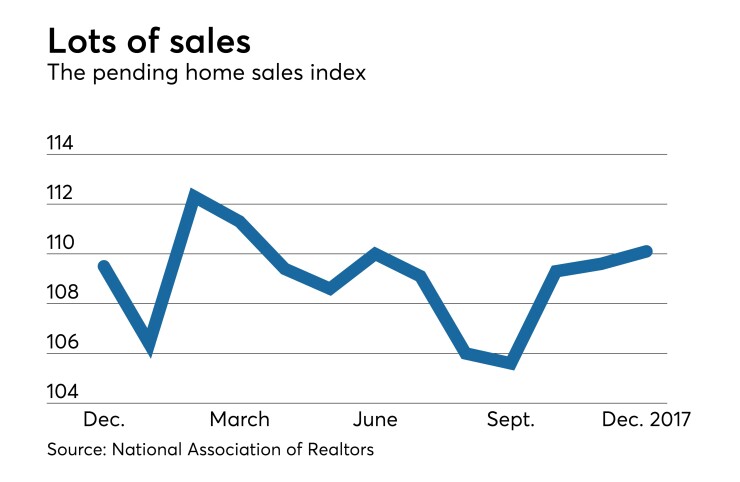

Pending home sales rose 0.5% to an index reading of 110.1 in December, from an upwardly revised 109.6 in November, first reported as 109.5, according to a report released Wednesday by the National Association of Realtors.

An index of 100 is equal to the average level of contract activity during 2001.

Year-over-year the pending homes sales index increased 0.5% from last December, when the index was 109.5.

IFR Markets predicted the index would be up 0.3%.

Regionally, pending sales were mixed. The Northeast saw a 5.1% fall to 93.9, and sales dropped 0.3% to 105.0 in the Midwest, while gaining 2.6% in the South to 126.9 , and growing 1.5% in the West to 101.7.

“Another month of modest increases in contract activity is evidence that the housing market has a small trace of momentum at the start of 2018,” NAR Chief Economist Lawrence Yun said. “However, new buyers coming into the market are finding out quickly that their options are limited and competition is robust. Realtors say many would-be buyers from earlier this year, stifled by tight supply and higher prices, are still trying to buy a home.

"Sadly, these positive indicators may not lead to a stronger sales pace. Buyers throughout the country continue to be hamstrung by record low supply levels that are pushing up prices – especially at the lower end of the market."

NAR said existing-home sales and price growth are forecast to moderate this year, in part because the new tax law’s negative impact on high-cost housing markets.

“In the short term, the larger paychecks most households will see from the tax cuts may give prospective buyers the ability to save for a larger down payment this year, and the healthy labor economy and job market will continue to boost demand,” said Yun. “However, there’s no doubt the nation’s most expensive markets with high property taxes are going to be adversely impacted by the tax law.

Yun added, “Just how severe is still uncertain, but with homeownership now less incentivized in the tax code, sellers in the upper end of the market may have to adjust their price expectations if they want to trade down or move to less expensive areas. This could in turn lead to both a decrease in sales and home values.”