The market continued to be choppy, as municipal bond yields reversed on Thursday and increased. Top-shelf muni bond yields were up as many as 11 basis points in some maturities, according to traders, as they had a few deals to work with, including a much anticipated deal from Chicago schools.

The last issuance of the week came in on Thursday, with all eyes on the Chicago Board of Education deal, which was increased to almost $730 million from the original amount of $500 million.

Barclays Capital priced the Chicago BOE's $729.58 million of dedicated capital improvement tax bonds. The bonds were priced to yield 5.95% with a 5.75% coupon in 2033; 6.00% with a 5.75% coupon in 2034; 6.05% with a 5.75% coupon in 2035; at par to yield 6.10% in 2036; and a term bond in 2046 priced to yield 6.25% with a 6% coupon. The bonds are rated A by Fitch Ratings and BBB by Kroll Bond Rating Agency.

"I am not surprised to see 6% plus yields on Chicago Public Schools," said Alan Schankel, a managing director at Janney Capital Markets. "Fitch's rating methodology is novel, and for special revenue issues, such as CPS, it is significantly more aggressive than Moody's or S&P criteria. That being said, I think the distinct security feature and Fitch's A rating will bring yield in well lower than where Chicago BOE bonds from the February deal are trading."

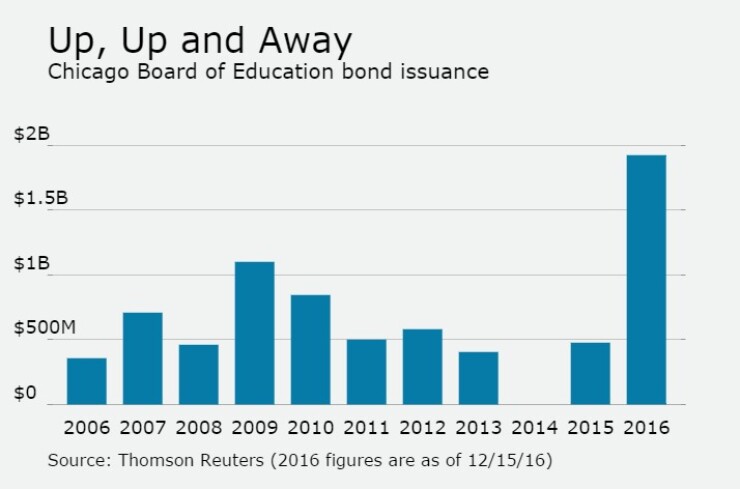

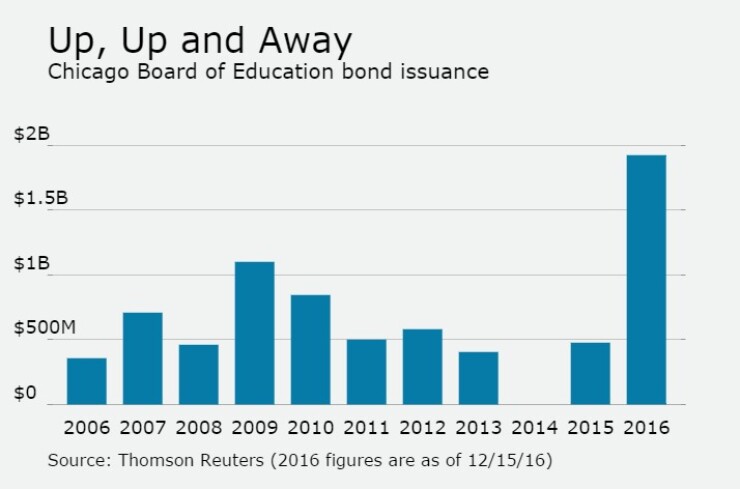

Since 2006, the Chicago BOE has sold about $8.56 billion of bonds, with the largest issuance before this year occurring in 2009 when it issued $1.1 billion. Its issuance soared past the $1 billion mark this year, with Wednesday's sale bringing the total to about $1.9 billion.

"That dedicated special revenue feature definitely brought some new people to the table," said a Midwest trader. "They clearly saw demand due to the upsize, especially in that 2046 maturity. It is a tough time of year to bring a transaction like that. Some folks have shut down for the year in terms of putting money to work, but I think overall the results were much better than they have had in the past and I would expect [the BOE] are happy with how it went."

According to CPS, this A-rated credit sold over 200 basis points tighter than the district's February general obligation bond offering.

"CPS successfully sold today $729 million of A-rated Capital Improvement Tax bonds with proceeds from these dedicated capital bonds going towards much-needed capital investments like relieving overcrowding, modernizing schools and making critical repairs," said Ronald DeNard, senior vice president of finance for CPS.

Jefferies priced the Westchester Tobacco Asset Securitization Corp., N.Y.'s $180.99 million of taxable Series 2016A tobacco settlement senior bonds and taxable Series 2016C tobacco settlement subordinate bonds. The $7.165 million of taxables were priced at par to yield from 2.125% in 2017 to 3.625% in 2020.

The $91.30 million of tax-exempt series 2016B bonds were priced to yield from 2.16% with a 5% coupon in 2020 to 4.35% with a 4.125% coupon in 2036. A term bond in 2041 was priced to yield 4.69% with a 5% coupon in 2041.

