Top rated municipal bonds ended weaker in quiet activity on Thursday, traders said, as only a few smaller-sized bond sales hit the primary market.

Secondary market

The yield on the 10-year benchmark muni general obligation rose one basis point to 2.03% from 2.02% on Wednesday, while the 30-year GO yield increased two basis points to 2.82% from 2.80%, according to the final read of Municipal Market Data's triple-A scale.

Treasuries were weaker. The yield on the two-year Treasury fell to 1.40% from 1.41% on Wednesday, the 10-year Treasury yield rose to 2.37% from 2.33% and the yield on the 30-year Treasury bond increased to 2.90% from

The 10-year muni to Treasury ratio was calculated at 85.7% on Thursday, compared with 86.6% on Wednesday, while the 30-year muni to Treasury ratio stood at 97.1% versus 98.1%, according to MMD.

MSRB: Previous session's activity

The Municipal Securities Rulemaking Board reported 47,754 trades on Wednesday on volume of $8.12 billion.

Will munis follow Treasuries?

With the Treasury 10- and 30-year slope at 12-month lows, traders are concerned whether municipals will follow. That's not necessarily the case, according to MMD Senior Market Strategist Daniel Berger.

“There has been some press about the flattening of the Treasury yield curve,” Berger said in a report released on Monday. “On [June 30], the Treasury 10/30-year slope closed at its 12-month low of +54 basis points. In the past 12 months it has averaged +67 basis points and the 12-month high of +81 basis points was reached on 11/9/17 (the day after the presidential election).”

The slope reached 52 basis points on Monday. The average dropped to 66 basis points.

According to some analysts, a flattening yield curves signals worry and could mean the U.S. is heading toward a recession.

“The thinking is that if long-term and short-term rates are close, markets must be expecting little growth or lenders would demand a bigger time premium. Yield curves sometimes flatten on the way to inversions, which tend to precede recessions,” Berger said. “Munis have not moved in tandem with Treasuries in this regard. On Friday, the 10/30-year muni slope closed at +80 basis points. This is below the high of +88 basis points reached in late April, but above the 12-month average of +78 basis points.”

Primary market

In the negotiated sector on Thursday, Citigroup priced Denton, Texas’ $76.73 million of Series 2017 permanent improvement refunding bonds. The deal is rated triple-A by Moody’s Investors Service and S&P Global Ratings.

In the competitive arena, Stamford, Conn., sold $30 million of general obligation bonds in two separate sales. Wells Fargo Securities won the $25 million of Issue of 2017 Series A GOs with a true interest cost of 2.68% and Wells also won the $5 million of Issue of 2017 Series B GOs with a TIC of 1.89%. The deals are rated AAA by S&P and Fitch Ratings.

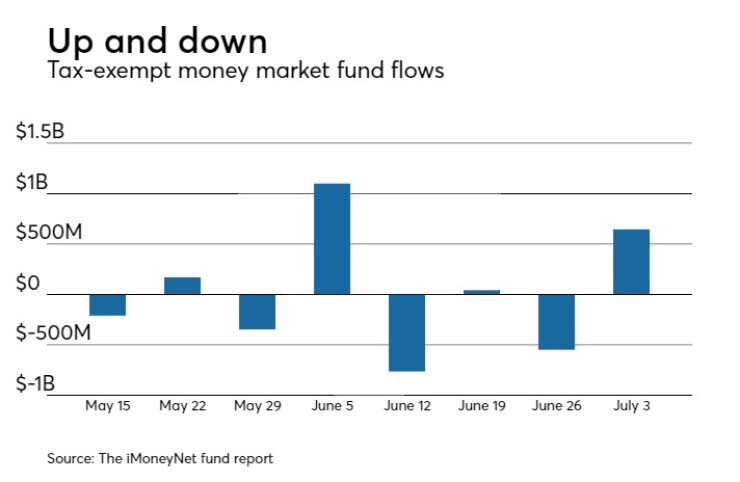

Tax-exempt money market funds see inflows

Tax-exempt money market funds experienced inflows of $645.7 million, bringing total net assets to $129.81 billion in the week ended July 3, according to The Money Fund Report, a service of iMoneyNet.com.

This followed an outflow of $549.1 million to $129.16 billion in the previous week.

The average, seven-day simple yield for the 232 weekly reporting tax-exempt funds jumped to 0.43% from 0.39% in the previous week.

The total net assets of the 852 weekly reporting taxable money funds decreased $1.17 billion to $2.466 trillion in the week ended July 4, after an inflow of $10.56 billion to $2.467 trillion the week before.

The average, seven-day simple yield for the taxable money funds increased to 0.62% from 0.60% in the prior week.

Overall, the combined total net assets of the 1,084 weekly reporting money funds decreased $520.9 million to $2.595 trillion in the week ended July 4, after inflows of $10.01 billion to $2.596 trillion in the prior week.