Top-rated municipal bonds were weaker at midday as traders eagerly await the new issue slate to start rolling in.

Secondary market

The yield on the 10-year benchmark muni general obligation rose as much as one basis point from 1.87% on Friday, while the 30-year GO yield increased as much as one basis point from 2.71%, according to a read of Municipal Market Data's triple-A scale.

U.S. Treasuries were mixed on Monday. The yield on the two-year Treasury rose to 1.34% from 1.33% on Friday as the 10-year Treasury yield fell to 2.19% from 2.20% while the yield on the 30-year Treasury bond decreased to 2.84% from 2.85%.

The 10-year muni to Treasury ratio was calculated at 85.1% on Friday, compared with 84.4% on Thursday, while the 30-year muni to Treasury ratio stood at 95.0% versus 94.2%, according to MMD.

MSRB: Previous session's activity

The Municipal Securities Rulemaking Board reported 31,691 trades on Friday on volume of $7.749 billion.

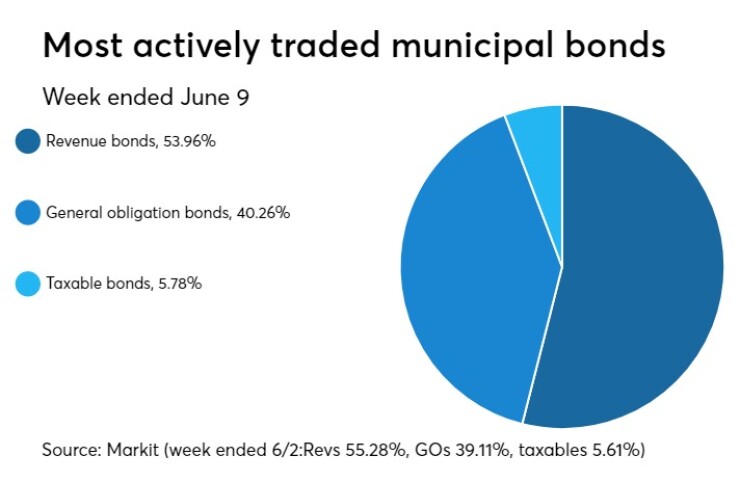

Prior week's actively traded issues

Revenue bonds comprised 53.96% of new issuance in the week ended June 9, down from 55.28% in the previous week, according to

General obligation bonds comprised 40.26% of total issuance, up from 39.11%, while taxable bonds made up 5.78%, up from 5.61%.

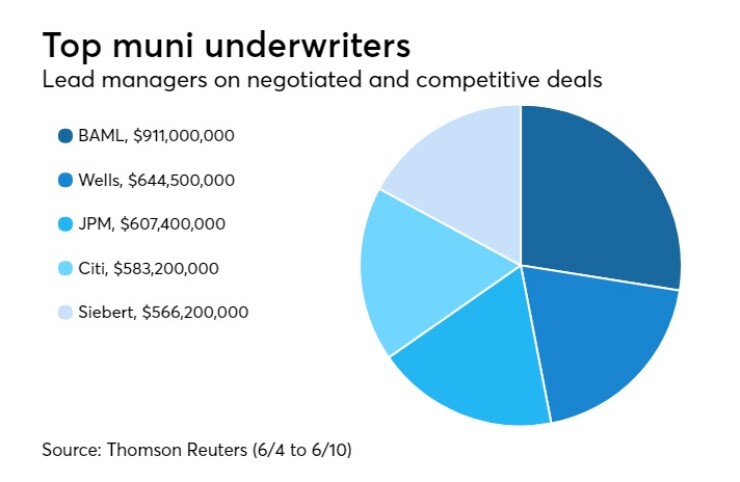

Previous week's top underwriters

The top negotiated and competitive underwriters of last week included Bank of America Merrill Lynch, Wells Fargo, JPMorgan Securities, Citigroup and Siebert Cisneros Shank & Co., according to Thomson Reuters data.

In the week of June 4 to June 10, BAML underwrote $911 million, Wells $644.5 million, JPMorgan $607.4 million, Citi $583.2 million and Siebert $566.2 million.

Primary market

On this week’s calendar, there are 15 scheduled negotiated deals bond sales larger than $100 million and one competitive deal.

JPMorgan is slated to price the New York City Housing Development Corp.’s $272.73 million of multi-family housing revenue sustainable neighborhood bonds for retail investors on Monday, ahead of the institutional pricing on Tuesday. The deal is rated Aa2 by Moody’s Investors Service and AA-plus by S&P Global Ratings.

Fifth Third Securities are expected to price the county of New Hanover, N.C.’s $213.76 million of hospital revenue bonds for the New Hanover Regional Medical Center. It is anticipated the deal will mature serially from 2018 through 2037 and feature terms in 2042 and 2047 and is rated A1 by Moody’s and A-plus by S&P.

Bond Buyer reports 30-day visible supply

The Bond Buyer's 30-day visible supply calendar increased $2.30 billion to $11.34 billion on Monday. The total is comprised of $3.60 billion of competitive sales and $7.74 billion of negotiated deals.

Muni bond CUSIP requests rose 32% in May

Demand for new municipal bond CUSIP identifiers surged 32% in May after falling 13% in April, CUSIP Global Services said on Monday. This made last month the most active so far this year for new requests for muni bond identifiers. The report tracks requests by issuers for bond identifiers as an early indicator of new volume.

A total of 1,224 new municipal bond identifier requests were made last month, compared to 930 in April, 1,066 in March, 933 in February and 826 in January.

On a year-over-year basis, however, municipal bond request volume was down through the end of May. For the year to date through May, municipal bond CUSIP orders were 4,979, down 25.2% from the same period in 2016, when 6,660 were sought.

“A combination of macroeconomic and technical variables have driven a fair amount of volatility in month-to-month CUSIP request volume so far this year,” Gerard Faulkner, director of Operations at CUSIP Global Services, said in a press release. “Overall uncertainty about where the markets and interest rates are going, and preparations for pending regulatory reforms such as the Fiduciary Rule have all conspired to create a choppy trend in pre-trade activity.”

Broken down, long-term muni note CUSIP requests totaled 41 and 79 short-term muni requests were made along with 69 other municipal CUSIP category requests bringing the municipal bond industry total to 1,413 for May. On a year-over-year basis, the industry total was 5,871 down 21.4% from the 7,465 sought in the same period in 2016.

“In the big picture, we’re seeing very healthy levels of CUSIP request volume, indicative of robust new issuance activity,” said Richard Peterson, senior director at S&P Global Market Intelligence. “But the path we’ve been taking to get there has been bumpy with monthly surges in activity followed by slow-downs over the course of the year.”