A mixture of taxable and tax-exempt deals priced into a market flush with cash. Muni yields continued to descend, moving three basis points lower today.

“Any tax-exempt municipal bond deals are being oversold and repriced, with nobody blinking an eye,” said one Pennsylvania trader. "The yields [on these deals] are probably lower than we’ve seen since the end of WWII but nobody cares — it’s a seller’s market.”

He added that some small Pennsylvania deals that came this week were a minimum of six-times oversubscribed in orders — with no allocations to the street.

“Bonds are hard to come by right now, so we have had to turn to the secondary market and find bonds maturing in 2021 thru 2023,” he said. “If they’re longer than that then you better have a pretty sharp pencil because you’re bidding against one of the most active streets in years, or decades, with 15 to 18 bidders on each CUSIP. It’s going be a tough February.”

One New York trader added that the bottom line is that there is too much money around, especially for yield.

"Trading accounts and The Street are light — very positive fund flows are driving the market now, especially with firm U.S. Treasuries," he said. "For the time being there is simply not enough supply to sate demand."

In the week ended Jan. 22, Lipper reported $1.999 billion of inflows into municipal bond bonds — marking the 55th consecutive week of inflows.

Primary market

Citi priced JobOhio Beverage System’s (Aa3/AA/ ) $370.865 million of statewide senior lien liquor profits taxable revenue refunding bonds.

Citi priced Hartford Healthcare’s (A2/A/A+/NR) $359.524 million of taxable corporate CUSIP bonds.

JP Morgan received the verbal award on the Connecticut Health and Educational Facilities Authority’s (Aaa/AAA/NR/NR) $346 million of remarketing revenue bonds for Yale University.

Goldman Sachs priced John Hopkins Health System’s (Aa2/AA-/AA-) $290.91 million of taxable bonds.

JP Morgan priced and received the verbal award on Delaware Health Facilities Authority’s (Aa2/AA+/NR/NR) $264.915 million of revenue and refunding bonds for Christiana Care Health Systems.

JP Morgan received the written award on Massachusetts Development Finance Authority’s (Aa3/AA-/NR/NR) $228.865 million of revenue bonds for Mass General Brigham.

Wells Fargo received the verbal award on Oklahoma Development Finance Authority’s (Baa2/NR/NR/NR) $125 million of limited obligation revenue bonds subject to alternative minimum tax for the Gilcrease Expressway West Project.

Competitively, the Florida Board of Education (Aaa/AAA/AAA) sold $251.63 million of public education capital outlay refunding bonds. Bank of America Securities won the bidding war with a true interest cost of 2.0936%.

Secondary market

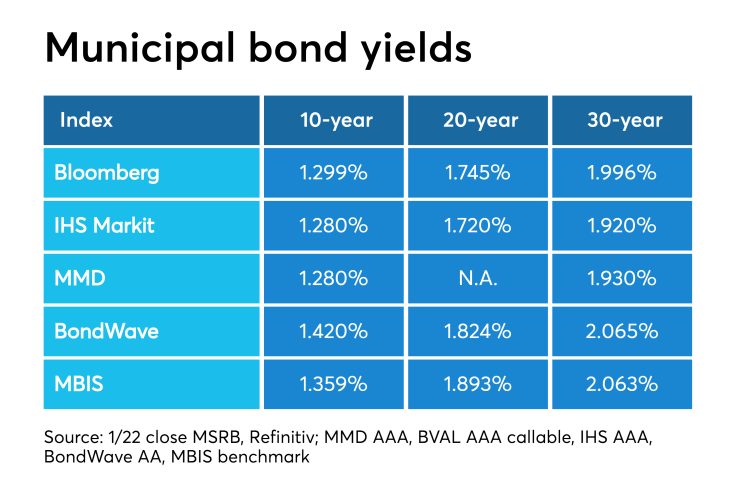

Munis were stronger on the MBIS benchmark scale, with yields falling by three basis points in the 10-year and by four basis points in the 30-year maturity. High-grades were also stronger with yields on MBIS AAA scale decreasing four basis points in the 10-year maturity and increasing by less than one basis point in the 30-year maturity.

On the MMD benchmark scale, the yield on both the 10- and 30-year were three basis points lower to 1.25% and 1.90%, respectively.

The 10-year muni-to-Treasury ratio was calculated at 71.8% while the 30-year muni-to-Treasury ratio stood at 87.1%, according to MMD.

“The ICE muni yield curve is one to three basis points lower.” ICE Data Services said in a Thursday market comment. “Tobaccos and high-yield are also lower by one basis point as the market starts to take its direction from Treasuries. Taxable yields are up to basis points lower. Puerto Rico is mixed.”

Stocks were little changed while Treasury yields moved mostly lower.

The Dow Jones Industrial Average was down about 0.06%, the S&P 500 Index rose around 0.01% and the Nasdaq gained about 0.22%.

