Municipal yields ended the week little changed amid quiet trading, once again ignoring more volatile swings in U.S. Treasuries, with the 30-year there nearing 2.00% at the close Friday.

Stimulus news out of Washington ($1.9 trillion) and disappointing employment numbers — a mere 49,000 nonfarm payrolls gain in January — had equities on the move higher and Treasury yields rising.

Triple-A curves were little changed, with a basis point bump on some shorter maturities.

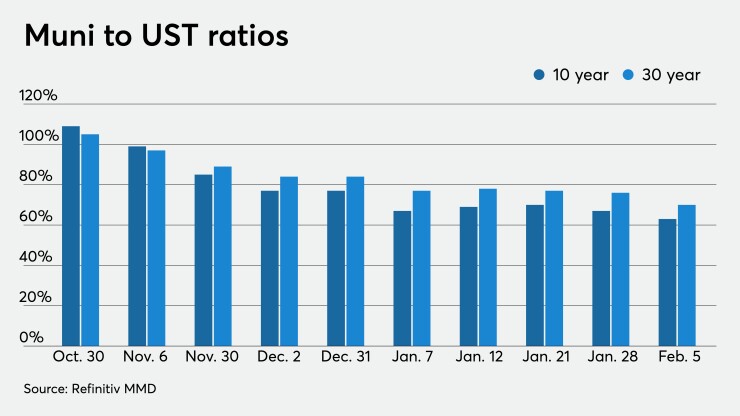

Municipal to U.S. Treasury ratios stayed at 63% in 10 years and fell a basis point to 70% in 30 years, according to Refinitiv MMD. ICE Data Services showed ratios fall a basis point to 60% in 10 years and one basis point to 72% in 30.

The primary slate for next week totals $8.23 billion, up from $4.421 billion this week. Negotiated deals total $5.133 billion and competitive deals total $3.096 billion.

The Tennessee State School Bond Authority leads the negotiated slate with $716 million of taxable higher education facilities bonds while the New York Metropolitan Transportation Authority will sell three competitive deals, two of which are green bonds, totaling more than $700 million on Tuesday. High-grade Washington state has four competitive deals scheduled totaling more than $881 million also on Tuesday.

If how new deals got done this week are any indication, issuers of all stripes should fare well, all else being equal in the municipal space.

A New York money manager said the $1.14 billion Nassau County Interim Finance Authority (NIFA) issue — the largest refinancing in the county’s history — demonstrated the overwhelming demand for new paper in the current market. That and the Detroit deal saw big bumps in repricings. The New York City Transitional Finance Authority's $1.4 billion deal this week saw $274 million of orders from retail investors and $2.3 billion of priority orders, representing three times the bonds offered for sale to institutional investors, the issuer said.

With yields at historic lows, investors are clamoring for extra yield, but worried over the economy and market uncertainty. “If you tax adjust a zero percent yield, it is still zero,” the manager said. “It may be prudent to sit on the sidelines and watch a few stories develop until rates increase.”

Secondary trading was sparse Friday but several prints showed how levels weren't moving. Fairfax County, Virginia, 4s of 2022 traded at 0.11%-0.09%, Maryland Department of Transportation rev 5s of 2024 at 0.12% (the issuer comes to market Wednesday). Wisconsin, also slated to sell taxables on Thursday, 5s of 2024 traded at 0.16% versus 0.22% on Jan. 19. Washington 5s of 2026 traded at 0.33% (0.62%-0.60% in early January). Washington 5s of 2035 traded at 1.09%-1.06%. The state has four large competitive loans scheduled for Tuesday.

New York City GO 5s of 2027 traded at 0.55%. Yale 5s of 2027 traded at 0.39%. North Carolina GO 5 of 2029 at 0.62%-0.60%. San Diego green water bond 5s of 2029 traded at 0.50%-0.47%. Denver city and county 5s of 2029 at 0.62%.

Further out, Friendswood, Texas, ISD 2s of 2043 traded at 1.85%-1.84%. Massachusetts GO 5s of 2045, traded at 1.46%. Dallas waterworks 4s of 2049 traded at 1.45%-1.44% versus 1.50% on Jan. 27.

Weak employment

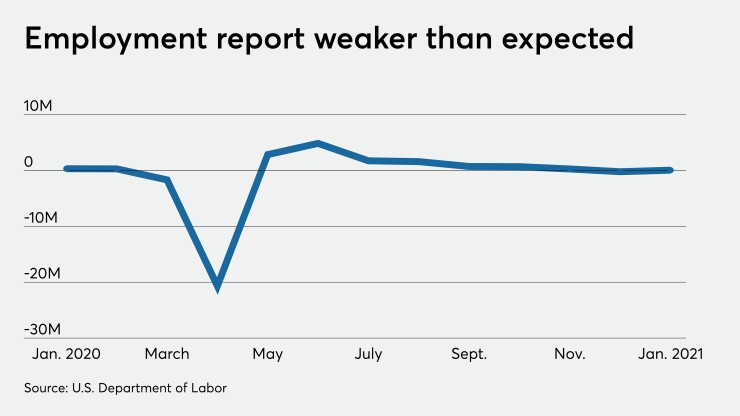

The January employment report headline number disappointed, falling short of expectations, especially after the ADP payrolls report earlier in the week surpassed predictions, but the unemployment rate dropped as the participation rate inched lower.

