Municipal bonds were mixed on Thursday, a day after the Federal Reserve raised interest rates. In the primary market, a New York issuer competitively sold $1.6 billion of notes.

There was a tentative tone in the municipal market throughout the day, with tepid response from the retail crowd and municipals underperforming and lagging Treasuries. And a lull continued to hang over the municipal market at the end of trading as traders said yields were too rich for their blood.

“Yields are not really where we want them,” said a New York trader. “Yields are sitting tight and getting richer with the lack of supply.”

He described a quandary on the short end of the yield curve, as that is where most conservative retail investors were focusing their attention a few weeks ago. Now those yields are too aggressive. “It’s making for a tough trade, and making it trickier,” he said, especially inside of five years, where retail demand has been the strongest.

“We have been getting lucky the last few weeks, but as supply creeps down it’s a little tricky and hard to sell a muni bond because you can go after a Treasury or corporate at better yields,” he said. On the fixed income side, “you’re competing with your own product.”

Some secondary bonds have gotten more expensive and that has deterred investors, who are also distracted by the summer-like weather in New York, as well the World Cup soccer tournament and the U.S. Tennis Open. “There’s no muni focus right now,” he said.

“From our perspective the market feels technically strong, but sentiment seems weak given the strong economy and the hawkish Fed,” Michael Pietronico, president of Miller Tabak Asset Management, said earlier in the day.

“We would anticipate yields to slowly grind higher as we get closer to the end of the quarter,” he said. “Retail demand seems steady, but far from overly enthusiastic.”

Secondary market

Municipal bonds were little changed on Thursday, according to a late read of the MBIS benchmark scale. Benchmark muni yields fell less than one basis point in the two- to four-year, nine- to 14-year, 18-year, 20-year, 22- and 23-year and 25-year maturities, rose less than a basis point in the one-year, five- to eight year, 16-year and 30-year maturities and remained unchanged in the 15-year, 17-year, 19-year, 21-year and 26- to 29 year maturities.

High-grade munis were mostly stronger, with yields calculated on MBIS’ AAA scale rising as much as two basis points in the one-year and five-to 30-year maturities, falling less than a basis point in the two- and three-year maturities, and remaining unchanged in the four-year maturity.

Municipals were stronger on Municipal Market Data’s AAA benchmark scale, which showed yields rising one basis point in the 10-year muni general obligation and gaining one basis point in the 30-year muni maturity.

Treasury bonds were stronger as stock prices were mixed.

On Thursday, the 10-year muni-to-Treasury ratio was calculated at 84.6% while the 30-year muni-to-Treasury ratio stood at 98.3%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasury with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasury; if it is below 100%, munis are yielding less.

One New York trader described the tone in the market as firm and strong with very little supply — and extremely quiet.

He said investors are being “apprehensive” about the front end of the yield curve due to the highly aggressive yields. “The yields are too low [in 2019 and 2020] so everyone is running for cover,” he said at midday.

“Accounts are extremely patient and not really willing to pay up a few basis points from where the bid side was yesterday,” a second New York trader said. “They are tentative and not getting sucked in. We have not really seen any robust buying activity, and apathy is really high.”

Previous session's activity

The Municipal Securities Rulemaking Board reported 41,421 trades on Wednesday on volume of $15.10 billion.

California, New York and Texas were the states with the most trades, with the Golden State taking 13.755% of the market, the Empire State taking 12.107% and the Lone Star State taking 7.494%.

Primary market

The N.Y. Metropolitan Transportation Authority competitively sold $1.6 billion of transportation revenue bond anticipation notes in two sales consisting of $800 million of Series 2018B-1 and $800 million of Series 2018B-2.

The deals are rated MIG1 by Moody’s Investors Service, SP1-plus by S&P Global Ratings, F1-plus by Fitch Ratings and K1-plus by Kroll Bond Rating Agency.

The BANs were won by a variety of groups.

Eight groups won the Series 2018B-1 BANs: UBS Financial, Barclays Capital, Jefferies, Goldman Sachs, Citigroup, Morgan Stanley, RBC Capital Markets and JPMorgan Securities.

Five groups won the Series 2018B-2 BANs: Jefferies, Citigroup, TD Securities, Morgan Stanley and Bank of America Merrill Lynch.

