Assured Guaranty and Orrick, Herrington & Sutcliffe retained their positions in third-quarter rankings of municipal bond insurers and counsel, even as overall muni issuance plunged.

With municipal volume down about 20% from a year earlier, Assured retained its top position after three quarters, as the par value it guaranteed dipped just 2.8%. Build America Mutual rebounded from several weeks in Credit Watch negative to post its typical level of share in the quarter.

Orrick increased its market share among bond counsel to 13.5% from 10%, even as the firm's volume of deals dipped 11.9%.

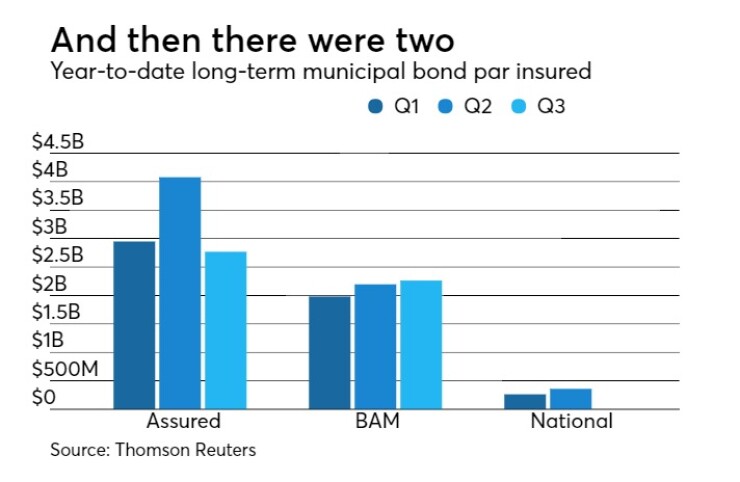

Assured has insured $9.79 billion through the first three quarters of the year in 634 transactions as its share of the insured market rose to 58% from 54.4% a year earlier, according to data from Thomson Reuters. Assured's insured par in 2017 slipped from $10.08 billion in 673 deals during the same time the year before. The figures include Assured's subsidiary Municipal Assurance Corp.

“Assured Guaranty’s financial strength and market recognition continued to produce industry-leading demand for our insurance during the third quarter of 2017, as we guaranteed 54%, or $2.8 billion, of primary market insured par, representing 195 small, medium and large transactions,” said Robert Tucker, senior managing director of communications and investor relations for Assured. “We also saw growth, once again, in our secondary market activity, with par insured up 49% from the same quarter the year before.”

Tucker said Assured’s total par insured for primary and secondary market activity during the third quarter of 2017 was $3.1 billion, which “reflects investors’ growing awareness of the benefits of our guaranty and the value of our sizable capital base, profitable business model, and ability to manage our exposure to troubled credits effectively. “

The municipal bond insurance penetration rate has grown to 5.86% year to date from 5.70% at the end of 2016. So far this year, Assured, Build America Mutual, and National Public Finance Guarantee wrapped a total of $16.89 billion in 1,248 issues, down from $18.53 billion in 1,406 transactions during the third quarter of 2016.

Tucker also said for the year through Sept. 30, monolines insured 6.2% of the municipal new issue par, a 9% increase over this point last year. In terms of insured market share, he said, Assured led with 58% of the insured par, up from 54% in the first nine months of last year.

“We insured $9.8 billion of primary market par, 51% more than that of our nearest competitor, with a transaction count totaling 634, 17% more deals than our nearest competitor insured,” said Tucker.

BAM's insured principal amount dipped to $6.49 billion across 543 deals or 38.4% market share, from $7.78 billion or 42% market share the same time the year before. BAM's new business activity was on hold during June due to the negative watch S&P Global Ratings placed on it and MBIA Inc.'s National. BAM finished the third quarter with about 44% par market share and 49% by volume, resuming business as usual after the watch period ended with its ratings intact.

"The affirmation of our AA / Stable rating was an important moment for BAM and the industry. The market recognized S&P’s decision as an affirmation not only of BAM, but also a vote of confidence in the staying power and relevance of bond insurance more broadly,” said Sean McCarthy, CEO of BAM. “We were pleased to see our volume respond with a strong quarter, and equally pleased to see the use of insurance become more common market-wide."

McCarthy said overall volume was relatively light in July, and BAM used that opportunity to reach out to the market and explain, often in person, exactly what S&P concluded.

“Their report was clear about the strength of our mutual ownership structure, the business franchise we've built in our first five years, and ultimately, BAM's financial resources -- and why that adds up to an AA rating that will remain durable over time,” he said. “So when volume picked up in the second half of the quarter, the market already had a strong sense of the value of our guaranty, and that translated to solid demand for our insured bonds, which benefits both the investors who hold the bonds and our issuer-members."

National finished the first nine months with $627 million of par insurance, down from $667 million for same time frame the year before. Its market share was unchanged at 3.6%. National ended up getting a

Legal Counsel

Orrick has accounted for $36.50 billion in 325 deals among legal counsel year to date, up from $32.13 billion in 335 deals a year earlier.

“There are headwinds everywhere: fiscal distress in a number of states, terrible natural disasters, and more political and regulatory uncertainty than we have felt in the better part of a decade,” said Justin Cooper, partner at Orrick and co-chair of its public finance practice and affordable housing finance group . “At Orrick, we feel fortunate to have a market share so far this year that is nearly twice that of our nearest competitor and that, for the first time, we are number one in number of transactions as well as dollar volume.”

Hawkins Delafield & Wood LLP finished in second place with $16.97 billion or 6.3% market share with 266 deals, up from the $16.09 billion or 5% market share over 273 deals during the same period the year before.

"Bond volume for the first nine months of 2017 was down approximately 20% for the market as a whole," said Howard Zucker, managing partner at Hawkins. "There may have been several reasons for that but prominently among them has been uncertainty in our nation's capital as to key policy issues, including tax reform and health insurance, as well as the credit and humanitarian concerns of Puerto Rico.”

“Markets abhor uncertainty,” he added.

Hawkins finished first among bond underwriters' counsel, with a par amount of $16.58 billion in 82 deals or 8.7% market share.

“As for lawyers who act as bond counsel, underwriter's counsel and disclosure counsel, there is ever more work in the ever-increasing complexity of transactions, and the more intense regulatory compliance regimes in both the tax law and securities law, all of which have made this market more challenging for lawyers,” said Zucker. “Now more than ever, expertise and experience should be and are valued.”

So far this year, Hawkins has participated in over $36 billion of transactions as bond counsel, underwriters' counsel and disclosure counsel. “The key to such achievements as retaining our longstanding national rankings as No. 1 underwriters’ counsel and No. 2 bond counsel based on bond volume is the quality of our attorneys and our relationships with our clients,” he said.

Norton Rose Fulbright ranked third among bond counsel with $15.73 billion, followed by Kutak Rock LLP with $10.30 billion and McCall Parkhurst & Horton LLP with $9.85 billion.

Rounding out the top 10 are Stradling Yocca Carlson & Rauth, Squire Patton Boggs, Ballard Spahr LLP, Nixon Peabody LLP and Gilmore & Bell PC.