Municipal bond market sentiment is firming amid investor wariness, according to market participants. On Monday, munis finished little changed in quiet activity.

Municipal bond buyers are approaching the early days of 2019 with caution, according to Jeffrey Lipton, managing director of credit at Oppenheimer & Co. Inc.

“As 2019 unfolds, we are paying close attention to market technicals and curve positioning,” he wrote in a recent market report. Volume is not indicating any rapid growth - especially given the loss of tax-exempt advance refunding capacity, he said.

Lipton expects municipals will move directionally with U.S. Treasuries over the near term as the bond market makes a more refined assessment of the interest-rate trajectory.

“For the time being, we believe that the steeper slope of the muni yield curve offers some investment opportunities as the spread between the benchmark 10- and 30-year maturities has widened to about 85 basis points with the 10-year spot becoming fairly rich relative to the comparable UST,” Lipton said in the report.

“Although our investment thesis has generally kept to the intermediate part of the curve, we have routinely pointed out that shifting relative value can justify episodic moves further out on the curve.”

Lipton advises that now is the time to make such adjustments given the weaker demand for longer-dated securities.

“We think there remains ample volatility, particularly stemming from interest rate uncertainty, and so we are hesitant to move out beyond 20-years,” he wrote.

Lipton noted that in 20-years, investors can capture 95% of the Municipal Market Data triple-A 30-year benchmark yield, while in 17-years, investors can gain almost 90% of the long-bond yield, he added.

Meanwhile, the market is looking ahead to the new competitive sales coming this week as events unfold in Washington and New York.

The Federal Open Market Committee will start its two-day monetary policy meeting in D.C. on Tuesday and is not expected to alter interest rates, but observers will pay close attention to any discussion of balance-sheet reduction for hints of flexibility.

In New York, The Bond Buyer holds its National Outlook Conference on Tuesday. Experts will unveil their expectations for the market this year and discuss infrastructure financing, fiscal policy, the effects of tax reform as well as regulatory developments, technology and pension funding.

Primary market

On Monday, the Wauwatosa School District in Wisconsin sold $124.9 million of general obligation school building and improvement bonds in two offerings.

Bank of America Merrill Lynch won the $63 million of Series 2019A GOs with a true interest cost of 3.1051%; JPMorgan Securities won the $61.9 million of Series 2019B GOs with a TIC of 2.0298%. Proceeds will be used to finance various school improvements.

The financial advisor is Robert W. Baird; the bond counsel is Quarles & Brady. The deals are rated Aa1 by Moody’s.

On Thursday, the New York Metropolitan Transportation Authority will sell over $1 billion of securities in two competitive sales.

The offerings consist of $462.8 million of Series 2019A transportation revenue climate bond certified green bonds and $750 million of transportation revenue bond anticipation notes

Moody's Investors Service rates the bonds A1 and assigns a MIG1 rating to the BANs while Kroll Bond Rating Agency assigns an AA-plus rating to the bonds and a K1-plus rating to the BANs.

Kroll revised its outlook to negative on the MTA's transportation revenue bonds.

“While not losing sight of the significant strengths provided by the essential nature of the MTA transportation services and the gross revenue pledge which covers debt service over 8.7x, KBRA has grown concerned regarding the inability of MTA’s political leadership to build consensus and begin executing plans to address MTA’s worsening operational and revenue trends,” Kroll said in a rating report Monday. “Ridership declines are now showing a consistent multi-year downward trend despite years of robust growth in the New York metropolitan area economy. The ridership declines are caused by delays, disruptions, overcrowding, and, most important, the expanding popularity of alternatives such as rideshare services and biking. While all these issues are complex, KBRA believes they can be addressed once legislative and other elected leaders develop the urgency to do so.”

On Tuesday, Fairfax County, Virginia, plans to sell $270.3 million of public improvement bonds and refunding bonds in two offerings consisting of $225.395 million of Series 2019A bonds and $44.88 million of Series 2019 taxable refunding bonds. Proceeds will be used to finance various public and school improvements and to refund some outstanding debt. The financial advisor is PFM Financial Advisors; the bond counsel is Norton Rose. The deal is rated triple-A by Moody’s, S&P Global Ratings and Fitch Ratings.

Shelby County, Tennessee, will sell $243.325 million of GO public improvement and school bonds in two offerings consisting of $170.865 million of Series 2019A GOs and $72.46 million of Series 2019B GO refunding bonds. Proceeds will be used to finance various capital and school improvements and to redeem some outstanding debt. Financial advisors are ComCap Partners and PFM Financial Advisors; the bond counsel is Butler Snow. The deal is rated AA-plus by S&P and Fitch.

The Broward County School District, Florida, will sell $175.845 million of Series 2019 GO school bonds. Proceeds will be used for the acquisition, construction, renovation and equipping of educational facilities within the School District, including safety enhancements and instructional technology upgrades. The financial advisor is PFM Financial Advisors; the bond counsel are Greenberg Traurig and Edwards & Feanny. The deal is rated AA-minus by Fitch.

Monday’s bond sales

Wisconsin

Bond Buyer 30-day visible supply at $6.37B

The Bond Buyer's 30-day visible supply calendar increased $811.0 million to $6.37 billion for Monday. The total is comprised of $2.40 billion of competitive sales and $3.97 billion of negotiated deals.