The $82.515 million of series 2016C subordinate bonds were priced to yield 4.10% with a 4% coupon in 2042, with an expected final turbo redemption date of June 1, 2023. The 2045 maturity was priced to yield 5.15% with a 5% coupon with an expected final turbo redemption date of June 1, 2029, The 2051 maturity was priced to yield 5.40% with a 5.125% coupon with an expected final turbo redemption date of June 1, 2034.

One of the biggest risks in holding securitized tobacco debt is that it will wind up maturing later than an investor thought it would.

These structures typically funnel the settlement payments to pay off scheduled interest and principal on the bonds. With whatever is left over, the structures then buy outstanding bonds from the investors before their maturity. It's a process known as a turbo redemption, which is similar to a bond call or mortgage prepayment.

If the settlement payments continue to fall short of expectations, issuers will not exercise as many turbo redemptions and the outstanding tobacco debt will remain outstanding longer than anticipated. This is called extension risk.

Piper Jaffray received the written award on the Tuscaloosa City Board of Education, Ala.'s $152.13 million of school tax warrants, series 2016. The bonds were priced to yield from 1.34% with a 4% coupon in 2018 to 3.66% with a 5% coupon in 2036. A term bond in 2041 was priced to yield 3.81% with a 5% coupon and 4.08% with a 4% coupon in a split maturity. A term bond in 2046 was priced to yield 3.87% with a 5% coupon and 4.13% with a 4% coupon in a split maturity. The deal is rated Aa3 by Moody's Investors Service and AA by S&P Global Ratings.

Additionally, Citigroup priced the New York State Housing Finance Agency's $102.045 million of affordable housing revenue bonds. The issue is comprised of $45.125 Series 2016H climate bond certified green bonds, that were priced at par to yield from 1.75%, 1.80% and 1.80% in a triple split 2020 maturity to 3.05% and 3.10% in a split 2027 maturity. A term bond in 2031 was priced at par to yield 3.65%, a term bond in 2036 with a 4.00% coupon, a term bond in 2041 with a 4.10% coupon, a term bond in 2047 with a 4.15% coupon and a term bond in 2049 with a 4.20% coupon.

The $56.92 million of Series 2016I revenue bonds were priced at par to yield from 0.90% and 1.00% in a split 2017 maturity to 3.05% and 3.10% in a split 2027 maturity. A term bond in 2031 was priced at par to yield 3.65%, a term bond in 2036 with a 4.00% coupon, a term bond in 2041 with a 4.10% coupon and a term bond in 2047 with a 4.15% coupon. The deal is rated Aa2 by Moody's Investors Service.

Morgan Stanley priced the Nassau County, N.Y.'s $257.82 million of general obligation tax anticipation notes, Series' A, B and C. The $49.96 million of Series A notes were priced to yield 1.00% with a 2% coupon in a March 3, 2017 bullet maturity.

The $168.365 million of series B TANs were priced to yield 1.40% with a 3% coupon in a Sept. 15, 2017 bullet maturity.

The $39.495 million of Series C TANs were priced to yield 1.45% with a 3% coupon in a Dec. 8, 2017 bullet maturity. The deal is rated SP-1-plus by S&P and F1 by Fitch.

In other news, Goldman Sachs is expected to price the City of Chicago's $1.14 billion of general obligation bonds the week of Jan. 16, 2017. The deal will be comprised of approximately $865 million of Series 2017A tax-exempt project and refunding GOs and about $275 million Series 2017B taxable project GOs.

Secondary Market

Top-rated municipal bonds finished weaker on Thursday. The yield on the 10-year benchmark muni general obligation was 11 basis points higher to 2.48% from 2.37% on Wednesday, while the yield on the 30-year increased between five basis points to 3.21% from 3.16%, according to a final read of Municipal Market Data's triple-A scale.

U.S. Treasuries were mostly weaker on Thursday through midday. The yield on the two-year Treasury rose to 1.27% from 1.23% on Wednesday as the 10-year Treasury yield gained to 2.59% from 2.52%, while the yield on the 30-year Treasury bond was unchanged from 3.15%.

On Thursday, the 10-year muni to Treasury ratio was calculated at 96.3% compared to 94.0% on Wednesday while the 30-year muni to Treasury ratio stood at 102.2% versus 100.3%, according to MMD.

Tax-Exempt Money Market Fund Outflows

Tax-exempt money market funds experienced outflows of $360.4 million, bringing total net assets to $130.60 billion in the week ended Dec. 12, according to The Money Fund Report, a service of iMoneyNet.com. This followed an inflow of $870.9 million to $130.96 billion in the previous week.

The average, seven-day simple yield for the 237 weekly reporting tax-exempt funds was increased to 0.17% from 0.16% from previous week.

The total net assets of the 863 weekly reporting taxable money funds increased $19.94 billion to $2.592 trillion in the week ended Dec. 13, after an inflow of $4.58 billion to $2.572 trillion the week before.

The average, seven-day simple yield for the taxable money funds increased to 0.17% from 0.15% from the previous week.

Overall, the combined total net assets of the 1,100 weekly reporting money funds rose $19.58 billion to $2.723 trillion in the week ended Dec. 13 after inflows of $5.45 billion to $2.703 trillion in the prior week.