Top-shelf municipal bonds finished the day slightly stronger Thursday, as yields on some maturities were as much as two basis points lower, according to traders. The primary market is in virtual shutdown mode with the holidays just around the corner.

Secondary Market

The 10-year benchmark muni general obligation yield dropped two basis points to 2.41% on Thursday, while the yield on the 30-year GO decreased by two basis points to 3.13%, according to a final read of Municipal Market Data's triple-A scale

U.S. Treasuries were narrowly mixed at the market close on Thursday. The yield on the two-year Treasury dipped to 1.19% from 1.20% on Wednesday, while the 10-year Treasury yield nudged higher to 2.55% from 2.54%, and the yield on the 30-year Treasury bond ticked up to 3.13% from 3.12%.

The 10-year muni to Treasury ratio was calculated at 94.5% on Thursday, compared with 95.7% on Wednesday, while the 30-year muni to Treasury ratio stood at 100.0%, versus 101.0%, according to MMD.

"Muni bidders seemed emboldened by Treasuries finding footing," said Randy Smolik, MMD's senior market analyst. "Every trade looked like a bit of a reach."

Tax-Exempt Money Market Fund Inflows

Tax-exempt money market funds experienced inflows of $690.2 million, bringing total net assets to $131.29 billion in the week ended Dec. 19, according to The Money Fund Report, a service of iMoneyNet.com. This followed an outflow of $360.4 million to $130.60 billion in the previous week.

The average, seven-day simple yield for the 237 weekly reporting tax-exempt funds was increased to 0.21% from 0.17% from previous week.

The total net assets of the 862 weekly reporting taxable money funds decreased $37.81 billion to $2.554 trillion in the week ended Dec. 20, after an inflow of $19.94 billion to $2.592 trillion the week before. The average, seven-day simple yield for the taxable money funds increased to 0.22% from 0.17% from the previous week.

Overall, the combined total net assets of the 1,099 weekly reporting money funds fell $37.12 billion to $2.686 trillion in the week ended Dec. 20 after inflows of $19.58 billion to $2.723 trillion in the prior week.

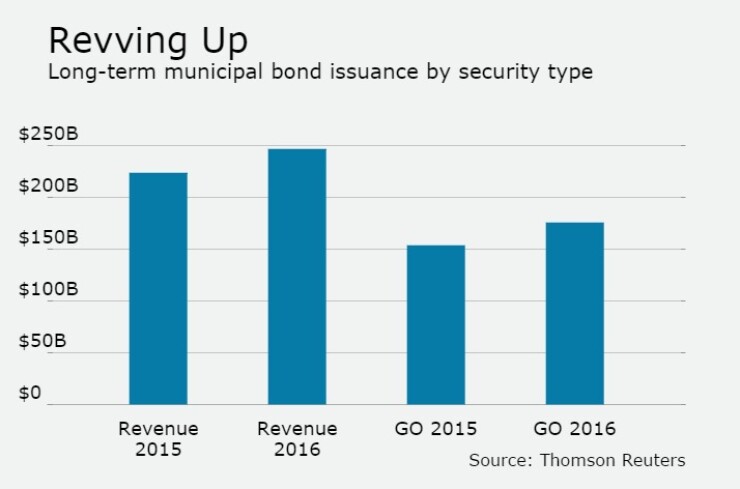

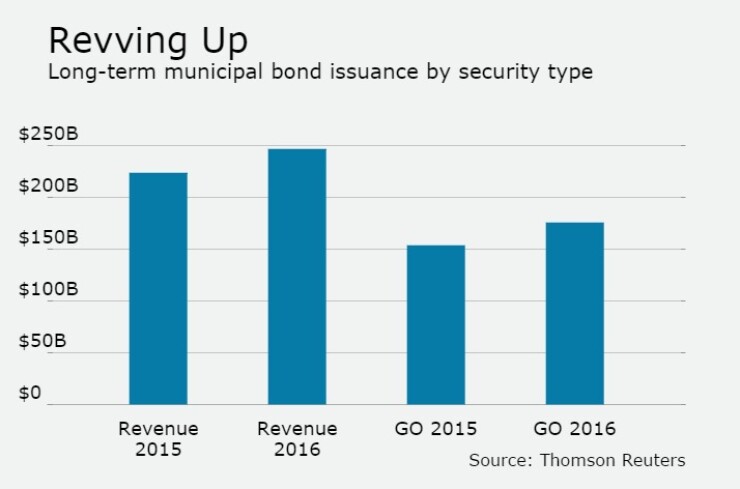

Revenue vs. General Obligation

There have been recent debates within the industry about the "fading strength" of general obligation bonds. Some market participants now prefer revenue bonds, as one trader said "once you identify a revenue stream, it never goes away. I would call revenue bonds more dependable than GOs, as once you build tolls, people don't stop driving but with GOs, they cannot stay true to their 'full faith of credit' word."

Marilyn Cohen, chief executive officer at Los Angeles-based Envision Capital Management, said she believes the rules about state and locality GOs have changed from those she learned earlier in her career.

"There's been a big tectonic shift," Cohen said. "No longer are general obligation bonds the holy grail like we were taught."

Over the past two years, there has been more issuance of revenue bonds than GOs. In 2016 to date $246.8 billion of revenue bonds were issued, compared to $223.8 billion in 2015. Those numbers are well above the GO total of $175.9 billion this year and $153.8 billion in 2015, according to data from Thomson Reuters.

"About 95% of our funds are revenue bonds, but I think GOs have been mispriced in the muni market for a long time," said David Hammer, head municipal portfolio manager at PIMCO. "You get a wider value with revenue bonds and they tend to be more secure. In the stressed GOs you have seen some second guessing, but the stronger-credit GOs you don't second guess."

Bond Buyer Visible Supply

The Bond Buyer's 30-day visible supply calendar increased $474.6 million to $6.39 billion on Friday. The total is comprised of $1.27 billion of competitive sales and $5.12 billion of negotiated deals.

Primary Market

There are no deals larger than $100 million scheduled for the rest of the calendar year. On Friday, the market will be open for an abbreviated trading session, with an early 2 pm close.