Top-rated municipal bonds finished stronger on Tuesday, according to traders who returned to their desks to get ready for a lighter-than-average holiday week new-issue calendar.

Volume for the week is estimated at $3.86 billion, consisting of $3.03 billion of negotiated deals and $828.2 million of competitive sales.

Secondary market

Bad news and bad weather combined to cause a flight-to-quality bid in bonds on Tuesday as investors fretted about the potentially deadly situations in North Korea and the Caribbean with Pyongyang boasting of its nuclear reach and Puerto Rico preparing for the effects of Hurricane Irma.

The yield on the 10-year benchmark muni general obligation fell three basis points to 1.85% from 1.88% on Friday, while the 30-year GO yield decreased three basis points to 2.68% from 2.71%, according to the final read of Municipal Market Data's triple-A scale.

U.S. Treasuries were stronger on Tuesday. The yield on the two-year Treasury declined to 1.29% from 1.34% on Friday, the 10-year Treasury yield dropped to 2.07% from 2.16% and the yield on the 30-year Treasury bond decreased to 2.69% from 2.77%.

The 10-year muni-to-Treasury ratio was calculated at 89.2% on Tuesday, compared with 87.2% on Friday, while the 30-year muni-to-Treasury ratio stood at 99.6% versus 97.9%, according to MMD.

MSRB: Previous session's activity

The Municipal Securities Rulemaking Board reported 21,653 trades on Friday on volume of $6.69 billion.

Prior week's actively traded issues

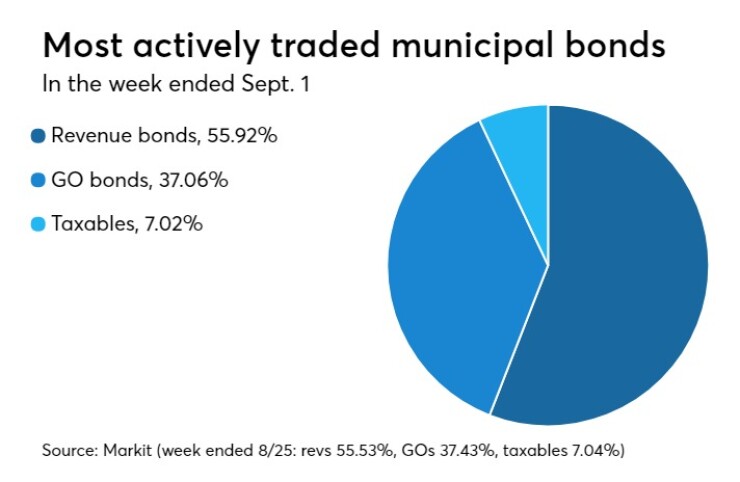

Revenue bonds comprised 55.92% of new issuance in the week ended Sept. 1, up from 55.53% in the previous week, according to

Some of the most actively traded bonds by type were from California, Texas and Illinois issuers.

In the GO bond sector, the California 4s of 2047 were traded 173 times. In the revenue bond sector, the Texas 4s of 2018 were traded 67 times. And in the taxable bond sector, the Chicago Board of Education 6.138s of 2039 were traded 26 times.

Previous week's top underwriters

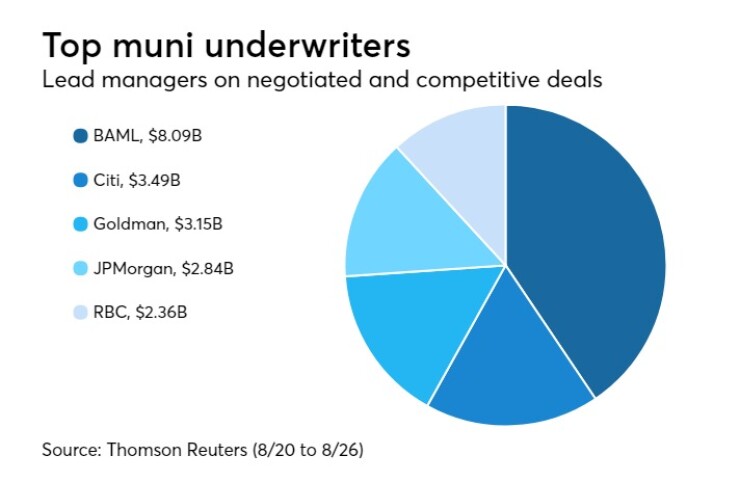

The top municipal bond underwriters of last week included Bank of America Merrill Lynch, Citigroup, Goldman Sachs, JPMorgan Securities and RBC Capital Markets, according to Thomson Reuters data.

In the week of Aug. 27 to Sept. 2, BAML underwrote $8.09 billion, Citi $3.49 billion, Goldman $3.15 billion, JPMorgan $2.84 billion, and RBC $2.36 billion.

Primary Market

In the short-term competitive sector on Tuesday, the Atlanta Independent School System, Ga., sold $100 million of Series 2017 tax anticipation notes.

TD Securities won the issue with a bid of 1.50% and a premium of $133,500, an effective rate of 1.067%.

The TANs, dated Sept. 8 and due Dec. 29, are not rated.

On Wednesday, Bank of America Merrill Lynch is expected to price the city and county of Honolulu’s $350 million of Series 2017H general obligation floating-rate bonds for the Honolulu rail transit project.

The deal is rated Aa1 by Moody’s Investors Service and AA-plus by Fitch Ratings.

In the competitive arena on Wednesday, the Pennsylvania Higher Educational Facilities Authority will sell almost $129 million of state system of higher education refunding and refunding revenue bonds in three separate offerings.

The sales consist of $77.51 million of Series AU-2 refunding revenue bonds, $36.18 million of Series AU-1 revenue bonds and $15.11 million of Series AU-3 million of Series AU-3 taxable refunding revenue bonds.

The deals are rated Aa3 by Moody’s and AA-minus by Fitch.

On Thursday, Morgan Stanley is expected to price the week's largest deal — the New Jersey Economic Development Authority’s $595 million of motor vehicle surcharges subordinate revenue and taxable bonds.

The deal is rated Baa2 by Moody’s, but some of the bonds are expected to be insured by Build America Mutual.

Also on Thursday, Goldman Sachs is on the docket to price the Regents of the

The deal is rated triple-A by Moody’s, S&P Global Ratings, and Fitch, and it is anticipated to come as a bullet maturity in 2047.