Top shelf municipal bonds are weaker in early activity as traders make preparations to tackle next week's $6 billion calendar.

Ipreo estimates next week's volume at $6.01 billion, down from a revised total of $6.49 billion this week, according to updated data from Thomson Reuters. Next week's slate is comprised of $4.94 billion of negotiated deals and $1.08 billion of competitive sales.

Secondary market

The yield on the 10-year benchmark muni general obligation rose as much as two basis points from 1.85% on Thursday, while the 30-year GO yield increased as much as two basis points from 2.69%, according to a read of Municipal Market Data's triple-A scale.

U.S. Treasuries were weaker on Friday. The yield on the two-year Treasury rose to 1.34% from 1.32% on Thursday as the 10-year Treasury yield gained to 2.88% from 2.19% while the yield on the 30-year Treasury bond increased to 2.88% from 2.85%.

On Thursday, the 10-year muni to Treasury ratio was calculated at 84.4%, compared with 84.0% on Wednesday, while the 30-year muni to Treasury ratio stood at 94.2% versus 93.8%, according to MMD.

MSRB: Previous session's activity

The Municipal Securities Rulemaking Board reported 39,160 trades on Thursday on volume of $11.996 billion.

Week's actively traded issues

Some of the most actively traded bonds by type in the week ended June 8 were from New Jersey California and Illinois issuers, according to

In the GO bond sector, the Union City, N.J., 2.25s of 2018 were traded 30 times. In the revenue bond sector, the Los Angeles County, Calif., 5s of 2018 were traded 112 times. And in the taxable bond sector, the Illinois 5.1s of 2033 were traded 46 times.

Week's actively quoted issues

Illinois and New York names were among the most actively quoted bonds in the week ended June 8, according to Markit.

On the bid side, the Illinois taxable 6.63s of 2035 were quoted by 74 unique dealers. On the ask side, the New York Hudson Yards Infrastructure Corp. revenue 4s of 2036 were quoted by 221 unique dealers. And among two-sided quotes, the Illinois taxable 6.725s of 2035 were quoted by 27 unique dealers.

Week’s primary market

Chicago came to market with two deals this week.

Siebert Cisneros Shank priced Chicago’s $396.74 million of project and refunding second lien wastewater transmission revenue bonds.

The bonds are rated A by S&P Global Ratings and AA-minus by Fitch Ratings and Kroll Bond Rating Agency, with the exception of the Series 2017A’s 2042 and 2052 maturities totaling $78.76 million that are insured by Assured Guaranty Municipal and are rated AA by S&P and AA-plus by Kroll.

Cabrera Capital Markets priced the city’s $196.22 million of Series 2017 second lien water revenue refunding bonds. The deal is rated A by S&P Global Ratings and AA-minus by Fitch Ratings and AA by Kroll except for the 2030-2035 maturities which are insured by AGM and rated AA by S&P and AA-plus by Kroll.

RBC Capital Markets priced the Metropolitan Washington Airports Authority’s $523.79 million of Series 2017A airport system revenue refunding bonds, subject to the alternative minimum tax. The deal is rated Aa3 by Moody’s Investors service and AA-minus by S&P and Fitch.

Barclays Capital priced the East Bay Municipal Utility District, Calif.’s $497.13 million of Series 2017A water system revenue green bonds and Series 2017B water system revenue refunding bonds. The deal is rated Aa1 by Moody’s, AAA by S&P and AA-plus by Fitch.

Morgan Stanley priced the Regional Transportation District, Colo.’s $120.09 million of Series 2017B sale tax revenue bonds for the Fasttracks Project. The deal is rated Aa2 by Moody’s, AA-plus by S&P and AA by Fitch.

Bank of America Merrill Lynch priced the Board of Regents of the Texas A&M University’s $496.9 million of tax-exempt and taxable bonds. The deal is rated triple-A by Moody’s, S&P and Fitch.

Wells Fargo Securities priced the city of St. Louis, Mo.’s $258.44 million of airport refunding and revenue bonds for the St. Louis Lambert International Airport. The $125.41 million of Series 2017A revenue refunding non-alternative minimum tax bonds were insured by AGM and rated A2 by Moody’s and AA by S&P. The $74.72 million of Series 2017B AMT bonds were insured by AGM and rated A2 by Moody’s and AA by S&P, with the exception of the 2018 maturity, which is un-insured and rated A3 by Moody’s and A-minus by S&P. The $31.7 million of revenue Series 2017C non-AMT bonds were insured by AGM and rated A2 by Moody’s and AA by S&P. The $26.605 million of Series 2017D AMT bonds were insured by AGM and rated A2 by Moody’s and AA by S&P.

Citigroup priced the Macomb Interceptor Drain Drainage District, Mich.’s $126.8 million of Series 2017A limited tax general obligation drain and refunding bonds. The deal is rated Aa1 by Moody’s Investors Service and AA-plus by S&P.

