Municipal bonds were substantially stronger in early action as the market gets set to see more volume come their way on Wednesday, led by a large sale from the District of Columbia.

Secondary market

Top-shelf municipal bonds strengthened with Treasuries on worries about the political problems the Trump Administration is having in Washington.

The yield on the 10-year benchmark muni general obligation fell three to five basis points from 2.09% on Tuesday, while the 30-year GO yield dropped four to six basis points from 2.96%, according to a morning read of Municipal Market Data's triple-A scale.

U.S. Treasuries were also stronger on Wednesday. The yield on the two-year Treasury fell to 1.25% from 1.29% on Tuesday, while the 10-year Treasury yield dropped to 2.26% from 2.33%, and the yield on the 30-year Treasury bond decreased to 2.94% from 2.99%.

On Tuesday, the 10-year muni to Treasury ratio was calculated at 89.9%, compared with 90.2% on Monday, while the 30-year muni to Treasury ratio stood at 99.0%, versus 99.1%, according to MMD.

MSRB: Previous session's activity

The Municipal Securities Rulemaking Board reported 44,812 trades on Tuesday on volume of $9.60 billion.

Primary market

Sibert Cisneros Shank is set to price the District of Columbia’s $576 million of Series 2017A general obligation bonds on Wednesday.

Market sources said that a premarketing scale on the deal was released on Tuesday. The consensus scale was offered to yield from 1.01% with a 3% coupon in 2019 to 3.11% with a 5% coupon and 3.41% with a 4% coupon in a split 2037 maturity.

The deal is rated Aa1 by Moody’s Investors Service and AA by S&P Global Ratings and Fitch Ratings.

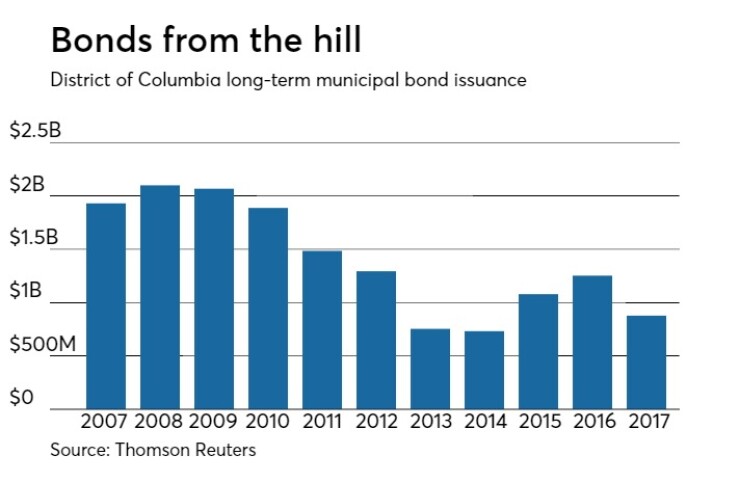

Since 2007, the nation’s capitol has sold roughly $15.76 billion of securities, with the most issuance occurring in 2008 when it sold $2.09 billion. Washington D.C., has sold bonds every year for the past decade, only issuing less than $1 billion in a year twice during that span, with the lowest being $732 million in 2014.

Bank of America Merrill Lynch is set to price the Indiana Finance Authority’s $296 million of Series 2017A health facilities revenue bonds for the Baptist Healthcare System Obligated Group.

The deal is rated Baa2 by Moody’s and A by Fitch.

RBC Capital Markets is expected to price the North Carolina Housing Finance Agency’s $255.56 million of homeownership revenue refunding bonds consisting of Series 38-A bonds subject to the alternative minimum tax and Series 38-B non-AMT bonds.

The deal is rated Aa2 by Moody’s and AA by S&P.

Citigroup is set to price the Tennessee Housing Development Agency’s $175 million of residential finance program bonds consisting of Series 2017-2A non-AMT and Series 2017-2B bonds.

The deal is rated Aa1 by Moody’s and AA-plus by S&P.

Bond Buyer 30-day visible supply

The Bond Buyer's 30-day visible supply calendar decreased $484.4 million to $14.04 billion on Wednesday. The total is comprised of $3.95 billion of competitive sales and $10.09 billion of negotiated deals.