Top-shelf municipal bonds were stronger at Wednesday's market close, according to traders, as yields on some maturities were as many as three basis points lower.

Secondary Market

The yield on the 10-year benchmark muni general obligation was two basis points lower to 2.43% from 2.45% on Tuesday, while the yield on the 30-year decreased three basis points to 3.15% from 3.18%, according to a final read of Municipal Market Data's triple-A scale.

U.S. Treasuries were stronger at the close Wednesday. The yield on the two-year Treasury was lower at 1.20% from 1.22% on Tuesday, while the 10-year Treasury yield fell to 2.54% from 2.56%, and the yield on the 30-year Treasury bond decreased to 3.12% from 3.15%.

The 10-year muni to Treasury ratio was calculated at 95.7% on Wednesday, compared with 95.6% on Tuesday, while the 30-year muni to Treasury ratio stood at 101.0%, versus 101.0%, according to MMD.

'Tis the Season

As municipal bond yields fell, John Dillon, muni strategist and managing director for Morgan Stanley Wealth Management, says seasonal technical factors that are typical for year-end have taken hold.

"They are supportive," he said. "You have a plenty of reinvestment from maturing bonds and coupons, and not a lot of issuance, so you have a lot of money chasing very few bonds."

Dillon said that it is difficult to anticipate where yields are heading in the next few weeks, as money has been flowing out of municipal funds.

"So with the rise in rates, you have people pulling money out of mutual funds. We've seen $2 billion being pulled out every week. That kind of muddies the water for a little bit, and in my opinion you're not going to get a clear view of muni market sentiment until you get past these seasonal factors ,which will probably take you to mid to late January."

At that point, he said, it will be clearer whether investors are overly concerned about tax reform and whether they're concerned over rising rates.

Dillion said municipal bond yields should be higher given tax reform concerns, so investors might want to hit the pause button until "compelling relative value" shows itself again.

"On an absolute returns standpoint, municipal bonds are a much more compelling product," he said. "But the concern is that are the tax reform anxieties priced in there? At 97 percent of treasuries, which is where they were Monday night, I would venture to say that those concerns are not adequately reflected."

Dillion said current prices reflect the rise in interest rates, but not the muni-specific outlook under tax reform.

"So you can have rates in a range bound fashion, but you can have municipals underperform dramatically [against treasuries], if the fears of tax reform really start to solidify. And you're not likely to get clarification on that for months if not longer. "

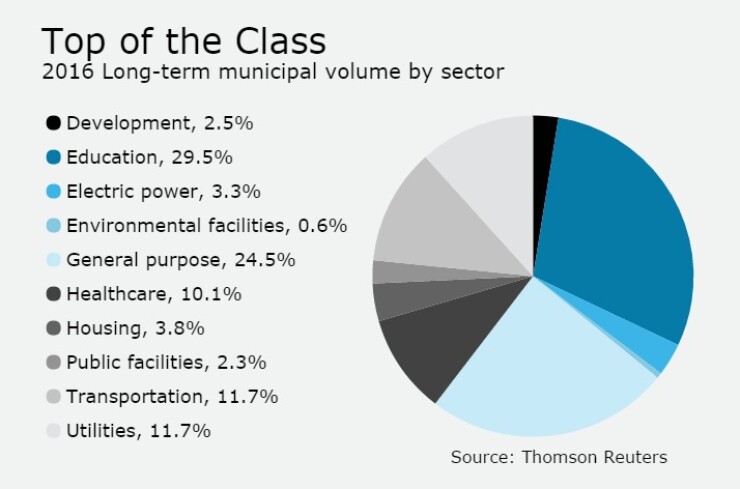

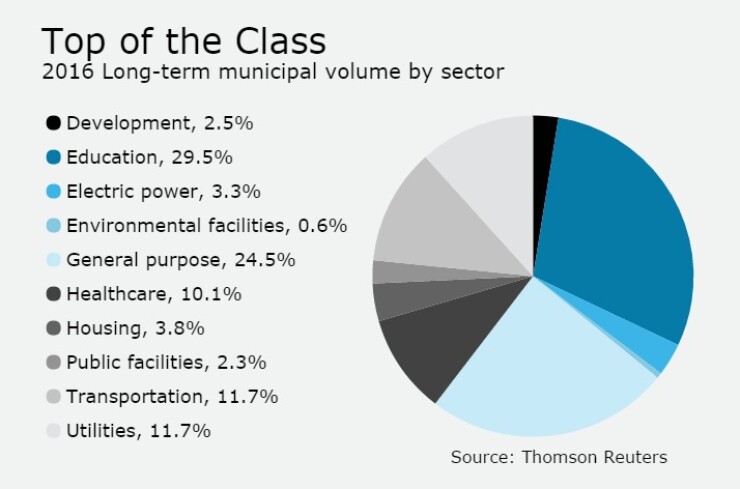

2016 Issuance by Sector

Education and general purpose bonds were the leading sectors by volume, as the days of issuance in the year dwindle, education has seen $124.82 billion, followed by general purpose with $103.70 billion, according to data from Thomson Reuters.

After the top two, there is a huge drop off as the next highest sector, transportation, has accounted for $49.59 billion and utilities follows with $49.44 billion.

The bottom two sectors accounted for only $12.12 billion, with public facilities accounting for $9.79 billion and environmental facilities $2.33 billion.

Primary Market

There are no scheduled deals larger than $100 million for the rest of this week.

It comes as no surprise, since at this time of year it is not unusual to see such minuscule activity.

"Right around this time every year, the market goes into a little hibernation," said a Midwest trader. "Things should start rolling again in the New Year."