Markets remained quiet on Wednesday as participants cautiously waited during most of the day to see what clues might come out of the latest Federal Reserve monetary policy meeting.

Munis finished steady, with yields on the AAA scales barely budging after the Federal Open Market Committee again left interest rates unchanged.

Secondary trading picked up somewhat while the new-issue market saw a large amount of taxables in the negotiated space while Pennsylvania competitively sold $470 million of general obligation bonds to Jefferies.

The municipal market is still somewhat dislocated with ICI reporting near $2 billion of inflows and trading ranges on various names seeing spread-widening, even if their ratings are similar, as investors navigate the ongoing COVID-19 stresses.

The FOMC kept the target range for the federal funds rate at zero to 0.25% and said it "expects it will be appropriate to maintain this target range until labor market conditions have reached levels consistent with the committee's assessments of maximum employment and inflation has risen to 2% and is on track to moderately exceed 2% for some time." This was a hint that it would hold rates near zero through at least 2023 to help the U.S. economy recover from the coronavirus pandemic.

The FOMC also said it would "increase its holdings of Treasury securities and agency mortgage-backed securities at least at the current pace to sustain smooth market functioning and help foster accommodative financial conditions, thereby supporting the flow of credit to households and businesses."

The N.Y. Fed's Open Market Trading Desk said it would continue to increase holdings of Treasury securities by about $80 billion a month and of agency MBS by around $40 billion a month. In addition, the Fed said it will continue to conduct agency CMBS operations to keep that market functioning smoothly.

BNP Paribas gave much credit to the Fed for keeping the markets afloat in the wake of the COVID-19 pandemic, especially the $1.7 trillion extension in its balance sheet, mainly in the form of Treasury and MBS.

“It has definitely alleviated market dislocations,” Jean-Yves Fillion, CEO of BNP Paribas Americas, said in a media call with reporters Wednesday. “Lending facilities made available to banks provided a backstop to the markets across all asset classes from high-grade and high-yield loans … to green bonds and COVID-19 rescue bonds.”

Fillion added that BNP didn’t expect to see a solid and sustainable economic recovery begin until there was a widely distributed vaccine “and under the current circumstances our economists do not expect to see a return to pre-COVID-19 economic output economic metrics until early 2022.”

Municipal trading ticked up somewhat Wednesday as more new issues priced.

Hamilton County, Tennessee, 5s of 2022 traded at 0.13%-0.12%. Stanford University revs, 5s of 2023, at 0.23%. Frisco Texas ISD 5s of 2024 traded at 0.22%. Madison, Wisconsin promissory notes, 4s of 2024, traded at 0.21%-0.25%. Texas A&M 5s of 2025 traded at 0.26%.

In fire-ravaged Washington, its GOs, 5s of 2027, traded at 0.48%. Starkly compared to New York City TFA 5s of 2027 which traded at 0.85%. Both issuers are highly rated in the triple-A range. NYC TFA subordinates, 5s of 2030, traded at 1.30%.

Forsyth, Georgia 5s of 2030 traded at 0.82%-0.81%. Maryland GOs in 2032 traded at 1.09%-1.07%. Texas waters, 4s of 2037, traded at 1.47%. Ohio waters, 4s of 2037 at 1.37%. Dallas waters, 5s of 2039, at 1.51%-1.48% after selling in June at 1.80%.

"The trading differential between Washington State and a New York City credit, such as the tax-backed TFAs, is striking and shows the unease that traders have with New York credits generally," a New York trader said. "It's not so much that New York is going away, but the fact is investors are starting to scoff at these low rates. Certain issuers are going to pay a premium."

Another East Coast trader echoed this sentiment.

"For me, any city/state N.Y. credit has a serious haircut on yield based on huge unknowns how much time it will take for revenues to recover," she said. "There’s also some bias toward one to two notch downgrades built in. And — NYC TFA is a belly button name that a lot of in-state buyers are full on — hence some reduced marketability too. Not pretty right now."

Primary market

Jefferies won the deal with a true interest cost of 1.933%. The bonds were priced to yield from 0.22% with a 3% coupon in 2021 to 2.22% with a 2.125% coupon in 2040.

Proceeds will be used for capital facilities and Pennvest projects. PFM Financial Advisors and Sustainable Capital Advisors are the financial advisors. Stradley Ronon and the Tucker Law Group along with the State Attorney General are the bond counsel.

JPMorgan Securities priced the San Jose Financing Authority, Calif.’s (Aa2/AA/AA/NR) $355.62 million of Series 2020A taxable lease revenue bonds for the Civic Center refunding project. The bonds were priced at par to yield from 0.421% (+28 basis points to UST) in 2021 to 2.882% (+ 220 bps UST) in 2039.

Morgan Stanley priced the State Center Community College District of Fresno, Madera, Tulare and Kings Counties, Calif.’s (Aa1/AA/NR/NR) $205.75 million of Series 2020B Election of 2016 GOs.

The $205 million of tax-exempts were priced to yield from 0.10% with a 3% coupon in 2021 to 2.06% with a 3% coupon in 2041; a 2045 maturity was priced as 2.25s to yield 2.43%. The $750,000 of taxables were priced at par to yield 0.25%.

PNC Capital Markets priced the Allegheny County Sanitary Authority, Pa.’s (Aa3/A+/NR/NR) $154.765 million of sewer revenue bonds.