Nonfarm payrolls rose 49,000 in the month, just below expectations of 50,000, with the December number being revised to a loss of 227,000 jobs higher than the 140,000 decline first reported.

Earlier this week, ADP reported private-sector payrolls added 174,000 jobs in January, well above the 45,000 expected.

The unemployment rate fell to 6.3% from 6.7%, with economists expecting the rate to hold at 6.7%. But, the labor participation rate dipped to 61.4% from 61.5%.

Average hours worked climbed to 35.0 from 34.7 last month, while average earning per hour rose 0.2% after a 1.0% jump in December.

“Job growth slowed markedly in January, and the previous two months’ revisions were also to the downside,” noted Sameer Samana, senior global market strategist, Wells Fargo Investment Institute. But the news was not all bad. Unemployment and underemployment both declined in the month, he noted, although that could be attributed to the lower participation rate.

“Other internals also indicated that things may not be as bad as the headline suggests with wages and the average workweek both ticking higher,” Samana said. However, the job market “softened in the past few months and the need for fiscal stimulus remains high,” he said.

The key takeaway is “we are still in the grips of the pandemic,” said Marvin Loh, senior global macro strategist at State Street, and until more people get vaccinated, “the employment situation will remain fluid and pressure the continuation of monetary and fiscal stimulus.”

Recent job losses have been short-term and “narrowly based,” said Fitch Chief Economist Brian Coulton, “almost exclusively in the leisure and transport sector.” In his opinion, this shows the broader economy appears “to be adapting and learning to live with the renewed social distancing restrictions imposed at the turn of the year,” which happened in Europe during its second shutdown period. And the result was a lesser hit to gross domestic product.

While those in “pandemic sensitive sectors” have been hard hit, and probably been unable to seek new employment, DWS Group U.S. Economist Christian Scherrmann said those in sectors not so affected by the pandemic had different outcomes. “Those people working in sectors that are not that much affected by the pandemic enjoyed some protection and even some higher work load,” he said. “Be it a slightly longer to do list in the home office or simply jumping in for sick colleagues.”

In the near future, Scherrmann expects those in hard-hit sectors will get some “as pandemic effects are likely to fade.”

Also released Friday, the international trade deficit narrowed to $66.6 billion in December from $69.0 billion in November.

Economists polled by IFR Markets expected a $65.7 billion shortfall.

For the 2020 calendar year, with the COVID pandemic hurting U.S. exports, the deficit surged to $678.7 billion from $576.9 billion in 2019, marking the largest trade deficit since 2008.

Finally, consumer credit rose $9.7 billion in December, after gaining a revised $13.9 billion in November, first reported as a $15.3 billion increase. Economists expected a $12.0 billion climb.

Secondary market

High-grade municipals were little changed, according to final readings on Refinitiv MMD’s AAA benchmark scale. Short yields were bumped one basis point to 0.08% in 2022 and 0.09% in 2023. The 10-year stayed at 0.73% and the 30-year was flat at 1.38%.

The ICE AAA municipal yield curve showed short maturities steady at 0.09% in 2022 and 0.11% in 2023. The 10-year was at 0.70% while the 30-year yield sat at 1.40%.

The IHS Markit municipal analytics AAA curve showed yields at 0.09% in 2022 and 0.10% in 2023 while the 10-year remained at 0.68% and the 30-year at 1.37%.

The Bloomberg BVAL AAA curve showed yields at 0.08% in 2022 and 0.10% in 2023, while the 10-year was flat at 0.69%, and the 30-year yield steady at 1.42%.

The three-month Treasury note was yielding 0.09%, the 10-year Treasury was yielding 1.17% and the 30-year Treasury was yielding 1.97% near the close. Equities saw gains for a third day with the Dow up 89 points, the S&P 500 rose 0.38% and the Nasdaq gained 0.48%.

Negotiated primary market week of Feb. 8

The Tennessee State School Bond Authority (Aa1/AA+/AA+/NR) is set to price $716 million of taxable higher education facilities second program bonds, serials 2021-2035; terms 2040, 2045. Jefferies LLC is bookrunner.

The Regional Transportation District, Colorado, is set to price $519.9 million of taxable sales tax revenue refunding bonds. Serials 2024-2037. Goldman Sachs & Co. is bookrunner.

The New York City Industrial Development Agency (A2/AA//) is set to price $507.8 million of Queens Baseball Stadium Project PILOT refunding bonds on Wednesday. Assured Guaranty insured. Goldman Sachs & Co. LLC is head underwriter.

