Bond hungry investors are ready and waiting for another deal-driven week with an estimated $11.8 billion.

“Investors will be eagerly anticipating the deals coming through the pipeline this week,” said one New York trader. “They will want to eat up as many bonds as they can, especially given how next week will be a throw away week, with the Thanksgiving holiday there won’t be a whole lot going on.”

Primary market

The muni market is projected to see

“Investors have a large menu of new-issue offerings to select from this week,” Patrick Luby senior municipal strategist at CreditSights said. “While next week is likely to be very quiet , it would not be unprecedented for the strong pace of issuance to resume after the holiday.”

He noted that last year, new-issue volume in the first two weeks of December were heavier than any of the previous six weeks and in 2016, the two weeks that followed Thanksgiving were both heavier than the average week for that year.

“2017 issuance was distorted by the then pending tax reform legislation,” he said.

The action will start to get underway on Tuesday, when the biggest deal of the week is slated to hit the market as Bank of America Securities is expected to price Port Authority of New York and New Jersey’s (Aa3/AA-/AA-) $1.1 billion of consolidated bonds.

Raymond James is set to price California Health Facilities Authority's (Aa3/AA-/AA-) $500 million of senior revenue federally taxable bonds.

Citi is slated to price Round Rock Independent School District’s (Aaa/NR/AAA) $426.965 million of unlimited tax school building refunding and non-Permanent School Fund ( /NR/ ) refunding bonds.

Wells Fargo is anticipated to price University of Cincinnati (Aa3/AA-/NR) $287.715 million of general receipts bonds.

Citi is expected to price

The largest competitive deal will come from the State of Nevada (Aa1/AA+/AA+) when it sells $155.29 million of general obligation limited tax capital improvement and refunding bonds on Tuesday.

Nevada snagged its

S&P Global Ratings upgraded the state’s GO rating Nov. 14 to AA-plus from AA, affecting $1.2 billion in outstanding GOs. S&P also upgraded the state’s highway revenue improvement bonds to AAA from AA-plus, which applies to over $745 million of outstanding bonds.

Nevada received an upgrade to Aa1 from Aa2 from Moody’s Investors Service on Nov. 12. Fitch affirmed the state’s AA-plus rating. Both gave stable outlooks.

Last week's actively traded issues

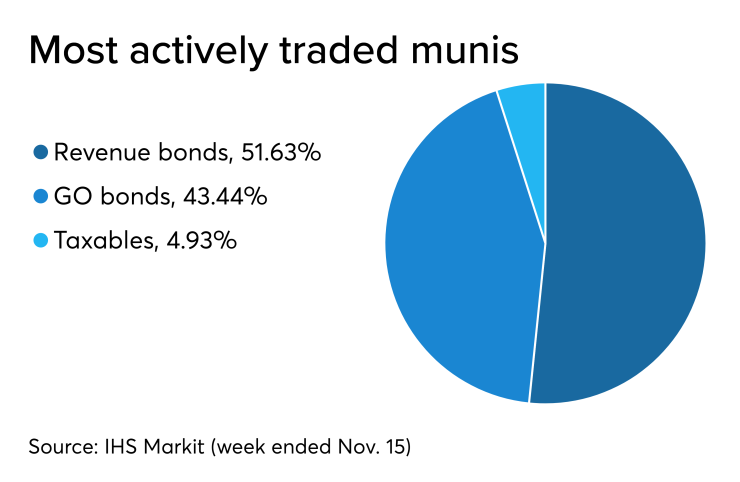

Revenue bonds made up 51.63% of total new issuance in the week ended Nov. 15, down from 52.13% in the prior week, according to

Some of the most actively traded munis by type in the week were from Connecticut, New Jersey and Massachusetts issuers.

In the GO bond sector, the New Haven, Conn., 5s of 2039 traded 13 times. In the revenue bond sector, the New Jersey Economic Development Authority, 4s of 2049 traded 57 times. In the taxable bond sector, the Massachusetts School Building Authority, 3.395s of 2040 traded 67 times.

Secondary market

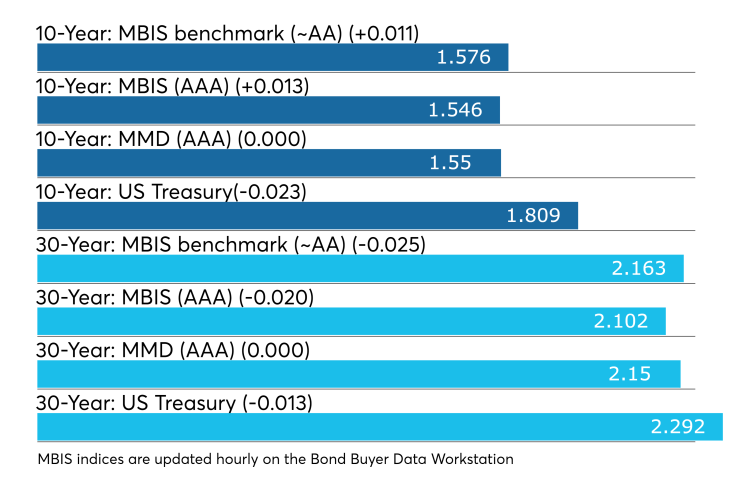

Munis were mixed on the MBIS benchmark scale, with yields rising by one basis point in the 10-year maturity and 30-year maturity was falling by two basis points . High-grades were weaker, with yields on MBIS AAA scale increasing less than a basis point in the 10-year and by two basis points in the 30-year maturity.

On Refinitiv Municipal Market Data’s AAA benchmark scale, the yield on both the 10- and the 30-year GO were unchanged from 1.55% and 2.15%, respectively.

The 10-year muni-to-Treasury ratio was calculated at 89.3% while the 30-year muni-to-Treasury ratio stood at 97.7%, according to MMD.

Treasuries were mostly lower and stocks were higher, with all three major indexes in the green. The Treasury three-month was up and yielding 1.571%, the two-year was down and yielding 1.590%, the five-year was down and yielding 1.625%, the 10-year was down and yielding 1.809% and the 30-year was down and yielding 2.292%.

Previous session's activity

The MSRB reported 32,570 trades Friday on volume of $12.54 billion. The 30-day average trade summary showed on a par amount basis of $10.38 million that customers bought $5.85 million, customers sold $2.69 million and interdealer trades totaled $1.84 million.

California, New York and Texas were most traded, with the Golden State taking 13.484% of the market, the Empire State taking 10.472% and the Lone Star State taking 9.905%.

The most actively traded securities were the University of North Carolina Chapel Hill revenue, 5s of 2049 traded 23 times on volume of $36.365 million.

Treasury auctions discount rate bills

Tender rates for the Treasury Department's latest 91-day and 182-day discount bills were lower, as the $45 billion of three-months incurred a 1.540% high rate, down from 1.565% the prior week, and the $42 billion of six-months incurred a 1.540% high rate, off from 1.550% the week before.

Coupon equivalents were 1.572% and 1.578%, respectively. The price for the 91s was 99.610722 and that for the 182s was 99.221444.

The median bid on the 91s was 1.520%. The low bid was 1.490%.

Tenders at the high rate were allotted 14.44%. The bid-to-cover ratio was 3.01.

The median bid for the 182s was 1.520%. The low bid was 1.495%.

Tenders at the high rate were allotted 88.92%. The bid-to-cover ratio was 2.89.

Gary E. Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.