Ramirez priced the Texas Department of Housing and Community Affairs’ $133.7 million of single-family mortgage revenue and refunding bonds. The deal is rated Aa1 by Moody’s and AA-plus by S&P.

Piper Jaffray priced the Pearland Independent School District, Texas’ $105.51 million of Series 2017 unlimited tax school building bonds. The deal, which is backed by the Permanent School Fund guarantee program, is rated triple-A by Moody’s and Fitch.

In the short-term sector, Citigroup priced Los Angeles County, Calif.’s $800 million of 2017-2018 tax and revenue anticipation notes. The TRANs are rated MIG1 by Moody’s, SP1-plus by S&P and F1-plus by Fitch.

And JP Morgan Securities priced Riverside County, Calif.’s $340 million of 2017 tax and revenue anticipation notes. The deal is rated SP1-plus by S&P and F1-plus by Fitch.

In the competitive arena, the Clark County School District, Nev., sold $473.88 million of bonds in two separate offerings. JPMorgan won the $412.31 million of Series 2017A limited tax general obligation building and refunding bonds with a true interest cost of 2.55%. Citigroup won the $61.57 million of Series 2017B limited tax GO refunding bonds additionally secured by pledged revenues with a TIC of 1.12%. The deals are rated A1 by Moody’s and AA-minus by S&P.

The Virginia College Building Authority sold $251.04 million of Series 2017A & B education facilities revenue and revenue refunding bonds for the 21st Century College and equipment program. Citigroup won the deal with a true interest cost of 1.58%. The deal is rated Aa1 by Moody’s and AA-plus by S&P and Fitch.

Seattle, Wash., sold $239.92 million of Series 2017 drainage and wastewater system improvement and refunding revenue bonds. PNC Capital Markets won the deal with a TIC of 3.15%. The deal is rated Aa1 by Moody’s and AA-plus by S&P.

Orange County, Fla., sold $194.74 million of Series 2017 tourist development tax refunding revenue bonds. Wells Fargo Securities won the deal with a TIC of 2.05%. The deal is rated Aa3 by Moody’s, AA-minus by S&P and AA by Fitch.

And the New Hampshire Bond Bank sold $118.71 million of Series 2017B revenue bonds. BAML won the bonds with a TIC of 2.98%. The deal is rated Aa2 by Moody’s and AA-plus by S&P.

Bond Buyer reports 30-day visible supply

The Bond Buyer's 30-day visible supply calendar increased $1.77 billion to $9.04 billion on Friday. The total is comprised of $3.33 billion of competitive sales and $5.70 billion of negotiated deals.

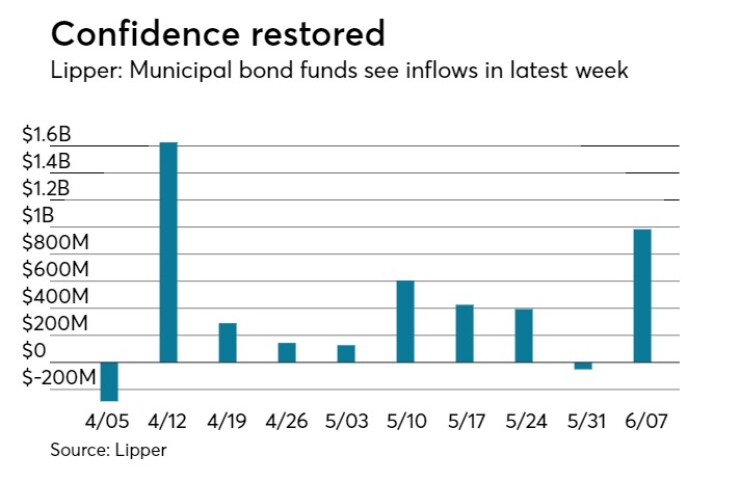

Lipper: Muni bond funds see inflows

Investors in municipal bond funds reversed course and put cash back into the funds in the latest week, according to Lipper data released late on Thursday.

The weekly reporters saw $985.092 million of outflows in the week ended June 7, after outflows of $50.837 million in the previous week.

The four-week moving average was in the green at positive $438.868 million, after being positive at $344.028 million in the previous week. A moving average is an analytical tool used to smooth out price changes by filtering out fluctuations.

Long-term muni bond funds had inflows of $636.005 million in the latest week after outflows of $106.029 million in the previous week. Intermediate-term funds had outflows of $97.336 million after outflows of $96.676 million in the prior week.

National funds had inflows of $947.171 million after inflows of $77.134 million in the previous week. High-yield muni funds reported inflows of $336.996 million in the latest reporting week, after outflows of $7.485 million the previous week.

Exchange traded funds saw inflows of $113.843 million, after inflows of $64.657 million in the previous week.