The Lower Colorado River Authority, Texas, (/A//) is set to price $407.4 million of LCRA transmission services corporation project revenue bonds. BofA Securities is lead underwriter.

The City of Chula Vista, California, (/AA//) is set to price $398.4 million of taxable pension obligation bonds on Wednesday, serials 2022-2036; terms 2041, 2045. Stifel, Nicolaus & Company, Inc.

The University of Washington (Aaa/AA+//) is set to price $325 million of taxable and tax-exempt general revenue and refunding bonds on Wednesday. Goldman Sachs & Co. LLC is head underwriter.

The Tobacco Securitization Authority of Northern California is set to price $236.5 million of tobacco settlement asset-backed refunding bonds (Sacramento County Tobacco Securitization Corp.). $124.6 million Series 2021A, serials 2021-2040; term 2049. $33.1 million Series B1, terms 2030, 2049, $78.7 million Series B2, term, 2060. Jefferies LLC leads the deal.

The Maryland Department of Transportation (A1/NR/A/) is set to price $211.9 million of Baltimore/Washington International Thurgood Marshall Airport special transportation project taxable refunding revenue bonds on Wednesday. Serials 2023-2030. Citigroup Global Markets Inc. will run the books.

The California Statewide Communities Development Authority is set to price $198 million of essential housing revenue social bonds. Goldman Sachs & Co. leads the deal.

The Connecticut Housing Finance Authority (Aaa/AAA//) is set to price $193 million of housing mortgage finance program bonds, $111.3 million Series A-1, serials, 2021-2022, 2024-2032; term 2034, 2038, $17.25 million Series A-2, serials 2021-2024; $64.2 million Series A-3, serials 2021, 2025-2032, term 2034. Citigroup Global Markets Inc. is lead underwriter.

The San Francisco Municipal Transportation Agency (Aa2/AA-//) is set to price $175 million of taxable and tax-exempt refunding revenue bonds on Tuesday. Series A, $170.5 million of taxable, serials 2023-2036, term 2044; Series B, $4.5 million of exempts, serial 2031. RBC Capital Markets is head underwriter.

The City of Austin, Texas, (A3//A-/) is set to price $149.3 million of Travis, Williamson and Hays Counties rental car special facility revenue refunding bonds on Tuesday. Serials 2024-2036, term 2042. Wells Fargo Securities will run the books.

Wisconsin (Aa2//AA/) is set to price $118.5 million of taxable general fund annual appropriation refunding bonds on Thursday, serials 2022-2031. Barclays Capital Inc. is lead underwriter.

Shoreline School District No. 412 King County, Washington, (Aaa///) is set to price tax-exempt and taxable unlimited tax general obligation improvement and refunding bonds on Tuesday, Series A exempts, $59 million of refunding, serials 2021-2022, 2024-2029, 2039, and $55.9 million Series B, serials 2021-2022, 2024-2030. RBC Capital Markets is head underwriter.

The City of Downey, California (/AA//) is set to price $113.7 million of taxable pension obligation bonds on Tuesday. BofA Securities is bookrunner.

Bethel School District N. 52, Lane County, Oregon, (Aa1///) is set to price $107.5 million of general obligation bonds on Tuesday. Insured by Oregon School Bond Guaranty Act. Piper Sandler & Co. is lead underwriter.

Competitive market

On Tuesday, the New York Metropolitan Transportation Authority (A3//A-/) has three sales on tap: $205 million of transportation revenue bonds, 2041-2043, at 10:15 a.m.; $266 million of transportation revenue green bonds (CBI certified), 2044-2047, at 10:45 a.m.; $229 million of transportation revenue green bonds (CBI certified), 2048-2050, 11:15 a.m.

The State of Washington (Aaa/AA+/AA+/) will sell $257.9 million of various purpose general obligation bonds, 2022-2037, at 10:30 a.m.; $260 million of various purpose general obligation bonds, 2038-2046, at 11 a.m.; $109.6 million of motor vehicle fuel tax and vehicle-related fees GOs, 2022-2046, at 11:30 a.m.; $234.7 million of motor vehicle fuel tax and vehicle-related fees GOs, 2022-2046, at 11:45 a.m.

Richland County, South Carolina, (Aaa/AAA//) will sell $100 million of transportation sales and use tax general obligation bonds at 11 a.m.

On Wednesday, the Las Vegas Valley Water District, Nevada, is set to sell $154 million of general obligation limited tax water refunding bonds (additionally secured by SNWA pledged revenues) at 10:45 a.m. and $35 million of general obligation limited tax water refunding bonds (additionally secured by pledged revenues) at 11:15 a.m.

Cherry Creek SD #5, Colorado, is set to sell $150 million of general obligation bonds at 11 a.m.

On Thursday, the Maryland University System is set to sell $108 million of auxiliary facility and tuition taxable refunding revenue bonds at 10:45 a.m. and $230 million of auxiliary facility and tuition tax-exempt refunding revenue bonds at 10:30 a.m.

Christine Albano contributed to this report.