With only a few weeks left in the year, the muni market is poised for a burst of activity, while also looking ahead to what 2019 might bring.

Topping the new issue slate this week is a $1.7 billion deal from the Dormitory Authority of the State of New York. Bank of America Merrill Lynch is set to price the DASNY state personal income tax revenue bonds on Tuesday. The offering consists of Series 2018A tax-exempt PITs and Series 2018B taxable PITs. The deal is rated Aa1 by Moody’s Investors Service and AA-plus by S&P Global Ratings.

In the competitive arena on Tuesday, the Washington Suburban Sanitary District, Md., sold $390 million of consolidated public improvement bonds of 2018, Goldman Sachs won with a true interest cost of 3.5936%. The deal is rated triple-A by Moody’s, S&P and Fitch Ratings.

Let the good times roll

2019 should be a good year for municipal bond investors, the research team at Bank of America Merrill Lynch said in a report released Tuesday morning.

“This year has been a good year for muni investors, and we anticipate that 2019 will be, too. Munis proved to be a credit-stable, quality asset in a high volatility period,” the report says. While muni credits should be solid in 2019, BAML recommends some caution on high-yield products.

“We are bullish on muni rates for the year, with the 10-year AAA likely reaching 2% or lower in 2019,” the report says.

Although there will be a new Congress, the research team at BAML expects very little progress. “A divided 116th Congress implies little will be done, but also little will be undone. The SALT cap will remain, but we are very cautiously optimistic on a small infrastructure package, though, if small, it is unlikely to move the needle.”

Secondary market

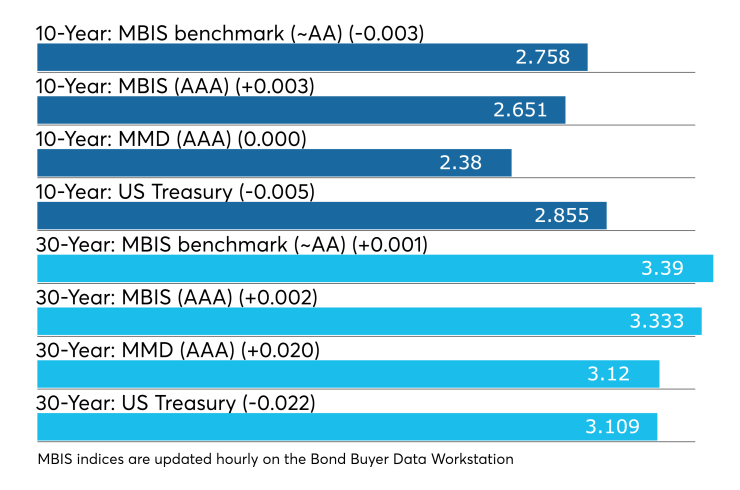

Municipal bonds were mixed on Tuesday, according to a midday read of the MBIS benchmark scale. Benchmark muni yields were either flat or higher by less than one basis point in the one- to five-year, and the 11- to -17 and the 29- and 30-year maturities. While the remaining 15 maturities; the six- to 10-year and 18- to 28-year maturities fell less than one basis point.

High-grade munis were mixed, with yields calculated on MBIS' AAA scale decreasing as much as one basis in the one- to three-year, eight- to nine-year, and the 19- to 27-year maturities. The remaining 16 maturities; the four- to seven-year, ten- to 18-year and the 28- to 30-year maturities were either unchanged or higher by no more than one basis point.

Municipals were mixed on Municipal Market Data’s AAA benchmark scale, which showed the yield on the 10-year muni general obligation steady and on the 30-year muni maturity was as much as two basis points higher.

On Monday, the 10-year muni-to-Treasury ratio was calculated at 83.5% while the 30-year muni-to-Treasury ratio stood at 99.1%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasury with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasury; if it is below 100%, munis are yielding less.

Previous session's activity

The Municipal Securities Rulemaking Board reported 44,663 trades on Monday on volume of $10.342 billion.

California, New York and Texas were the municipalities with the most trades, with the Golden State taking 14.052% of the market, the Empire State taking 12.409% and the Lone Star State taking 9.42%.

Treasury to sell $40B 4-week bills

The Treasury Department said it will sell $40 billion of four-week discount bills Thursday. There are currently $30.000 billion of four-week bills outstanding.

Treasury also said it will sell $30 billion of eight-week bills Thursday.

Gary E. Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.