The last issuance of the week started to come in on Thursday, as munis were weaker still.

Secondary market

The yield on the 10-year benchmark muni general obligation was as many as two basis points higher from 1.98% from on Wednesday, while the 30-year GO yield also increased as many as two basis points from 2.84%, according to a read of Municipal Market Data's triple-A scale.

U.S. Treasuries were mixed on Thursday around midday. The yield on the two-year Treasury dipped to 1.46% from 1.47%, the 10-year Treasury yield was flat at 2.33% and the yield on the 30-year Treasury bond rose to 2.89% from 2.88%.

On Wednesday, the 10-year muni-to-Treasury ratio was calculated at 85.9% compared with 86.1% on Tuesday, while the 30-year muni-to-Treasury ratio stood at 99.3% versus 100.3%, according to MMD.

Primary market

RBC Capital Markets received the written award for the Pennsylvania Economic Development Authority’s $436.75 million of revenue bonds for the University of Pittsburgh Medical Center on Thursday. The bonds were priced to yield from 0.98% with a 4% coupon in 2018 to 3.60% with a 4% coupon in 2037. A term bond in 2042 was priced to yield 3.73% with a 4% coupon and a term bond in 2047 was priced to yield 3.80% with a 4% coupon. The deal is rated A1 by Moody’s Investors Service, A-plus by S&P Global Ratings and AA-minus by Fitch Ratings.

Morgan Stanley priced the Industrial Development Authority of the County of Maricopa, Ariz.’s $362.07 million of revenue bonds for Banner Health. The $189.52 million of Series 2017A bonds were priced to yield 3.70% with a 4% coupon and 3.30% with a 5% coupon in a split 2041 bullet maturity.

The $86.275 million of Series 2017B bonds were priced to yield 1.78% with a 5% coupon in a bullet 2048 maturity.

The $86.275 million of Series 2017C bonds were priced to yield 2.22% with a 5% coupon in a bullet 2024 maturity. The deal is rated AA-minus by S&P Global Ratings and Fitch Ratings.

On the competitive side, the California State Public Works Board sold $202.325 million of various lease revenue bonds. Wells Fargo appeared to have the high bid of 2.49%. No further pricing information was immediately available. The deal is rated A1 by Moody’s and A-plus by S&P and Fitch Ratings.

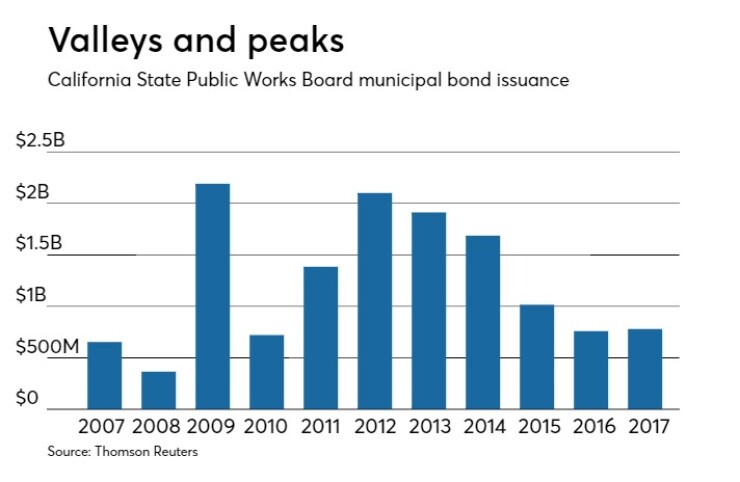

Since 2007, the California PWB has sold about $13.57 billion of securities, with the most issuance in 2009 when it sold $2.19 billion. The board saw the lowest year of issuance in 2008 when it sold $365 million. With Thursday’s sale, the board sold more this year than last year.

MSRB: Previous session's activity

The Municipal Securities Rulemaking Board reported 42,958 trades on Wednesday on volume of $14.567 billion.

Tax-exempt money market funds see outflows

Tax-exempt money market funds experienced outflows of $327.1 million, lowering total net assets to $127.90 billion in the week ended Sept. 25, according to The Money Fund Report, a service of iMoneyNet.com. This followed an inflow of $236.6 million to $128.23 billion in the previous week.

The average, seven-day simple yield for the 224 weekly reporting tax-exempt funds moved up to 0.40% from 0.37% the previous week.

The total net assets of the 830 weekly reporting taxable money funds increased $30.27 billion to $2.587 trillion in the week ended Sept. 26, after an outflow of $25.08 billion to $2.557 trillion the week before.

The average, seven-day simple yield for the taxable money funds held steady at 0.68% from the prior week.

Overall, the combined total net assets of the 1,054 weekly reporting money funds increased $29.94 billion to $2.715 trillion in the week ended Sept. 26, after outflows of $24.85 million to $2.685 trillion in the prior week.