Municipal bonds were stronger at mid-session ahead of this week’s chunky new issue supply slate. The calendar is estimated at $7.77 billion this week, consisting of $5.81 billion of negotiated deals and $1.96 billion of competitive sales.

Primary market

On Monday, Bank of America Merrill Lynch held a second day of retail orders on Massachusetts’ $918.49 million of tax-exempt general obligation bonds.

The deal will be priced for institutions on Tuesday.

The bonds are rated Aa1 by Moody’s Investors Service, AA by S&P Global Ratings and AA-plus by Fitch Ratings.

In the competitive arena on Tuesday, New York’s Empire State Development is selling about $1.56 billion of Urban Development Corp. state personal income tax revenue bonds in six sales.

On Wednesday, Wells Fargo Securities is expected to price the New Jersey Transportation Trust Fund Authority’s $500 million of transportation program bonds.

The deal is rated A-minus by Kroll Bond Rating Agency,

On Thursday, JPMorgan Securities expected to price the San Francisco Airport Commission’s $1.78 billion of tax-exempt and taxable revenue and revenue refunding bonds.

The deal, which consists of bonds subject to the alternative minimum tax and non-AMT bonds, is rated A1 by Moody’s and A-plus by S&P and Fitch.

Bond sale

Bond Buyer 30-day visible supply at $10.53B

The Bond Buyer's 30-day visible supply calendar increased $259.6 million to $10.53 billion for Monday. The total is comprised of $3.99 billion of competitive sales and $6.55 billion of negotiated deals.

Secondary market

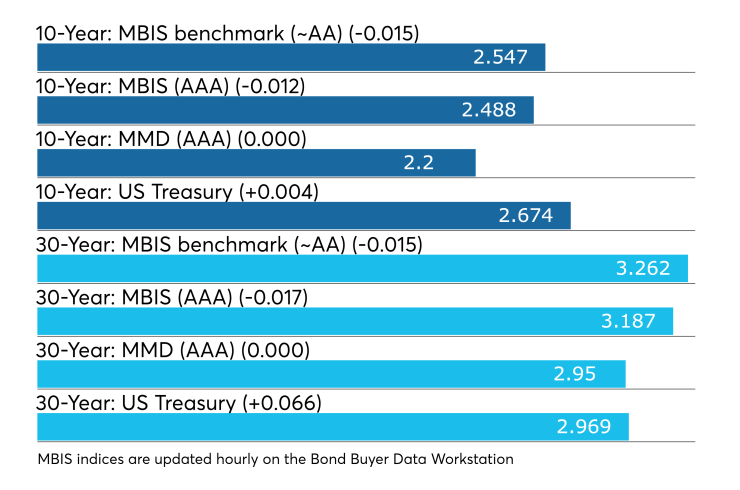

Municipal bonds were stronger on Monday, according to a midday read of the MBIS benchmark scale. Benchmark muni yields fell as much as two basis points in the three- to 30-year maturities while dropping four basis points in the one-year maturity and declining three basis points in the two-year maturity.

High-grade munis were also stronger, with yields calculated on MBIS' AAA scale falling as much as two basis points in the three- to 30-year maturities and decreasing four basis points in the one-year maturity and declining three basis points in the two-year maturity.

Municipals were steady on Municipal Market Data’s AAA benchmark scale, which showed the yield on both the 10-year muni general obligation and the 30-year muni maturity remaining unchanged.

Treasury bonds were weaker amid continuing stock market volatility. The Treasury 30-year was yielding 2.969%, the 10-year yield stood at 2.674%, the five-year was at 2.508%, the two-year was at 2.524% while the Treasury three-month bill stood at 2.424%.

On Friday, the 10-year muni-to-Treasury ratio was calculated at 83.0% while the 30-year muni-to-Treasury ratio stood at 99.3%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasury with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasury; if it is below 100%, munis are yielding less.

Previous session's activity

The Municipal Securities Rulemaking Board reported 36,387 trades on Friday on volume of $7.66 billion.

California, New York and Texas were the municipalities with the most trades, with the Golden State taking 14.95% of the market, the Empire State taking 11.183% and the Lone Star State taking 9.685%.

Week's actively traded issues

Revenue bonds comprised 56.69% of total new issuance in the week ended Jan. 4, according to

Some of the most actively traded munis by type in the were from New Jersey, Texas and Puerto Rico issuers.

In the GO bond sector, the Jersey City 3.25s of 2020 traded 22 times. In the revenue bond sector, the Texas 4s of 2019 traded 20 times. And in the taxable bond sector, the Puerto Rico Government Development Bank Recovery Authority 7.5s of 2040 traded 27 times.

Treasury auctions discount rate bills

Tender rates for the Treasury Department's latest 91-day and 182-day discount bills were lower, as the $39 billion of three-months incurred a 2.410% high rate, off from 2.465% the prior week, and the $36 billion of six-months incurred a 2.470% high rate, down from 2.505% the week before.

Coupon equivalents were 2.458% and 2.536%, respectively. The price for the 91s was 99.390806and that for the 182s was 98.751278.

The median bid on the 91s was 2.390%. The low bid was 2.350%. Tenders at the high rate were allotted 47.49%. The bid-to-cover ratio was 3.06.

The median bid for the 182s was 2.440%. The low bid was 2.410%. Tenders at the high rate were allotted 81.66%. The bid-to-cover ratio was 2.98.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.

Gary Siegel contributed to this report.