The municipal bond market is putting this week into the history books as traders look ahead to next week’s supply.

The upcoming calendar will be dominated by big California issuers, including Los Angeles, San Francisco BART and the Oakland Unified School District, as well as deals from the New York Metropolitan Transportation Authority, the Dormitory Authority of the state of New York, Denver, Hawaii, and Cuyahoga County, Ohio.

Secondary market

U.S. Treasuries were little changed on Friday after the release of the U.S. employment report for April. Non-farm payrolls rose 211,000 last month, higher than the 185,000 gain predicted in a survey of economists done by IFR Markets. The unemployment rate in April fell to 4.4%, the lowest since May 2001, and lower than the 4.5% rate predicted in IFR's survey.

The yield on the two-year Treasury rose to 1.32% from 1.31% on Thursday, while the 10-year Treasury yield was unchanged from 2.35%, and the yield on the 30-year Treasury bond decreased to 2.99% from 3.00%.

Top-shelf municipal bonds were weaker on Thursday. The yield on the 10-year benchmark muni general obligation rose two basis points to 2.17% from 2.15% on Wednesday, while the 30-year GO yield increased one basis point to 3.03% from 3.02%, according to the final read of Municipal Market Data's triple-A scale.

On Thursday, the 10-year muni to Treasury ratio was calculated at 92.3%, compared with 93.1% on Wednesday, while the 30-year muni to Treasury ratio stood at 101.1%, versus 102.2%, according to MMD.

MSRB: Previous session's activity

The Municipal Securities Rulemaking Board reported 40,225 trades on Thursday on volume of $9.17 billion.

Week's actively traded issues

Some of the most actively traded issues by type in the week ended May 5 were from Georgia, Kentucky and Wisconsin, according to

In the GO bond sector, the Fulton County, Ga., 2s of 2017 were traded 19 times. In the revenue bond sector, the Kentucky Economic Development Finance Authority 4s of 2045 were traded 46 times. And in the taxable bond sector, the Wisconsin 3.154s of 2027 were traded 72 times.

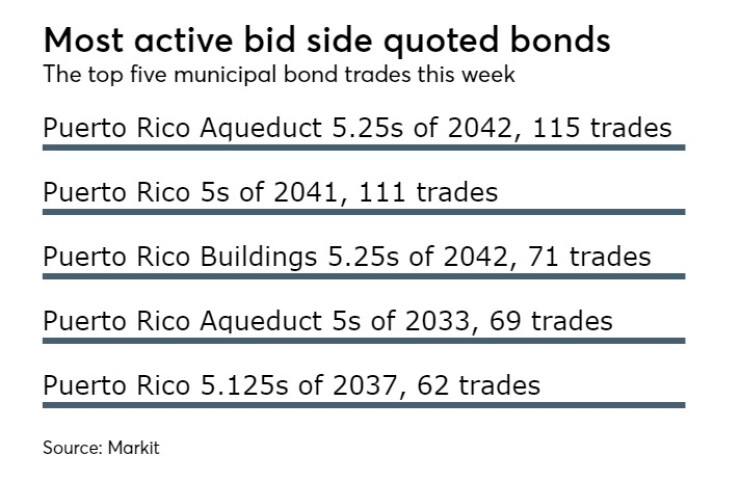

Week's actively quoted issues

Puerto Rico, Connecticut and New York & New Jersey names were among the most actively quoted bonds in the week ended May 5, according to Markit.

On the bid side, the Puerto Rico Aqueduct and Sewer Authority revenue 5.25s of 2042 were quoted by 115 unique dealers. On the ask side, Connecticut taxable 5.459s of 2030 were quoted by 76 unique dealers. And among two-sided quotes, the Port Authority of New York & New Jersey taxable 5s of 2039 were quoted by 22 unique dealers.

Week’s primary market

Jefferies priced the Regents of the University of California’s $1.1 billion bonds, which consisted of Series AV bonds general revenue bonds, Series AW taxables and Series AX taxable fixed-rate notes. The deal is rated Aa2 by Moody’s Investors Service and AA by S&P Global Ratings and Fitch Ratings.

The state of Wisconsin came to market with $686.59 million of tax-exempt and taxable bonds in two separate sales. Wells Fargo Securities priced the state’s $402.14 million of Series 2017C taxable general fund annual appropriation refunding bonds. The deal is rated Aa3 by Moody’s and AA-minus by S&P and Fitch. JPMorgan Securities priced the state’s $284.45 million of Series 2017-1 transportation revenue bonds. This deal is rated Aa2 by Moody’s, AA-plus by S&P and Fitch and AAA by Kroll Bond Rating Agency.