The $95.445 million of Series A of 2020 refunding bonds were priced to yield from 0.35% with a 3% coupon in 2023 to 2.38% with a 3% coupon in 2040. The $59.32 million of Series B of 2020 new-money bonds were priced to yield from 0.29% with a 3% coupon in 2022 to 2.08% with a 4% coupon in 2040; a 2045 maturity was priced as 4s to yield 2.24% and a 2050 maturity was priced as 4s to yield 2.30%.

RBC Capital Markets priced for retail the North Carolina Housing Finance Agency’s (Aa1/AA+/NR/NR) $178.22 million of Series 45 1998 Trust Agreement home ownership revenue and revenue refunding bonds. The bonds were priced for retail at par to yield from 0.25% in 2021 to 2.20% in 2035 and 2.30% in 2040.

Siebert Williams Shank & Co. received the written award on Austin, Texas’ (Aa1/AAA/AAA/NR) $246.135 million deal consisting of $218.725 million of tax-exempt public improvement and refunding bonds, certificates of obligation, public property finance contractual obligations and $49.41 million of taxable public improvement and refunding bonds.

Morgan Stanley received the written award on the Rhode Island Housing and Mortgage Finance Corp.’s (Aa1/AA+/NR/NR) $142.11 million of Series 73 homeownership opportunity social and taxable bonds.

The $126.54 million of Series 73-A non-AMT social bonds were priced at par to yield from 0.80% in 2025 to 1.95% in 2032, 2.10% in 2035, 2.30% in 2040 and 2.50% in 2045. A 2050 PAC bond was priced as 3s to yield 0.99% with an average life of five years. The $15.57 million of Series 73-T taxables were priced at par to yield from 0.60% and 0.65% in a split 2021 maturity to 1.20% and 1.25% in a split 2025 maturity.

RBC received the official award on the Minnesota Housing Finance Agency’s $125 million of Series 202F AMT and Series 2020G non-AMT residential housing finance bonds.

On Thursday, Morgan Stanley will price

Also Thursday, JPMorgan Securities is set to price the Illinois Finance Authority’s $428 million of revenue bonds for the

Citigroup is set to price Sharp Healthcare (A3/AA/NR/NR) of California’s $341 million of taxable corporate CUSIP bonds on Thursday.

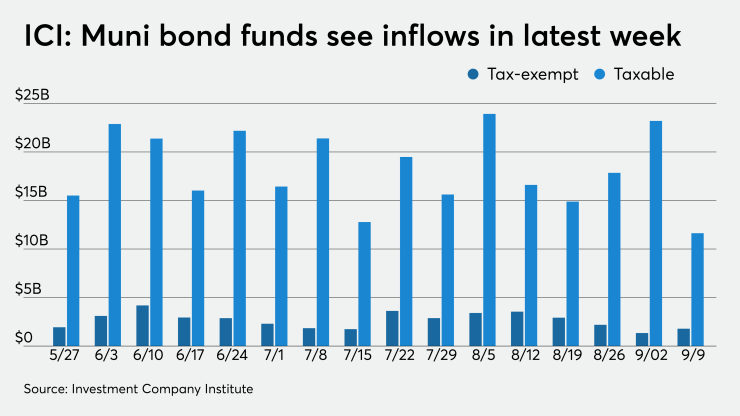

ICI: Muni bond funds see $1.8B inflow

Long-term municipal bond funds and exchange-traded funds saw combined inflows of $1.788 billion in the week ended Sept. 9, the Investment Company Institute reported Wednesday.

It marked the 19th week in a row the funds saw inflows. In the previous week, muni funds saw an inflow of $1.342 billion, ICI said.

Long-term muni funds alone had an inflow of $1.457 billion in the latest reporting week after an inflow of $1.719 billion in the prior week.

ETF muni funds alone saw an inflow of $331 million after an outflow of $377 million in the prior week.

Taxable bond funds saw combined inflows of $13.419 billion in the latest reporting week after an inflow of $23.201 billion in the prior week.

ICI said the total combined estimated inflows from all long-term mutual funds and ETFs were $4.139 billion after a revised outflow of $4.209 billion in the previous week, originally reported as a $4.211 billion outflow.

Secondary market

High-grade municipals were unchanged on Wednesday, according to final readings on Refinitiv MMD’s AAA benchmark scale. Yields were flat in 2021 and 2022 at 0.12% and 0.13%, respectively. The yield on the 10-year muni was steady at 0.84% while the 30-year yield remained at 1.58%.

The 10-year muni-to-Treasury ratio was calculated at 120.9% while the 30-year muni-to-Treasury ratio stood at 108.5%, according to MMD.

The ICE AAA municipal yield curve showed the 2021 maturity steady at 0.12% and the 2022 maturity flat at 0.12%. The 10-year maturity was unchanged at 0.80% and the 30-year was flat at 1.59%.

The 10-year muni-to-Treasury ratio was calculated at 122% while the 30-year muni-to-Treasury ratio stood at 108%, according to ICE.

The IHS Markit municipal analytics AAA curve showed the 2021 maturity yielding 0.13%, the 2022 maturity at 0.14%, the 10-year muni at 0.83% and the 30-year at 1.57%.

The BVAL AAA curve showed the yield on the 2021 maturity unchanged at 0.11%, the 2022 maturity steady at 0.14%, the 10-year flat at 0.81% and the 30-year unchanged at 1.58%.

Treasuries were weaker as stock prices traded mixed.

The three-month Treasury note was yielding 0.117%, the 10-year Treasury was yielding 0.685% and the 30-year Treasury was yielding 1.450%.

The Dow rose 0.80%, the S&P 500 increased 0.30% and the Nasdaq fell 0.30%.

Lynne Funk contributed to this report.