Municipal bonds were mostly stronger in late trading on Thursday as market activity slowed ahead of Friday’s shortened trading session preceding the three-day the Memorial Day weekend.

Secondary market

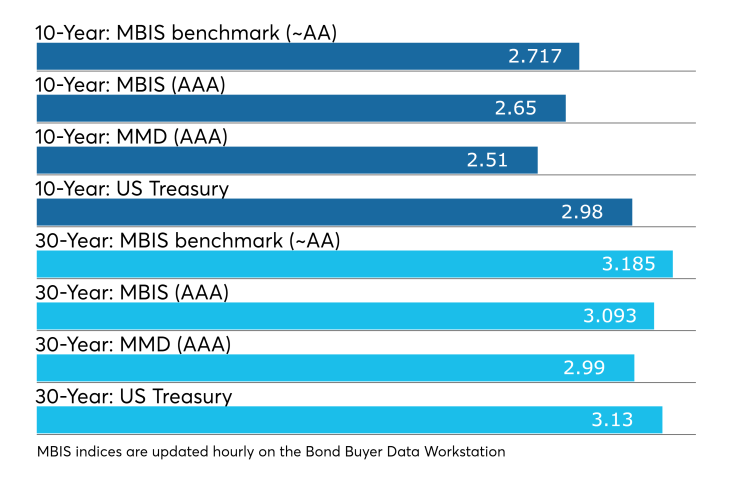

Municipal bonds were mostly stronger on Thursday, according to a late read of the MBIS benchmark scale.

Benchmark muni yields fell as much as two basis points in the seven- to 30-year maturities, while the one- to six-year maturities rose by less than a basis point.

High-grade munis were also mostly stronger, with yields calculated on MBIS’ AAA scale falling as much as one basis point in the seven- to 30-year maturities and rising as much as one basis point in the one- to five-year maturities.

According to a New York trader, concern over rising interest rates has receded as the 10-year Treasury yield fell.

“Last week it felt like it was the end of the world, but starting yesterday Treasurys rallied below 3% on the 10-year and there were big blocks trading and good activity,” he said on Thursday afternoon.

It was one of the largest declines in rates in nearly a month, the trader said, reflecting a good trading environment after with the Federal Reserve Board’s released the minutes from its May meeting and hinted at its intentions to raise interest rates in June.

“Today it’s firm — not a lot of activity — but some follow-through from yesterday’s positive day overall,” he said.

The trader said a small forward calendar compared with money coming into the market because of June 1 redemptions is a net positive.

“Muni sales will be far below redemptions going into June so that should create a decent tone if Treasuries hang in there,” he said. “Looking at the forward calendar, muni sales versus the supply is well below redemptions and announced calls, which should create a continued positive tone for the muni market.”

According to Municipal Market Data’s AAA benchmark scale, municipals strengthened with yields falling one basis point in the 10-year general obligation muni while the 30-year maturity dropped three basis points to dip under the 3% level.

“It’s super sleepy right now but we are in a good spot and we will soon see the June first redemptions when we get back, which will hopefully be followed by good issuance the first full week of the month," one New York trader said at midday.

Treasury bonds were stronger, with the 10-year yield dropping below the 3% level while stock prices were trading lower.

On Thursday, the 10-year muni-to-Treasury ratio was calculated at 84.2% while the 30-year muni-to-Treasury ratio stood at 95.5%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasuries with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasuries; if it is below 100%, munis are yielding less.

Previous session's activity

The Municipal Securities Rulemaking Board reported 44,955 trades on Wednesday on volume of $13.88 billion.

California, New York and Texas were the states with the most trades, with the Golden State taking 18.813% of the market, the Empire State taking 12.538% and the Lone Star State taking 10.939%.

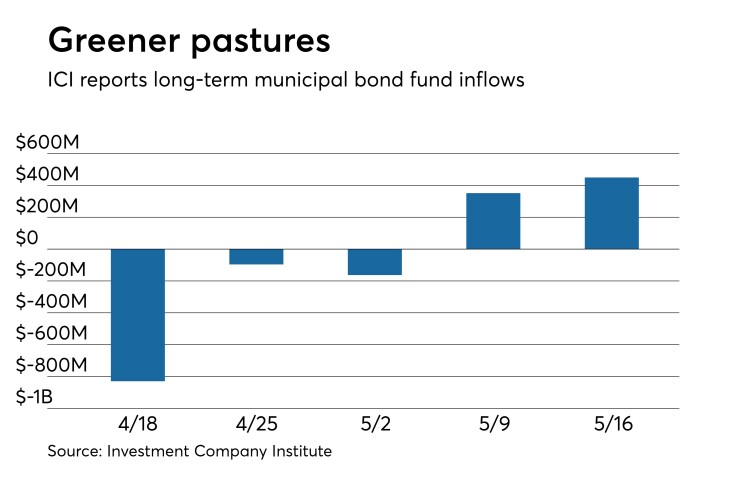

ICI: Long-term muni funds see $450M inflow

Long-term municipal bond funds saw an inflow of $450 million in the week ended May 16, the Investment Company Institute reported on Thursday.

This followed an inflow of $352 million of the tax-exempt mutual funds in the week ended May 9 and outflows of $163 million, $96 million, and $830 million in the three prior weeks.

Taxable bond funds saw an estimated inflow of $4.73 billion in the latest reporting week, after seeing an inflow of $2.38 billion in the previous week.

ICI said the total estimated inflows to long-term mutual funds and exchange-traded funds were $12.43 billion for the week ended May 16 after inflows of $4.23 billion in the prior week.

Tax-exempt money market funds saw inflows

Tax-exempt money market funds experienced inflows of $2.75 billion, raising their total net assets to $139.45 billion in the week ended May 22, according to The Money Fund Report, a service of iMoneyNet.com. This followed an inflow of $2.09 billion on to $136.70 billion in the previous week.

The average, seven-day simple yield for the 202 weekly reporting tax-exempt funds fell to 0.92% from 1.02% the previous week.

The total net assets of the 833 weekly reporting taxable money funds fell to $2.20 billion to $2.653 trillion in the week ended May 21, after an inflow of $15.51 billion to $2.655 trillion the week before.

The average, seven-day simple yield for the taxable money funds nudged up to 1.38% from 1.37% from the prior week.

Overall, the combined total net assets of the 1,035 weekly reporting money funds increased $550.4 million to $2.793 trillion in the week ended May 21, after inflows of $17.60 billion to $2.792 trillion in the prior week.

Bond Buyer 30-day visible supply at $6.95B

The Bond Buyer's 30-day visible supply calendar increased $218.8 million to $6.95 billion on Friday. The total is comprised of $3.48 billion of competitive sales and $3.48 billion of negotiated deals.

Treasury sells $20B 7-year notes

The Treasury Department Thursday auctioned $30 billion of seven-year notes, with a 2 7/8% coupon and a 2.930% high yield, a price of 99.654192. The bid-to-cover ratio was 2.62.

Tenders at the high yield were allotted 33.68%. All competitive tenders at lower yields were accepted in full. The median yield was 2.900%. The low yield was 1.888%.

Treasury announces auctions

The Treasury Department on Thursday announced the following auctions for next week:

- $42 billion of 182-day bills selling on May 29;

- $48 billion of 91-day bills selling on May 29; and

- $40 billion of four-week bills selling on May 29.

Gary E. Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.