Top-shelf municipal bonds were steady as most of the week's handful of bond sales priced on Tuesday, according to traders.

Secondary Market

Top-shelf municipal bonds finished Tuesday unchanged, as the yield on the 10-year benchmark muni general obligation was flat at 2.45% from Monday, while the yield on the 30-year was steady at 3.18%, according to a final read of Municipal Market Data's triple-A scale.

U.S. Treasuries were mostly weaker at Tuesday's close. The yield on the two-year Treasury was flat at 1.22% from Monday, while the 10-year Treasury yield rose to 2.56% from 2.53%, and the yield on the 30-year Treasury bond increased to 3.15% from 3.11%.

The 10-year muni to Treasury ratio was calculated at 95.6% on Tuesday, compared with 96.7% on Monday, while the 30-year muni to Treasury ratio stood at 101.0%, versus 102.3%, according to MMD.

"The secondary is still pretty busy with a rush to get as much tax loss selling/swapping done as is reasonably possible," said one New York trader. "The ability to continue to trade right into the end of the year is an opportunity that hasn't presented itself like this in at least the last 10 years."

Primary Market

Volume for this week is forecast by Ipreo to drop to $481 million, from a revised $4.17 billion in the previous week, according data from Thomson Reuters. The calendar is comprised of $210 million of negotiated deals and $271 million of competitive sales.

There are no negotiated deals on the calendar larger than $100 million; in fact, the largest negotiated deal is just $62 million.

"Issuance is basically finished for the year now," said the New York trader. "Volumes are around 20% lighter than the last two weeks but there is pretty much no primary action, so it's busier in the secondary."

The commonwealth of Massachusetts sold two competitive deals, totaling $188.49 million on Tuesday. The $100 million of general obligation refunding SIFMA index bonds series A were won by Morgan Stanley with a true interest cost of 1.22%. The bonds were priced as a bullet maturity in 2019 and are due Feb. 1, 2019 and can be callable on Aug. 1, 2018 at par. There were six firms that bid.

The $88.49 million of GO refunding SIFMA index bonds series B were won by RBC Capital Markets with a TIC of 1.31%. The bonds were priced as a bullet maturity in 2020 and are due Feb. 1, 2020 and can be callable on Aug. 1, 2019 at par. There were eight firms that bid.

Both deals are rated Aa1 by Moody's Investors Service and AA-plus by S&P Global Ratings and Fitch Ratings.

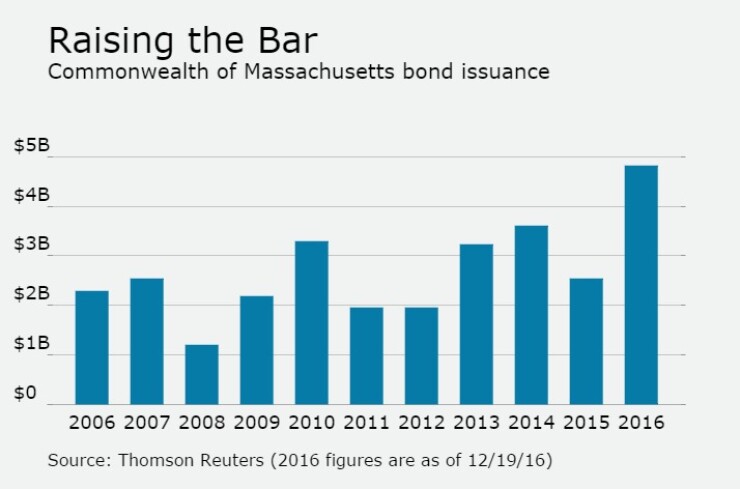

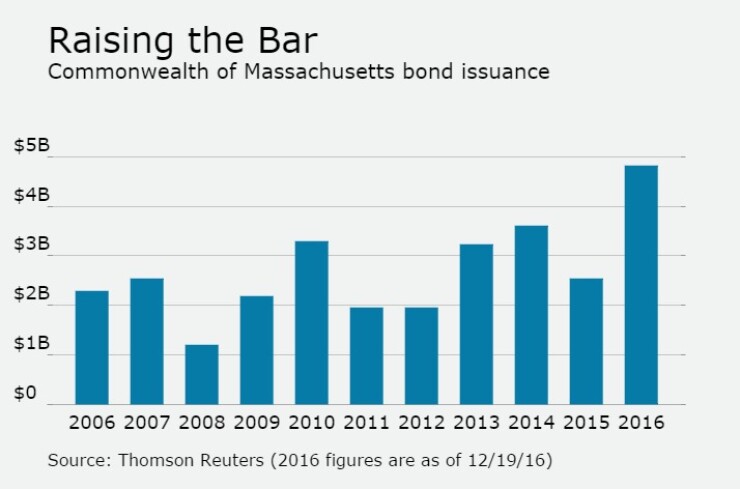

Since 2006, the Bay State has sold roughly $29.64 billion of securities, with the largest issuance before this year occurring in 2014 when it sold $3.6 billion. With Tuesday's sales, it puts the commonwealth at roughly $4.8 billion of issuance this year. Massachusetts has issued over $1 billion in every year since 2006 and saw the lowest issuance in 2008 with $1.2 billion.

The Florida Board of Governors competitively sold $53.04 million of dormitory revenue refunding bonds for Florida Atlantic University, which were won by Janney with a TIC of 3.47%. The bonds were priced to yield from 1.11% with a 3% coupon in 2017 to 4.00% with a 4% coupon in 2033. A term bond in 2036 was priced to yield 4.05% with a 4% coupon. The deal is rated A1 by Moody's, A by S&P and A-plus by Fitch.