Municipal bond buyers had a wide variety of offerings to choose from on Tuesday, as several large deals came to market, led by the big LaGuardia Delta sale.

Primary market

Citigroup priced the New York Transportation Development Corp.’s $1.39 billion of special facilities revenue bonds. The issue is redevelopment financing to fix Delta Airlines’ Terminals C and D at LaGuardia Airport.

The offering is subject to the alternative minimum tax and is rated Baa3 by Moody’s Investors Service and BBB-minus by Fitch Ratings.

JPMorgan Securities priced the Texas Water Development Board’s $824.67 million of Series 2018 Master Trust State Water Implementation Revenue Fund for Texas revenue bonds.

The deal is rated AAA by S&P Global Ratings and Fitch.

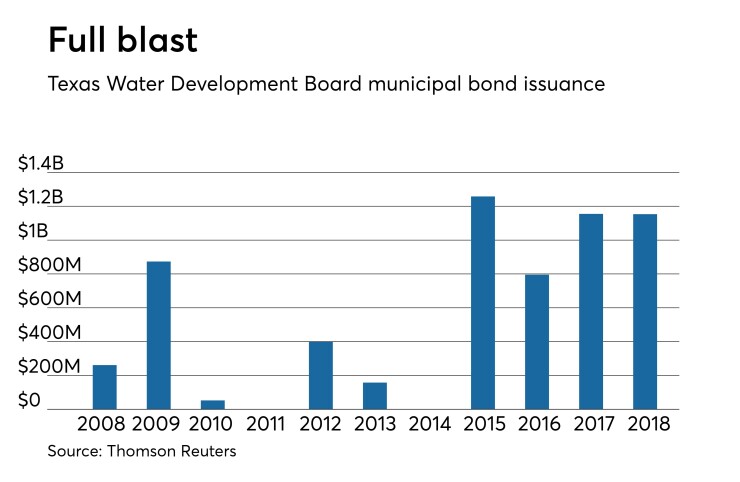

Since 2008, the TWDB has sold about $6.1 billion of securities, with the most issuance occurring in 2015 when it sold $1.26 billion. The board did not come to market in 2011 or 2014.

Ramirez & Co. priced the Port Authority of New York and New Jersey’s $413.13 million of 209th Series consolidated bonds for retail investors ahead of the institutional pricing on Wednesday.

The deal is rated Aa3 by Moody’s and AA-minus by S&P and Fitch.

In the competitive arena, Massachusetts sold $500 million of general obligation bonds in two sales.

Morgan Stanley won the $250 million of Series C consolidated loan of 2018 GOs with a true interest cost of 3.9221%

Citigroup won the $250 million of Series D consolidated loan of 2018 GOs with a TIC of 3.8%.

The deals are rated Aa1 by Moody’s, AA, by S&P and AA-plus by Fitch.

Later this afternoon, the West Contra Costa Unified School District will sell $125 million of Series E 2010 election and Series D 2012 election GOs.

The deal is rated Aa3 by Moody’s, AA-minus by S&P and AAA by Fitch.

Portland, Ore., sold $189.11 million of Series 2018A second lien sewer system revenue bonds. JPMorgan Securities won the deal with a TIC of 3.4357%.

Tuesday’s bond sales

New York:

Texas:

Secondary market

Municipal bonds were mixed on Tuesday, according to a midday read of the MBIS benchmark scale. Benchmark muni yields rose less than a basis point in the one-year, five- to seven-year and 11- to 30-year maturities and fell in the two- to four-year and eight- to 10-year maturities.

Yields calculated on MBIS’ AAA scale were also mixed as yields rose less than a basis point in the one-year, five- to seven-year and 11- to 18-year maturities, were unchanged in the 19- to 21-year maturities, and fell less than a basis point in the two- to four-year, eight- to 10-year and 22- to 30-year maturities.

Treasury bonds were weaker as the Dow Jones Industrial Average, S&P 500 Index and Nasdaq Composite Index all declined.

Bond Buyer 30-day visible supply at $11.13B

The Bond Buyer's 30-day visible supply calendar decreased $5.8 million to $11.13 billion on Tuesday. The total is comprised of $5.03 billion of competitive sales and $6.10 billion of negotiated deals.

Previous session's activity

The Municipal Securities Rulemaking Board reported 41,866 trades on Monday on volume of $8.57 billion.

California, New York and Texas were the states with the most trades, with the Golden State taking 17.874% of the market, the Empire State taking 12.459% and the Lone Star State taking 8.947%.

Treasury sells 4-week, year bills

The Treasury Department Tuesday auctioned $26 billion of 364-day bills at a 2.200% high yield, a price of 97.775556.

The coupon equivalent was 2.268%. The bid-to-cover ratio was 3.39. Tenders at the high rate were allotted 90.02%. The median yield was 2.180%. The low yield was 2.150%.

Treasury also auctioned $45 billion of four-week bills at a 1.680% high yield, a price of 99.869333.

The coupon equivalent was 1.706%. The bid-to-cover ratio was 3.16. Tenders at the high rate were allotted 31.54%. The median rate was 1.650%. The low rate was 1.640%.

Gary Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.