Municipal bonds ended steady on Monday, ahead of this week’s $9.36 billion new issue calendar.

The yield on the 10-year benchmark muni general obligation was flat from 2.17% on Friday, while the 30-year GO yield was unchanged from 3.03%, according to the final read of Municipal Market Data's triple-A scale.

U.S. Treasuries were weaker on Monday. The yield on the two-year Treasury rose to 1.33% from 1.31% on Friday, while the 10-year Treasury yield gained to 2.37% from 2.35%, and the yield on the 30-year Treasury bond increased to 3.01% from 2.99%.

The 10-year muni to Treasury ratio was calculated at 91.3% on Monday, compared with 92.3% on Friday, while the 30-year muni to Treasury ratio stood at 100.5%, versus 101.4%, according to MMD.

MSRB: Previous session's activity

The Municipal Securities Rulemaking Board reported 35,141 trades on Friday on volume of $8.62 billion.

Prior week's actively traded issues

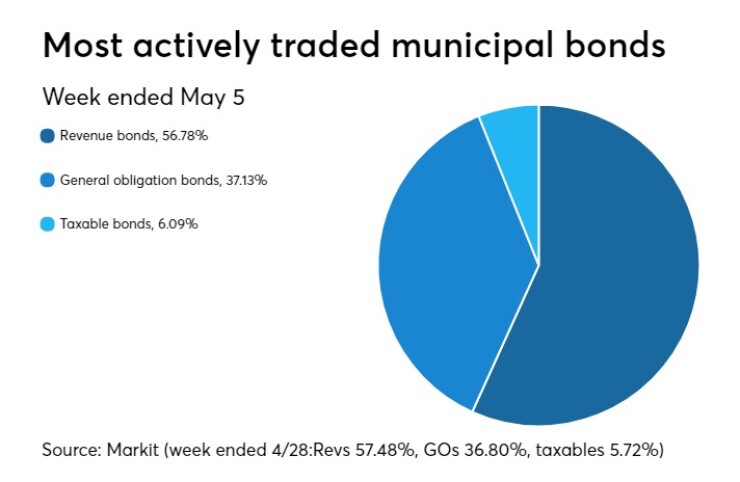

Revenue bonds comprised 56.78% of new issuance in the week ended May 5, down from 57.48% in the previous week, according to

Some of the most actively traded issues by type were from Georgia, Kentucky and Wisconsin.

In the GO bond sector, the Fulton County, Ga., 2s of 2017 were traded 19 times. In the revenue bond sector, the Kentucky Economic Development Finance Authority 4s of 2045 were traded 46 times. And in the taxable bond sector, the Wisconsin 3.154s of 2027 were traded 72 times.

Previous week's top underwriters

The top negotiated and competitive underwriters of last week included Jefferies, Bank of America Merrill Lynch, JPMorgan Securities, Wells Fargo Securities, and Piper Jaffray, and Stifel, according to Thomson Reuters data.

In the week of April 29 to May 6, Jefferies underwrote $1.2 billion, BAML $974.6 million, JPMorgan $826.8 million, Wells Fargo $674.5 million and Piper $550.6 million.

Primary market

This week’s slate is composed of $7.82 billion of negotiated deals and $1.54 billion of competitive sales.

Bank of America is set to price Cuyahoga County, Ohio’s $915 million of Series 2017 hospital revenue bonds for the MetroHealth System for retail investors on Tuesday ahead of the institutional pricing on Wednesday.

The deal is rated Baa3 by Moody’s Investors Service and BBB-minus by S&P Global Ratings and Fitch Ratings.

BAML is also expected to price Hawaii’s $856 million of Series 2017 FK, FL, FM, FN, FO and FP refunding and taxable general obligation bonds for retail investors on Tuesday ahead of the institutional pricing on Wednesday.

The deal is rated Aa1 by Moody’s, AA-plus by S&P and AA by Fitch.

Citigroup is set to price the Houston Independent School District, Texas’ $838 million of Series 2017 limited tax schoolhouse and refunding bonds on Tuesday. The deal is backed by the Permanent School Funding guarantee program and rated triple-A by Moody’s, S&P and Fitch.

Barclays Capital is expected to price the San Francisco Bay Area Rapid Transit District, Calif.’s $388.85 million of general obligation bonds for retail investors on Tuesday ahead of the institutional pricing on Wednesday.

The deal is rated triple-A by Moody’s and S&P.

Jefferies is set to price the Pennsylvania Housing Finance Agency’s $262.23 million of alternative minimum tax, non-AMT, and taxable bonds for retail investors on Tuesday ahead of the institutional pricing on Wednesday.

BAML is set to price the Monroe County Industrial Development Corp., N.Y.’s $152 million of Series 2017 tax-exempt revenue bonds for Rochester General Hospital for retail investors on Tuesday ahead of the institutional pricing on Wednesday.

The deal is rated A-minus by S&P.