Bank of America Merrill Lynch priced the Kentucky Economic Development Finance Authority’s $473.37 million of Series 2017 A and B hospital revenue refunding bonds for Owensboro Health. The deal is rated Baa3 by Moody’s and BBB by Fitch except for the half of the Series 2017A 2037 and 2045 maturities and Series 2017B 2031, 2032 and 2037 maturities which are insured by Assured Guaranty Municipal and rated A2 by Moody’s and AA by S&P.

Barclays Capital priced the Massachusetts Water Resources Authority’s $324.63 million of Series 2017B general revenue bonds and Series 2017C general revenue refunding green bonds. The deal is rated Aa1 by Moody’s and AA-plus by S&P and Fitch.

Morgan Stanley priced the Trinity River of Texas’ Regional Wastewater System’s $286.61 million of Series 2017 revenue improvement and refunding bonds. The deal is rated AAA by S&P and AA-plus by Fitch.

JPMorgan priced the New Mexico Hospital Equipment Loan Council’s $239.38 million of Series 2017 A&B hospital system revenue bonds for Presbyterian Healthcare Services. The deal is rated Aa3 by Moody’s and AA by S&P and Fitch.

Raymond James & Associates priced the Richardson Independent School District, Texas’ $198.74 million of Series 2017 unlimited tax school building bonds on Tuesday. The deal, backed by the Permanent School Fund guarantee program, is rated triple-A by Moody’s and S&P.

Citigroup priced the Austin Convention Enterprises Inc.’s $194.66 million of convention center hotel bonds. The issuer is a non-profit public facility corporation acting on behalf of the city of Austin, Texas. The deal is rated BBB-plus by S&P.

In the competitive arena, the city of Mesa, Ariz., sold $171.06 million of bonds in two separate sales. Bank of America Merrill Lynch won Mesa’s $123.88 million of Series 2017 utility system revenue bonds with a true interest cost of 3.56%. Robert W. Baird won the $47.18 million of Series 2017 general obligation bonds with a TIC of 3.06%. Both deals are rated Aa2 by Moody’s and AA-minus by S&P.

Milwaukee, Wis., sold $132.23 million of Series 2017N4 GO promissory notes and GO corporate purpose bonds to Wells Fargo with a TIC of 2.13%. The deal is rated AA by S&P and Fitch.

New Castle County, Del., competitively sold $107.76 million of Series 2017 GOs on Wednesday. BAML won the bonds with a true interest cost of 3.17%. The deal is rated triple-A by Moody’s, S&P and Fitch.

Bond Buyer visible supply

The Bond Buyer's 30-day visible supply calendar increased $3.08 billion to $14.91 billion on Friday. The total is comprised of $3.73 billion of competitive sales and $11.18 billion of negotiated deals.

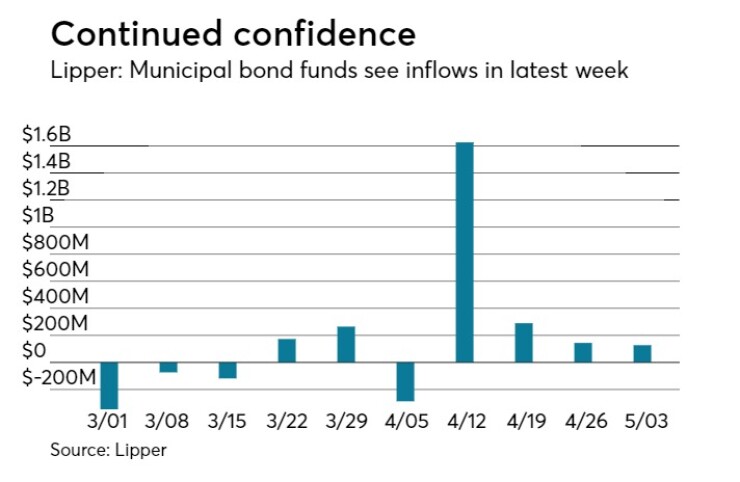

Lipper: Muni bond funds see inflows

Investors in municipal bond funds continued to put cash back into the funds in the latest week, according to Lipper data released late on Thursday.

The weekly reporters saw $127.783 million of inflows in the week ended April 26, after inflows of $144.519 million in the previous week.

The four-week moving average was still in the green at positive $547.560 million, after being positive at $443.814 million in the previous week. A moving average is an analytical tool used to smooth out price changes by filtering out fluctuations.

Long-term muni bond funds also had inflows, gaining $21.355 million in the latest week after rising $291.183 million in the previous week. Intermediate-term funds had outflows of $20.400 million after outflows of $2.015 million in the prior week.

National funds had inflows of $205.904 million after inflows of $195.710 million in the previous week. High-yield muni funds reported inflows of $36.671 million in the latest reporting week, after outflows of $129.979 million the previous week.

Exchange traded funds saw outflows of $21.160 million, after outflows of $72.246 million in the previous week.