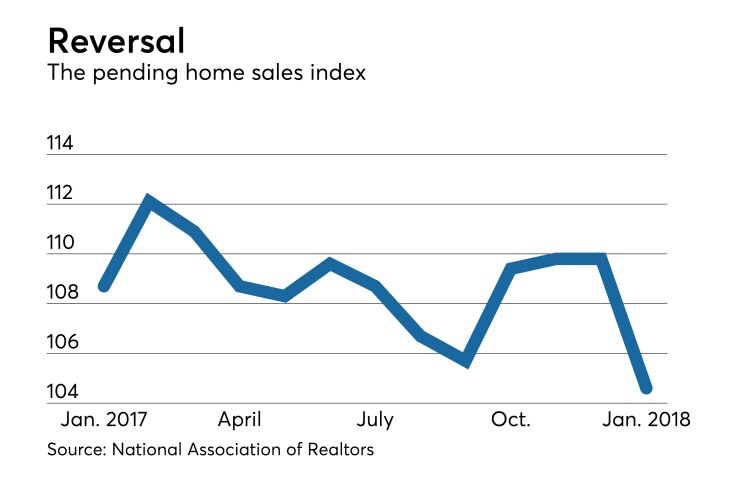

Pending home sales plunged 4.7% to an index reading of 104.6 in January, from a downwardly revised 109.8 in December, first reported as a 0.5% gain to 110.1, according to a report released Wednesday by the National Association of Realtors.

An index of 100 is equal to the average level of contract activity during 2001.

Year-over-year the pending homes sales index decreased 3.8% from last January, when the index was 104.1. The index hasn’t been this low since it was 104.1 in October 2014, NAR said.

IFR Markets predicted the index would be up 0.4%.

Regionally, pending sales were down. The Northeast saw a 9.0% fall to 87.0, and sales dropped 6.6% to 98.2 in the Midwest, while falling 3.9% in the South to 121.9 , and sliding 1.2% in the West to 97.9.

“The economy is in great shape, most local job markets are very strong and incomes are slowly rising, but there’s little doubt last month’s retreat in contract signings occurred because of woefully low supply levels and the sudden increase in mortgage rates,” NAR Chief Economist Lawrence Yun said. “The lower end of the market continues to feel the brunt of these supply and affordability impediments. With the cost of buying a home getting more expensive and not enough inventory, some prospective buyers are either waiting until listings increase come spring or now having to delay their search entirely to save up for a larger down payment.”

The supply at the end of January was an all-time low for the month and off 9.5% from a year ago.