Municipal bonds ended stronger on Tuesday as the the biggest deal of the week arrived in the primary market.

Morgan Stanley priced and repriced the Los Angeles Unified School District’s $1.08 billion of Series 2017A dedicated unlimited ad valorem property tax general obligation refunding bonds for institutions on Tuesday.

The issue was repriced as 5s to yield 0.74% in 2017, 0.83% in 2018 and 0.96% in 2019 and to yield from 1.25% with a 4% coupon in 2021 to 2.28% with 4% and 5% coupons in a split 2027 maturity.

The deal is rated Aa2 by Moody’s Investors Service and AAA by Fitch Ratings.

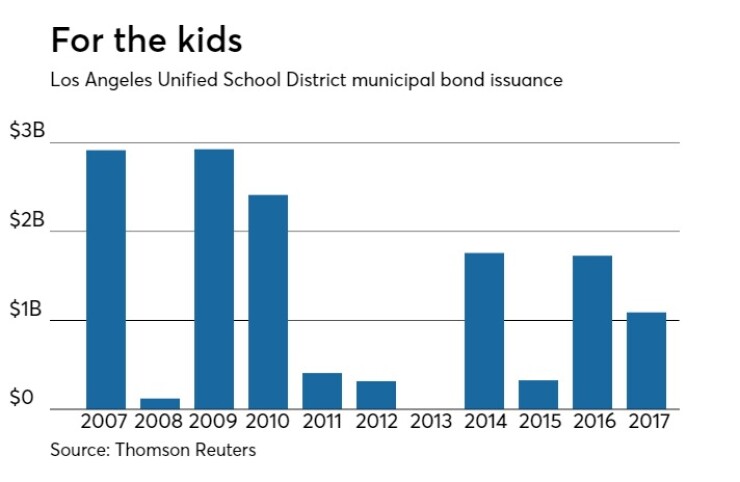

Since 2007, LAUSD has sold roughly $13.99 billion of securities, with the most issuance occurring in 2009 when it sold $2.92 billion. With this deal, the district has sold more than $1 billion in a year six times over the past decade, including three years when volume was greater than $2 billion. It didn't come to market in 2013.

Wells Fargo Securities priced the Dormitory Authority of the State of New York’s $680.95 million of tax-exempt and taxable revenue bonds for New York University.

DASNY’s $452.97 million of Series 2017A tax-exempts were repriced to yield from 0.97% with a 4% coupon in 2019 to 3.15% with a 5% coupon in 2040; a 2043 maturity was priced as 5s to yield 3.17%.

DASNY’s $227.98 million of Series 2017B taxables were priced at par to yield from 1.599% in 2019 to 3.729% in 2032, 3.779% in 2034, 3.998% in 2039 and 4.148% in 2047.

The deal is rated Aa2 by Moody’s and AA-minus by S&P Global Ratings.

“The new issue market is not very robust,” one New York trader said on Tuesday. “The NYU deal looked a bit rich to me and it still got bumped a bit, so there’s no real pullback in demand out there.”

Barclays Capital priced and repriced the California Health Facilities Financing Authority’s $275.67 million of Series 2017A revenue bonds for the Children's Hospital of Los Angeles.

The issue was repriced to yield from 3.40% with a 5% coupon in 2030 to 3.77% with a 5% coupon in 2037. A split 2042 maturity was priced at par to yield 4.20% and as 5s to yield 3.88%; a 2047 maturity was priced as 5s to yield 3.90%; and a 2049 maturity was priced as 4s to yield 4.20%.

The deal is rated Baa2 by Moody’s and BBB-plus by S&P.

Citi priced the Oregon Department of Transportation’s $336.24 million of highway user tax revenue bonds.

The $244.5 million of Series 2017A senior lien bonds were priced as 5s to yield from 1.03% in 2019 to 2.26% in 2027; a 2018 maturity was offered as a sealed bid.

The $91.75 million of Series 2017B senior lien refunding bonds were priced as 5s to yield 1.03% in 2019 and 1.19% in 2020 and to yield from 2% in 2025 to 2.49% in 2029.

The deal is rated Aa1 by Moody’s, AAA by S&P and AA-plus by Fitch.

Barclays priced the Connecticut Health and Educational Facilities Authority’s $170.92 million of Series 2017A revenue bonds for Yale University.

The $85.46 million of Series 2017A-1 bonds were priced as 5s to yield 1.50% in 2042 with a mandatory put in 2022.

The $85.46 million of Series 2017A-2 bonds were priced as 5s to yield 1.50% in 2042 with a mandatory put in 2022.

The deal is rated triple-A by Moody’s and S&P.

Citigroup priced the South Dakota Housing Development Authority’s $165.61 million of homeownership mortgage bonds.

The $110.5 million of Series 2017B bond not subjec5t to the alternative minimum tax were priced at par to yield from 1.75% in 2022 to 2.85% and 2.95% in a split 2028 maturity, and to yield 3.40% in 2032, 3.70% in 2036 and 3.90% in 2040. A 2047 maturity was priced as 4s to yield 2.11%.

The $30.24 million of Series 2017C AMT bonds were priced at par to yield from 1.15% in 2017 to 2% and 2.10% in a split 2022 maturity. A 2039 maturity was priced as 4s to yield 2.23%.

The $24.87 million of Series 2017A taxable bonds were priced at par to yield from 1.50% in 2017 to 3.442% and 3.492% in a split 2028 maturity. A 2032 maturity was priced at par to yield 3.892% and a 2037 planned amortization class bond was priced at par to yield 3.06% with an average life of four years.

The deal is rated triple-A by Moody’s and S&P.

In the competitive arena, the Phoenix Civic Improvement Corp. sold $232.27 of bonds in two separate sales.

Morgan Stanley won the $216.58 million of Series 2017A subordinate excise tax revenue bonds with a true interest cost of 2.04%. The issue was priced to yield from 0.90% with a 5% coupon in 2018 to about 3.10% with a 3% coupon in 2032.

Citi won the $15.69 million of Series 2017C taxable subordinate excise tax revenue bonds with a TIC of 1.94%.

The deals are rated Aa2 by Moody’s and AA-plus by S&P and Fitch.

Market sources said that Sibert Cisneros Shank on Tuesday released a premarketing scale on the District of Columbia’s $576 million of Series 2017A GOs that are set to price on Wednesday.

The consensus scale was offered to yield from 1.01% with a 3% coupon in 2019 to 3.11% with a 5% coupon and 3.41% with a 4% coupon in a split 2037 maturity.

The deal is rated Aa1 by Moody’s and AA by S&P and Fitch.

Secondary market

Top-shelf municipal bonds finished stronger on Tuesday. The yield on the 10-year benchmark muni general obligation fell two basis points to 2.09% from 2.11% from Monday, while the 30-year GO yield decreased two basis points to 2.96% from 2.98%, according to the final read of Municipal Market Data's triple-A scale.

U.S. Treasuries were narrowly mixed on Tuesday. The yield on the two-year Treasury was unchanged from 1.29% on Monday, while the 10-year Treasury yield dropped to 2.33% from 2.34%, and the yield on the 30-year Treasury bond decreased to 2.99% from 3.00%.

The 10-year muni to Treasury ratio was calculated at 89.9% on Tuesday, compared with 90.2% on Monday, while the 30-year muni to Treasury ratio stood at 99.0%, versus 99.1%, according to MMD.

MSRB: Previous session's activity

The Municipal Securities Rulemaking Board reported 37,982 trades on Monday on volume of $8.04 billion.