After lackluster activity last week, the municipal bond market will see an improvement this week as a big airport revenue bond deal hits the screens, some market participants say.

Citigroup is set to price the New York Transportation Development Corp.’s $1.4 billion of special facilities revenue bonds on Tuesday. The bonds are the next step in the rejuvenation of LaGuardia Airport, which some politicians have compared to a Third World country. The issue is redevelopment financing to fix Delta Airlines’ Terminals C and D at LaGuardia.

“We’re building a new state of the art airport at LaGuardia,” New York Gov. Andrew Cuomo said at an ABNY meeting in Manhattan on April 5. “Construction started in June 2016. The first gates [at Terminal B] will open this Fall and in 2021 [that] project will be completed. It’s design build. It’s done by the private sector in partnership with the government. It’s state of the art and it’s going to happen and it’s going to happen fast.”

The offering is subject to the alternative minimum tax and is rated Baa3 by Moody’s Investors Service and BBB-minus by Fitch Ratings.

On Friday, a New York trader anticipated spreads of 100 basis points on the long end of the deal, compared to the AAA general obligation MMD scale. He predicted the sale will jump start activity with its attractive yields, its infrequent appearance in the market, and its recognized name.

He added it should attract all types of investors — from the retail crowd, to institutional investors, to high-yield mutual funds. “It will be a little of everyone,” with more yield buyers overall, he said.

This week’s calendar is about $7.78 billion, composed of $5.36 billion of negotiated deals and $2.42 billion of competitive sales.

Also on the calendar is a big issue from the Texas Water Development Board.

JPMorgan Securities is set to price the Board’s $803.68 million of Series 2018 Master Trust State Water Implementation Revenue Fund for Texas revenue bonds on Tuesday.

The deal is rated AAA by S&P Global Ratings and Fitch.

Ramirez & Co. is expected to price the Port Authority of New York and New Jersey’s $412 million of 209th Series consolidated bonds on Wednesday.

In the competitive arena, Massachusetts is selling $500 million of general obligation bonds in two sales on Tuesday. The deals consist of $250 million of Series C consolidated loan of 2018 GOs and $250 million of Series D consolidated loan of 2018 GOs.

The deals are rated Aa1 by Moody’s, AA by S&P and AA-plus by Fitch.

On Wednesday, Illinois will sell $500 million of GOs in two sales, consisting of $450 million of Series of May 2018A GOs and $50 million of Series of May 2018B GOs.

The deals are rated Baa3 by Moody’s, BBB-minus by S&P and BBB by Fitch.

Prior week's actively traded issues

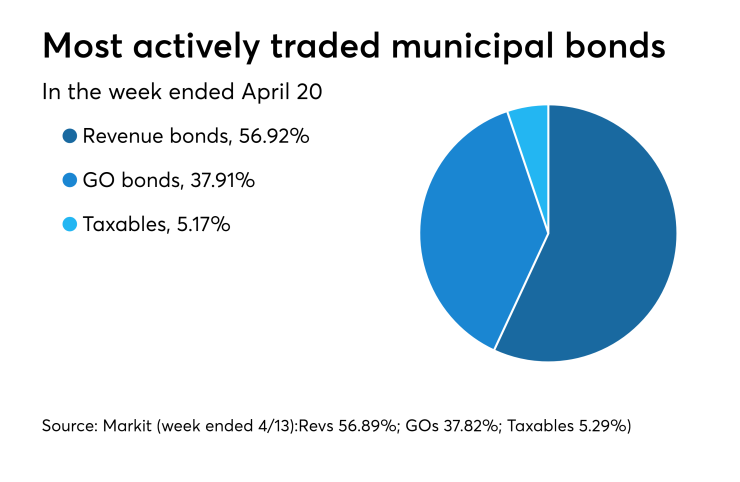

Revenue bonds comprised 56.92% of new issuance in the week ended April 20, up from 56.89% in the previous week, according to

Some of the most actively traded bonds by type were from Connecticut, Pennsylvania and California issuers.

In the GO bond sector, the University of Connecticut 4s of 2038 traded 37 times. In the revenue bond sector, the Montgomery County Higher Education and Health Authority, Pa., 4s of 2049 traded 57 times. And in the taxable bond sector, the California 4.6s of 2038 traded 117 times.

