Municipal bonds ended steady on Tuesday as billions of dollars in new supply hit traders' screens, led by competitive bond deals from the states of Georgia and Massachusetts and Chicago's O'Hare airport.

Primary market

The state of Georgia sold $1.4 billion of general obligation bonds in four separate competitive offerings on Tuesday.

Bank of America Merrill Lynch won the $430.53 million of Series 2017A Tranche 2 GOs with a true interest cost of 3.06%. The issue was priced to yield from 1.94% with a 5% coupon in 2028 to approximately 3.261% with a 3% coupon in 2037.

Morgan Stanley won the $358.11 million of Series 2017A Tranche 1 GOs with a TIC of 1.46%. Morgan Stanley also won the $352.45 million of Series 2017C refunding GOs with a TIC of 1.899%. Pricing information on these deals was not available.

Wells Fargo Securities won the $273.45 million of Series 2017B taxable GOs; a TIC was 2.99%. The issue was priced to yield from 1.25% with a 4% coupon in 2018 to 3.15% at par in 2033; a 2037 maturity was priced at par to yield 3.30%.

All four deals are rated triple-A by Moody’s Investors Service, S&P Global Ratings and Fitch Ratings.

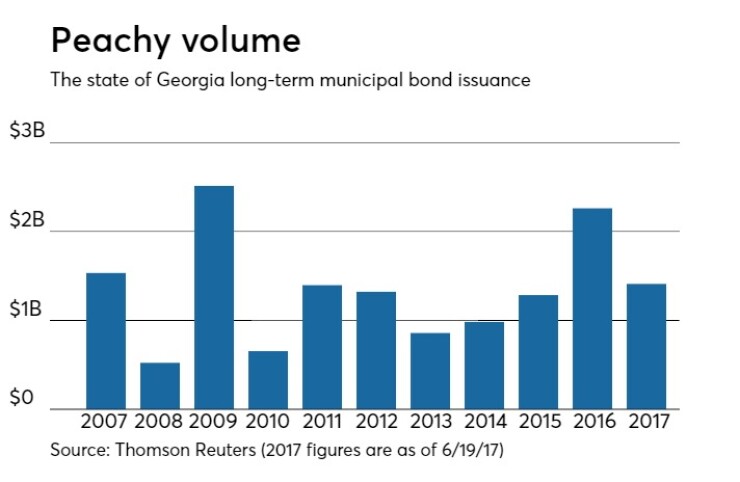

Since 2007 the Peach State has issued roughly $14.46 billion of securities, with the highest yearly total in 2009, when the state issued $2.51 billion of bonds. The lowest year of issuance took place in 2008, when it sold $522 million.

Traders said the deals were attractively priced and received a lot of interest from buyers.

The state of Massachusetts competitively sold almost $785 million of GOs in three separate offerings on Tuesday.

Bank of America Merrill Lynch won the $400 million of consolidated loan of 2017 Series D GOs with a TIC of 3.64%. The issue was priced to yield from 2.62% with a 5% coupon in 2033 to 3.42% with a 4% coupon in 2047.

Citigroup won the $284.85 million of Series 2017D GO refunding bonds with a TIC of 1.92%. The issue was priced as 5s to yield from 1.45% in 2023 to 2.25% in 2028.

Morgan Stanley won the $100 million of consolidated loan of 2017 Series C GOs with a TIC of 2.58%. Pricing information was not immediately available.

The deals are rated Aa1 by Moody’s, AA by S&P and AA-plus by Fitch.

“They came in [the deals] at good levels,” said one New York trader, who added that it was the busiest day in the competitive sector he had seen in a long while.

In the competitive note sector, the New York Metropolitan Transportation Authority sold $500 million of transportation revenue bond anticipation notes to six groups. The size of the sale was downsized from the $700 million originally planned.

Morgan Stanley won $250 million with a bid of 2% and a $1,640,000 premium, an effective rate of 0.879920%. BAML won $100 million with a bid of 2% and a $656,000 premium, an effective rate of 0.879920%.

Citigroup won $50 million with a bid of 2% and a $331,500 premium, an effective rate of 0.868060%. JPMorgan Securities won $50 million with a bid of 2% and a $327,500 premium, an effective rate of 0.881610%.

Goldman Sachs won $25 million with a bid of 2% and a $165,750 premium, an effective rate of 0.868060%. And RBC Capital Markets won $25 million with a bid of 2% and a $164,000 premium, an effective rate of 0.879920%.

The deal is rated MIG1 by Moody’s, SP1-plus by S&P and F1-plus by Fitch.

In the negotiated sector on Tuesday, Loop Capital Markets priced the city of Chicago’s $815.75 million of general airport senior lien revenue and revenue refunding bonds for the Chicago O’Hare International Airport.

The $55.67 million of Series 2017A senior lien revenue refunding bonds not subject to the alternative minimum tax were priced to yield from 1.36% with 5% coupon in 2021 to 3.21% with a 5% coupon in 2037; a 2040 maturity was priced as 5s to yield 3.27%. The $358.18 million of senior lien revenue refunding non-AMT bonds were priced to yield from 0.92% with a 5% coupon in 2018 to 3.25% with a 5% coupon in 2039.

The $122.16 million of Series 2017C senior lien revenue refunding bonds non-AMT were priced to yield from 1.09% with a 5% coupon in 2019 to 3.51% with a 4% coupon in 2037; a 2041 maturity was priced as 5s to yield 3.28%. The $279.75 million of Series 2017D senior lien revenue bonds subject to AMT were priced to yield from 1.78% with a 5% coupon in 2022 to 3.46% with a 5% coupon in 2037. A 2042 maturity was priced as 5s to yield 3.54%; a 2047 maturity was priced as 5s to yield 3.60%; a 2052 maturity was priced as 5s to yield 3.73%.

