Top-shelf municipal bonds were steady through midday on Tuesday, according to traders, who saw a handful of new deals hit the market.

Secondary Market

Top-shelf municipal bonds were unchanged at midday on Tuesday, as the yield on the 10-year benchmark muni general obligation was flat at 2.45% from Monday, while the yield on the 30-year was steady at 3.18%, according to a read of Municipal Market Data's triple-A scale.

U.S. Treasuries were weaker on Tuesday around midday. The yield on the two-year Treasury rose to 1.23% from 1.22% on Monday, while the 10-year Treasury yield gained to 2.57% from 2.53%, and the yield on the 30-year Treasury bond increased to 3.15% from 3.11%.

The 10-year muni to Treasury ratio was calculated at 96.7% on Monday, compared with 95.4% on Friday, while the 30-year muni to Treasury ratio stood at 102.3%, versus 100.8%, according to MMD.

Primary Market

Volume for this week is forecast by Ipreo to drop to $481 million, from a revised $4.17 billion in the previous week, according data from Thomson Reuters. The calendar is comprised of $210 million of negotiated deals and $271 million of competitive sales.

There are no negotiated deals on the calendar larger than $100 million; in fact, the largest negotiated deal is just $62 million.

The commonwealth of Massachusetts sold two competitive deals, totaling $188.49 million on Tuesday. The $100 million of general obligation refunding SIFMA index bonds series A were won by Morgan Stanley with a true interest cost of 1.22%. No pricing information was immediately available.

The $88.49 million of GO refunding SIFMA index bonds series B were won by RBC Capital Markets with a TIC of 1.31%. Both deals are rated Aa1 by Moody's Investors Service and AA-plus by S&P Global Ratings and Fitch Ratings.

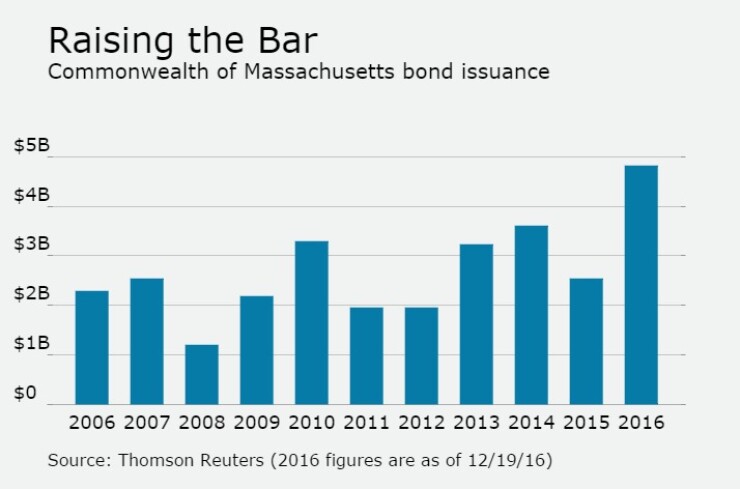

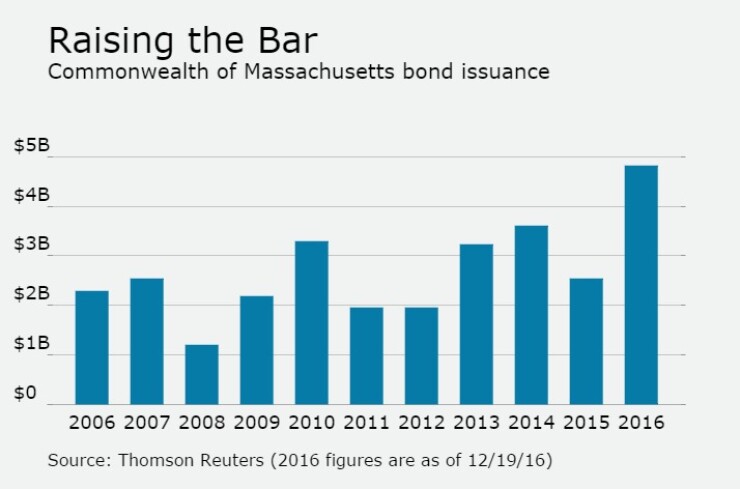

Since 2006, the Bay State has sold roughly $29.64 billion of securities, with the largest issuance before this year occurring in 2014 when it sold $3.6 billion. With Tuesday's sales, it puts the commonwealth at roughly $4.8 billion of issuance this year. Massachusetts has issued over $1 billion in every year since 2006 and saw the lowest issuance in 2008 with $1.2 billion.

The Florida Board of Governors competitively sold $53.725 million of dormitory revenue refunding bonds for Florida Atlantic University, which were won by Janney with a TIC of 3.47%. The deal is rated A1 by Moody's, A by S&P and A-plus by Fitch.

MSRB: Previous Session's Activity

The Municipal Securities Rulemaking Board reported 52,825 trades on Monday on volume of $12.858 billion.

Bond Buyer Visible Supply

The Bond Buyer's 30-day visible supply calendar decreased $145.2 million to $5.65 billion on Tuesday. The total is comprised of $1.34 billion of competitive sales and $4.31 billion of negotiated deals.