Prior week's actively traded issues

Revenue bonds comprised 55.69% of total new issuance in the week ended Jan. 25, down from 56.52% in the prior week, according to

Some of the most actively traded munis by type in the week were from Texas, New York and Illinois issuers.

In the GO bond sector, the Birdville Independent School District, Texas, 3.75s of 2044 traded 24 times. In the revenue bond sector, the New York City Municipal Water Finance Authority 5s of 2024 traded 39 times. In the taxable bond sector, the Chicago Sales Tax Securitization Corp. 4.787s of 2048 traded 38 times.

Secondary market

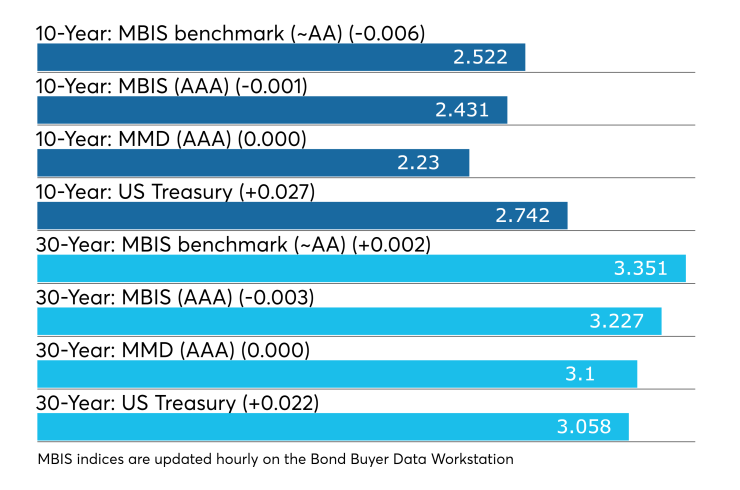

Municipal bonds were little changed Monday, according to a late read of the MBIS benchmark scale. Benchmark muni yields fell as much as one basis point in the one- to 11-year and 17-year maturities, rose less than a basis point in the 28- to 30-year maturities and remained unchanged in the 12- to 16-year and 18- to 27-year maturities.

High-grade munis were stronger, with muni yields falling as much as one basis point in the one- to 10-year and 17- to 30-year maturities, rising less than a basis point in the 12- to 15-year maturities and remaining unchanged in the 11- and 16-year maturities.

Municipals were steady on Municipal Market Data’s AAA benchmark scale, which showed the yield on both the 10-year muni general obligation and the yield on 30-year muni maturity remaining unchanged.

Treasury bonds were weaker as stock prices traded lower.

On Monday, the 10-year muni-to-Treasury ratio was calculated at 81.3% while the 30-year muni-to-Treasury ratio stood at 101.3%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasury with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasury; if it is below 100%, munis are yielding less.

“Munis were fairly quiet today with the broader curve down one basis point in yield from 2034 and longer,” ICE Data Services said in a market comment. “High-yield was also quiet and unchanged so far today. The taxable market was one to 1.4 basis point lower in yield.”

Previous session's activity

The Municipal Securities Rulemaking Board reported 37,381 trades on Friday on volume of $12.69 billion.

California, Texas and New York were the municipalities with the most trades, with the Golden State taking 15.236% of the market, the Lone Star State taking 13.875% and the Empire State taking 12.149%.

Foreign Treasury holdings drop

Foreign holdings of U.S. Treasuries dropped in October as China and Japan continued to sell, according to a report released Monday by Societe Generale.

“Overall holdings were down by $25.6 billion, led by the largest monthly decline in official account holdings (-$62.9 billion) since November 2016 as global reserves continued to decline,” the report said.

In a fifth straight monthly decline, China’s holdings fell $12.5 billion to $1.14 trillion, the lowest level since May 2017. China’s foreign reserves dropped $33.9 billion in October, the largest monthly decline since December 2016.

For the third month in a row, Japan cut its holdings, by $9.5 billion to $1.02 trillion, the lowest level since October 2011.

Meanwhile, primary dealers decreased their total holdings of US Treasury securities after taking them to highest level on Jan. 2. This was supported by the reduction in holdings of bills, to the lowest level since March 2017, and coupons maturing in the two- to 11-year sector.

Treasury sells notes, bills

The Treasury Department Monday auctioned $40 billion of two-year notes with a 2 1/2% coupon at a 2.600% yield, a price of 99.806335. The bid-to-cover ratio was 2.56.

Tenders at the high yield were allotted 8.00%. The median yield was 2.577%. The low yield was 2.500%.

Treasury also auctioned and $39 billion 182-day discount bills at a 2.450% high rate. The coupon equivalents was 2.515%. The price was 98.761389.

The median bid was 2.435% and the low bid was 2.400%. Tenders at the high rate were allotted 40.89%. The bid-to-cover ratio was 3.09.

Treasury also auctioned $41 billion of five-year notes, with a 2 1/2% coupon, a 2.576% high yield, a price of 99.645588. The bid-to-cover ratio was 2.41.

Tenders at the high yield were allotted 36.27%. All competitive tenders at lower yields were accepted in full. The median yield was 2.540%. The low yield was 2.470%.

Treasury auctioned $42 billion of 91-day discount bills at a 2.375% high rate. The coupon equivalent was 2.423% and the price was 99.399653.

The median bid was 2.350%. The low bid was 2.320%. Tenders at the high rate were allotted 43.98%. The bid-to-cover ratio was 3.27.

Gary E. Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.