The Treasury three-month was yielding 1.561%, the two-year was yielding 1.526%, the five-year was yielding 1.552%, the 10-year was yielding 1.741% and the 30-year was yielding 2.184%.

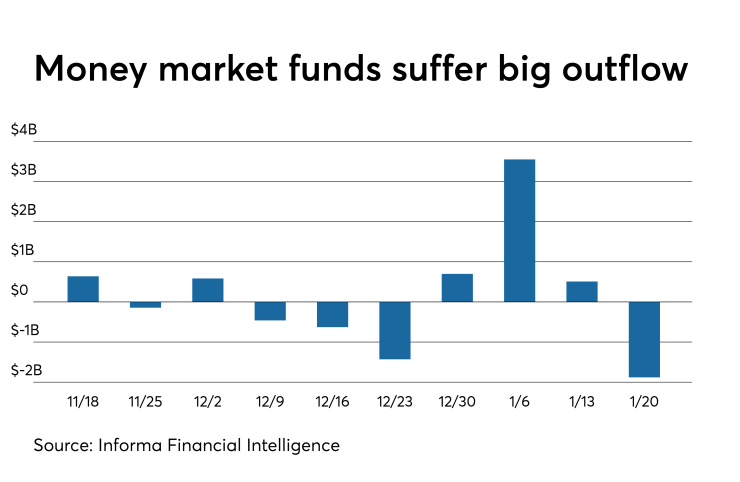

Muni money market funds see big outflow

Tax-exempt municipal money market fund assets decreased by $1.88 billion, lowering their total net assets to $139.29 billion in the week ended Jan. 20, according to the Money Fund Report, a publication of Informa Financial Intelligence.

The average seven-day simple yield for the 187 tax-free and municipal money-market funds sunk to 0.49% from 0.60% in the previous week.

Taxable money-fund assets fell by $14.87 billion in the week ended Jan. 21, bringing total net assets to $3.435 trillion. The average, seven-day simple yield for the 802 taxable reporting funds dipped to 1.26% from 1.27% the prior week.

Overall, the combined total net assets of the 989 reporting money funds dropped by $16.76 million to $3.574 trillion in the week ended Jan. 21.

Previous session's activity

The MSRB reported 34,775 trades Wednesday on volume of $13.153 billion. The 30-day average trade summary showed on a par amount basis of $10.75 million that customers bought $5.45 million, customers sold $3.49 million and interdealer trades totaled $1.81 million.

New York, California and Texas were most traded, with the Empire State taking 13.641% of the market, the Golden State taking 12.687% and the Lone Star State taking 12.311%.

The most actively traded security was the Puerto Rico Sales Tax Financing Corp. revenue taxable zeros of 2051, which traded 24 times on volume of $36.762 million.

Bond Buyer indexes move lower

The weekly average yield to maturity of the Bond Buyer Municipal Bond Index, which is based on 40 long-term bond prices, was lower to 3.56% from 3.58% the week before.

The Bond Buyer's 20-bond GO Index of 20-year general obligation yields was lower by two basis points to 2.54% from 2.56% the week before.

The 11-bond GO Index of higher-grade 11-year GOs dropped two basis points to 2.07% from 2.09% the prior week.

The Bond Buyer's Revenue Bond Index was down two basis points to 3.04% from 3.06% from the previous week.

The yield on the U.S. Treasury's 10-year note was lower to 1.73% from 1.81% the week before, while the yield on the 30-year Treasury fell to 2.18% from 2.26%.

Treasury auctions

The Treasury Department sold $14 billion of inflation-indexed 10-year TIPs at a 0.036% high yield, an adjusted price of 100.856173, with a 1/8% coupon. The bid-to-cover ratio was 2.33.

Tenders at the market-clearing yield were allotted 87.40%. Among competitive tenders, the median yield was negative 0.020% and the low yield negative 0.880%, Treasury said.

Treasury also auctioned $40 billion of four-week bills at a 1.500% high yield, a price of 99.883333. The coupon equivalent was 1.527%. The bid-to-cover ratio was 3.10.

Tenders at the high rate were allotted 47.09%. The median rate was 1.480%. The low rate was 1.450%.

Treasury also auctioned $40 billion of eight-week bills at a 1.540% high yield, a price of 99.760444. The coupon equivalent was 1.569%. The bid-to-cover ratio was 2.82.

Tenders at the high rate were allotted 44.07%. The median rate was 1.510%. The low rate was 1.470%.

Treasury auctions announced

The Treasury Department announced these auctions:

· $32 billion seven-year notes selling on Jan. 28;

· $41 billion five-year notes selling on Jan. 27;

· $40 billion two-year notes selling on Jan. 27;

· $20 billion two-year floating rate notes selling on Jan. 28;

· $26 billion 364-day bills selling on Jan. 28;

· $39 billion 182-day bills selling on Jan. 27; and

· $45 billion 91-day bills selling on Jan. 27.

Gary E. Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.