In the negotiated sector, BAML priced the Delaware Valley Regional Finance Authority, Pa.’s $125 million of local government revenue bonds. The deal is rated A1 by Moody’s and A-plus by S&P.

Thursday’s bond sales

New York:

Pennsylvania:

Bond Buyer 30-day visible supply at $8.60B

The Bond Buyer's 30-day visible supply calendar increased $3.11 billion to $8.60 billion on Friday. The total is comprised of $3.31 billion of competitive sales and $5.29 billion of negotiated deals.

ICI: Long-term muni funds see $648M inflow

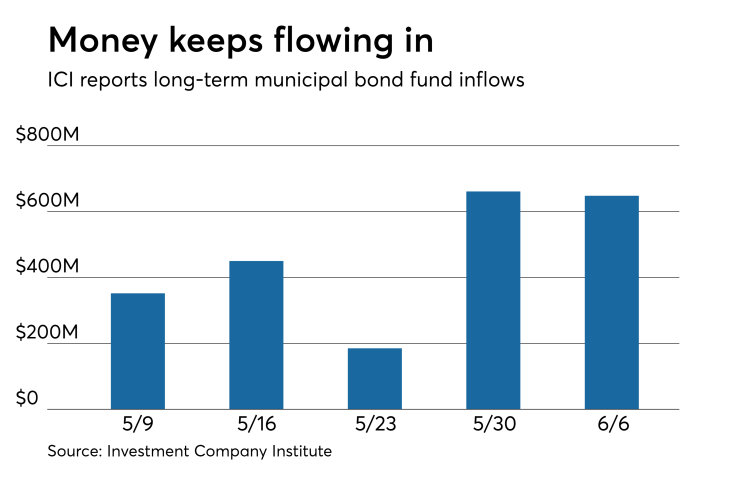

Long-term municipal bond funds saw an inflow of $648 million in the week ended June 6, the Investment Company Institute reported.

This followed an inflow of $661 million into the tax-exempt mutual funds in the week ended May30 and inflows of $185 million, 450 million and $352 million in the three prior weeks.

Taxable bond funds saw an estimated inflow of $727 million in the latest reporting week, after seeing an inflow of $1.57 billion in the previous week.

ICI said the total estimated outflows to long-term mutual funds and exchange-traded funds were $4.16 billion for the week ended June 6 after inflows of $7.15 billion in the prior week.

Tax-exempt money market funds saw outflows

Tax-exempt money market funds saw outflows of $1.96 billion, lowering total net assets to $137.69 billion in the week ended June 11, according to The Money Fund Report, a service of iMoneyNet.com. This followed an outflow of $389.8 million to $139.65 billion in the prior week.

The average, seven-day simple yield for the 202 weekly reporting tax-exempt funds fell to 0.64% from 0.66% the previous week.

The total net assets of the 830 weekly reporting taxable money funds fell $2.08 billion to $2.690 trillion in the week ended June 12, after an inflow of $35.04 billion to $2.692 trillion the week before.

The average, seven-day simple yield for the taxable money funds decreased to 1.41% from 1.42% from the prior week.

Overall, the combined total net assets of the 1,032 weekly reporting money funds fell $4.04 billion to $2.828 trillion in the week ended June 12, after inflows of $34.65 billion to $2.832 trillion in the prior week.

Treasury to auction $90B bills next week

The Treasury Department said it will sell $90 billion of bills on Monday, consisting of $48 billion of 91-day bills and $42 billion of 182-day bills.

The 13-week bills have an issue date of June 21, an original issue date of March 22, and are due Sept. 20. There are $45 billion of the bills outstanding.

The 26-week bills have an issue date of June 21 and are due Dec. 20. There are no bills outstanding.

Treasury to sell $5B 30-year TIPS, $26B year bills

The Treasury Department said it will sell $5 billion of 30-year Treasury Inflation Protected Securities on Thursday.

The 29-year and eight-month TIPS have an issue date of June 29, an original issue date of Feb. 28, and are due Feb. 15, 2048. There are $8.7 billion of the bills outstanding.

Treasury also said it will auction $26 billion of one-year bills on Tuesday.

The 52-week bills have an issue date of June 21 and are due June 20, 2019. There are $45 billion of the 364-day bills outstanding.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.