The deal is rated A by S&P and Fitch.

Loop also held a second day of retail orders for the New York City Transitional Finance Authority’s $850 million of tax-exempt Fiscal 2017 Series F Subseries F-1 future tax secured subordinate bonds.

A two-day retail order period was scheduled for the bonds, which will be priced for institutions on Wednesday. The TFA will also competitively sell $250 million of taxable bonds in two separate offerings on Wednesday.

The tax-exempts were priced for retail on Tuesday to yield from 0.99% with a 3% coupon in 2019 to approximately 3.317% with a 3.25% coupon in 2038; a 2043 maturity was priced as 5s to yield 2.96% and a 2043 maturity was priced as 5s to yield 2.96% and a 2044 maturity was priced as 4s to yield 3.27%. No retail orders were taken in the 2032-2033, 2036-2037, 2039 or 2042 maturities.

The issue is rated Aa1 by Moody’s and AAA by S&P and Fitch.

Citi priced the Alabama Federal Aid Highway Finance Authority’s $558.57 million of Series 2017A special obligation revenue bonds and Series 2017B special obligation revenue refunding bonds.

The $418.31 million of Series 2017A revenue bonds were priced to yield from 1% with a 5% coupon in 2019 to 3.24% with a 4% coupon and 2.84% with a 5% coupon in a split 2037 maturity. A 2018 maturity was offered as a sealed bid. The $140.27 million of Series 2017B revenue refunding bonds were priced to yield from1.56% with a 5% coupon in 2023 to 2.02% with a 5% coupon in 2026. The deal is rated Aa1 by Moody’s and AAA by S&P.

JPMorgan priced the Maryland Health and Higher Educational Facilities Authority’s $395.06 million of Series 2017A revenue bonds for MedStar Health. The issue was priced as 5s to yield 3.39% in 2042, as 5s to yield 3.43% in 2045, and as 3 3/4s to yield 3.95% and as 4s to yield 3.90% in a split 2047 maturity. The deal is rated A2 by Moody’s and A by S&P and Fitch.

BAML priced the California Housing Finance Agency’s $278.24 million of Series 2017A taxable home mortgage revenue bonds. The issue was priced at par to yield from 1.475% and 1.525% in a split 2018 maturity to 3.506% and 3.556% in a split 2027 maturity and to yield 3.656% in 2029. The deal is rated A1 by Moody’s and AA-minus by S&P.

Citi priced the Atlanta Development Authority’s $224.02 million of tax-exempt Series 2017A-1 senior healthcare facilities current interest revenue bonds for the Georgia Proton Treatment Center.

The issue was priced to yield 6.25% with a 6% coupon in 2023, 6.875% with a 6.50% coupon in 2029, 7.10% with a 6.75% coupon in 2035 and 7.25% with a 7% coupon in 2040. The deal is not rated.

BAML priced the county of Hawaii’s $136.99 million of general obligation bonds. The $90 million of Series 2017A GOs were priced as 5s to yield from 0.89% in 2018 to 2.82% in 2037.

The $2.49 million of Series 2017B refunding GOs were priced as 3s to yield 0.89% in 2018. The $3.18 million of Series 2017C refunding GOs were priced as 4s to yield 0.89% in 2018 and as 5s to yield 1.04% in 2019. The $40.64 million of Series 2017D refunding GOs were priced to yield from 1.25% with a 5% coupon in 2021 to 3.11% with a 3% coupon in 2032. The $685,000 of Series 2017E refunding GOs were priced as 3s to yield 0.89% in 2018.

The deal is rated Aa2 by Moody’s and AA-plus by Fitch.

Citi priced the State of New York Mortgage Agency’s $121.38 million of homeowner mortgage bonds.

The $102.19 million of Series 203 non-AMT bonds were priced at par to yield from 2% in 2025 to 2.65% and 2.70% in a split 2029 maturity, 3.10% in 2032, 3.40% in 2038, and 3.50% in 2041. A 2047 planned amortization class bonds was priced as 3 1/2s to yield 2% in 2047 with an average life of five years. The $19.19 million of Series 204 AMT bonds were priced at par to yield from 1.10% and 1.20% in a split 2018 maturity to 2.40% in 2025. The deal is rated Aa1 by Moody’s

Citi priced the Chester County Health and Education Facilities Authority’s $109.95 million of Series 2017A health system revenue bonds for the Pennsylvania Main Line Health System.

The issue was priced to yield 1.09% with a 3% coupon in 2019, 3.46 with a 4% coupon in 2037, 3.54% with a 4% coupon in 2042, 3.6% with a 4% coupon in 2047, and 3.35% with a 5% coupon in 2052. The deal is rated Aa3 by Moody’s and AA by S&P and Fitch.

Secondary market

The yield on the 10-year benchmark muni general obligation was steady from 1.86% on Monday, while the 30-year GO yield was flat from 2.70%, according to the final read of Municipal Market Data's triple-A scale.

Treasuries were stronger on Tuesday. The yield on the two-year Treasury dropped to 1.34% from 1.36% on Monday, the 10-year Treasury yield declined to 2.15% from 2.17% and the yield on the 30-year Treasury bond decreased to 2.73% from 2.78%.

The 10-year muni to Treasury ratio was calculated at 86.5% on Tuesday, compared with 85.0% on Monday, while the 30-year muni to Treasury ratio stood at 98.7% versus 96.8%, according to MMD.

MSRB: Previous session's activity

The Municipal Securities Rulemaking Board reported 37,322 trades on Monday on volume of $7.70 billion.

Jacob Schneider contributed to this report.