Top-shelf municipal bonds continued to yo-yo, as they reversed again and finished stronger on Monday. Yields were much as three basis points lower on some maturities, according to traders.

Secondary Market

The yield on the 10-year benchmark muni general obligation was three basis points lower to 2.45% from 2.48% on Friday, while the yield on the 30-year decreased three basis points to 3.18% from 3.21%, according to a final read of Municipal Market Data's triple-A scale.

U.S. Treasuries were stronger at the close on Monday. The yield on the two-year Treasury fell to 1.22% from 1.25% on Friday, while the 10-year Treasury yield dropped to 2.53% from 2.59%, and the yield on the 30-year Treasury bond decreased to 3.11% from 3.18%.

The 10-year muni to Treasury ratio was calculated at 96.7% on Monday, compared with 95.4% on Friday, while the 30-year muni to Treasury ratio stood at 102.3%, versus 100.8%, according to MMD.

Primary Market

Volume for this week is forecast by Ipreo to drop to $481 million, from a revised total of $4.17 billion in the previous week, according data from Thomson Reuters. The calendar is comprised of $210 million of negotiated deals and $271 million of competitive sales.

There are no negotiated deals on the calendar larger than $100 million; in fact, the largest negotiated deal is just $62 million. The bulk of the issuance comes on Tuesday.

The commonwealth of Massachusetts is scheduled to set sell two competitive deals, totaling $188.49 million of general obligation refunding SIFMA index bonds on Tuesday. The sales are broken down into $100 million and $88.49 million. Both parts are rated Aa1 by Moody's Investors Service and AA-plus by S&P Global Ratings and Fitch Ratings.

George K. Baum and Co. is slated to run the books for the Weld County School District RE-1 Colo.’s $62 million GO bonds. It is expected some maturities will be insured by Assured Guaranty. The deal and is rated Aa2 by Moody’s and AA by S&P.

Mesirow Financial is expected to price Community High School District No. 28, Ill.'s $51.21 million of taxable GO limited tax school bonds and qualified school construction bonds. The deal is rated Aa3 by Moody's.

Janney's Look Ahead at Tax Reform

Janney's municipal bond market monthly report focused on the debate over tax reform that's likely in the next Congress. The Philadelphia based firm said that a strong argument can be made that elimination of the exemption on municipal bonds would be costly to state and local governments, which are now able to finance infrastructure and other projects at lower cost, thanks to the exemption.

"A counter-argument is that direct subsidies would be a more efficient way of supporting financing of infrastructure at the state and local level. This is what oc¬curred with the Build America Bond (BABs) program, popular in 2009 and 2010 before it ended," said the report. "Bonds issued by state and local government issuers under the program were taxable, but a federal subsidy to the issuing government of 35% of interest cost brought net borrowing cost down to below that of tax exempt alternatives."

The report also said that the firm would not be surprised to see a BABs like program return as supplement or even substitute for the current muni exemption.

"Given one-party control in DC, we believe the chances of comprehensive tax reform are stronger than at any point in recent memory. Whether the tax exemption is in jeopardy is less certain. If the only substan¬tive change to the tax system is lowering of the top bracket for individual investors from 39.6% to perhaps 33%, tax free bonds will see little impact, since high bracket investors will still gain significant benefit from the tax exemption."

The report also mentioned the flip side, that to bring marginal tax rates down below 30%, the list of tax expenditures would almost certainly need to be pared, and the tax exemption would be a likely target.

"If this were to happen, we believe older issues would be grandfathered, since making all municipal bonds taxable in one stroke would seriously impair individual and corporate balance sheets."

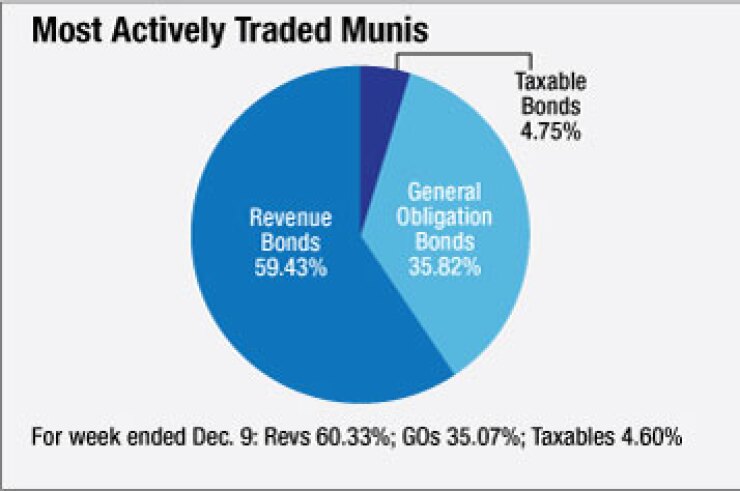

Prior Week's Actively Traded Issues

Revenue bonds comprised 59.43% of new issuance in the week ended Dec. 12, down from 60.33% in the previous week,

Some of the most actively traded issues by type were from New York, Missouri and Alabama. In the GO bond sector, the Suffolk County. N.Y., 2s of 2017 were traded 40 times. In the revenue bond sector, the Metropolitan St. Louis Sewer District, Mo., 5s of 2046 were traded 37 times. And in the taxable bond sector, the Alabama Economic Settlement Authority 4.263s of 2032 were traded 14 times.

Previous Week's Top Underwriters

The top negotiated and competitive underwriters of last week included Barclays, Piper Jaffray, Stifel, Morgan Stanley and RBC Capital Markets, according to Thomson Reuters data. In the week of Dec. 11-Dec. 17, Barclays underwrote $1.46 billion, Piper $574.3 million, Stifel $484 million, Morgan Stanley $361.2 million and RBC $292.9 million.