Secondary market

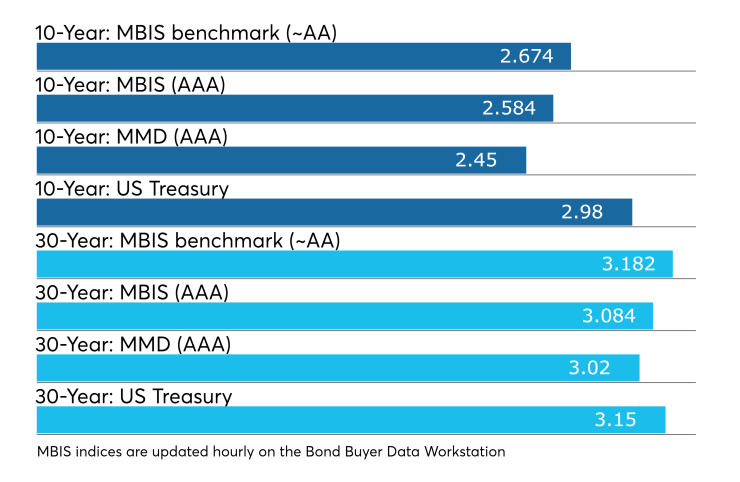

Municipal bonds were mostly weaker on Monday, according to a midday read of the MBIS benchmark scale. Benchmark muni yields rose less than a basis point in the one- and two-year, six- to eight-year and 10- to 30-year maturities and fell in three- and four-year and nine-year maturities.

Yields calculated on MBIS’ AAA scale were mixed as yields rose less than a basis point in the one-year, six- to eight year, 13- to 16-year and 23- to 30-year maturities and fell less than a basis point in the two- to five-year, nine- to 12-year and 17- to 22-year maturities.

Treasury bonds were weaker as the Dow Jones Industrial Average, S&P 500 Index and Nasdaq Composite Index all moved up.

Bond Buyer 30-day visible supply at $11.14B

The Bond Buyer's 30-day visible supply calendar increased $506.4 million to $11.14 billion on Monday. The total is comprised of $5.05 billion of competitive sales and $6.08 billion of negotiated deals.

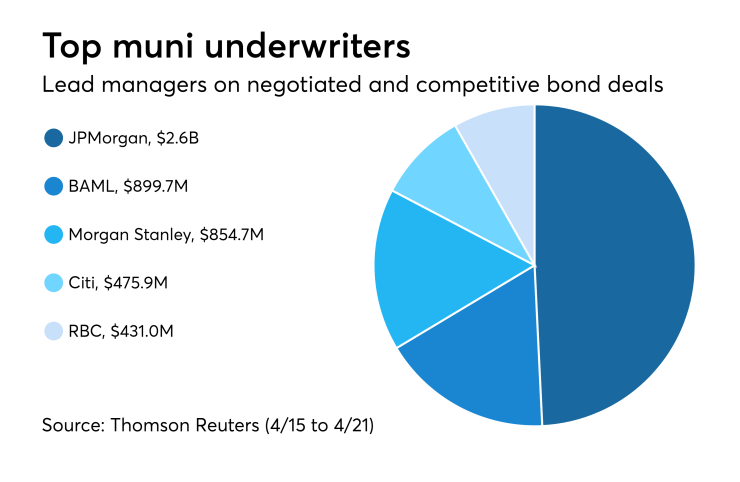

Prior week's top underwriters

The top municipal bond underwriters of last week included JPMorgan Securities, Bank of America Merrill Lynch, Morgan Stanley, Citigroup and RBC Capital Markets, according to Thomson Reuters data.

In the week of April 15 to April 21, JPMorgan underwrote $2.58 billion, BAML $899.7 million, Morgan Stanley $854.7 million, Citi $475.9 million and RBC $431.0 million.

Previous session's activity

The Municipal Securities Rulemaking Board reported 36,605 trades on Friday on volume of $11.11 billion.

California, New York and Texas were the states with the most trades, with the Golden State taking 16.623% of the market, the Empire State taking 10.225% and the Lone Star State taking 9.914%.

Treasury to sell $45B 4-week bills

The Treasury Department said it will sell $45 billion of four-week discount bills Tuesday. There are currently $106.998 billion of four-week bills outstanding.

Treasury auctions discount bills

Tender rates for the Treasury Department's latest 91-day and 182-day discount bills were higher, as the three-months incurred a 1.830% high rate, up from 1.760% the prior week, and the six-months incurred a 1.985% high rate, up from 1.945% the week before.

Coupon equivalents were 1.864% and 2.033%, respectively. The price for the 91s was 99.537417 and that for the 182s was 98.996472. The median bid on the 91s was 1.790%. The low bid was 1.770%.

Tenders at the high rate were allotted 2.26%. The bid-to-cover ratio was 2.98.

The median bid for the 182s was 1.970%. The low bid was 1.940%.

Tenders at the high rate were allotted 76.72%. The bid-to-cover ratio was 3.27.

Gary Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.