Municipal market participants won't see a ton of action on Thursday, as only one big deal is expected to price.

Secondary Market

U.S. Treasuries were mostly weaker on Thursday. The yield on the two-year Treasury was unchanged from 0.73% on Wednesday, as the 10-year Treasury yield rose to 1.53% from 1.52% and the yield on the 30-year Treasury bond increased to 2.25% from 2.23%.

The yield on the 10-year benchmark muni general obligation was three basis points lower to 1.42% from 1.45% on Tuesday, while the yield on the 30-year muni was two basis points lower to 2.13% from 2.15%, according to a final read of Municipal Market Data's triple-A scale.

On Wednesday, the 10-year muni to Treasury ratio was calculated at 93.7% compared to 93.0% on Tuesday, while the 30-year muni to Treasury ratio stood at 95.6% versus 94.3%, according to MMD.

MSRB: Previous Session's Activity

The Municipal Securities Rulemaking Board reported 34,979 trades on Wednesday on volume of $14.43 billion.

Primary Market

Thursday will be similar to Wednesday, where the marketed paused with a wary eye toward the Federal Open Market Committee statement, in that there will be little to no action other than one large deal.

The FOMC held rates but noted improvement that may set the stage for the next rate hike.

RBC Capital Markets is expected to price the state of Wisconsin's $317 million of general obligation refunding bonds. The deal is rated Aa2 by Moody's and AA by S&P and Fitch.

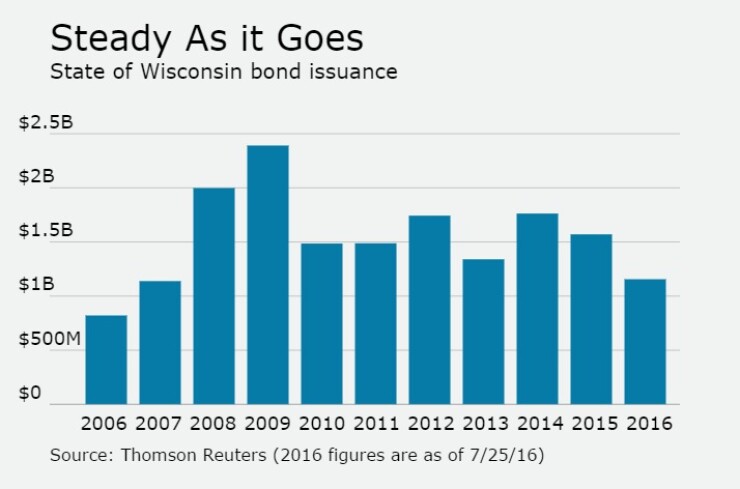

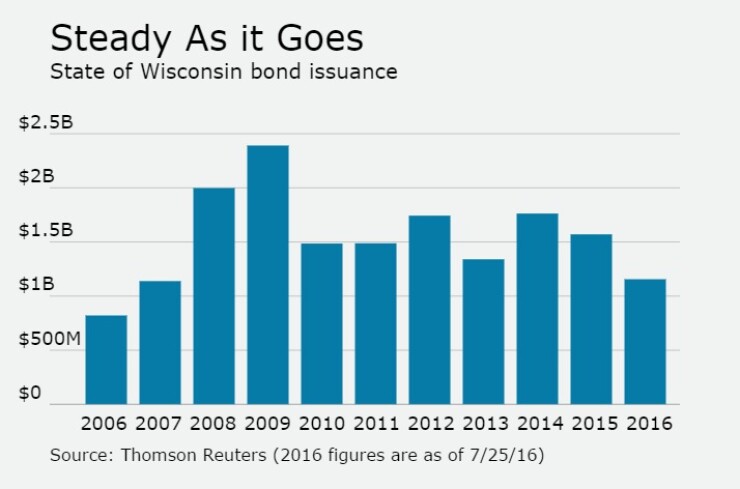

Since 2006, the state of Wisconsin has issued about $17 billion of debt, with the largest issuance occurring in 2009 when it sold $2.4 billion of securities. The Badger State is consistent, having sold more than $1 billion of bonds every year since 2007.

The Dalcomp calendar originally had a $550 million offering from the Alabama Federal Aid Highway Finance Authority to be priced this past Monday, but the deal never came. It was speculated by some market sources that the special obligation revenue bonds might price on Thursday, but according to Citi – the expected lead manager – the deal "has been delayed."

Bond Buyer Visible Supply

The Bond Buyer's 30-day visible supply calendar increased $691.4 million to $12.61 billion on Thursday. The total is comprised of $5.10 billion of competitive sales and $7.50 billion of negotiated deals.

Tax-Exempt Money Market Fund Outflows

Tax-exempt money market funds experienced outflows of $2.49 billion, bringing total net assets to $185.92 billion in the week ended July 25, according to The Money Fund Report, a service of iMoneyNet.com. This followed an outflow of $1.25 million to $188.42 billion in the previous week.

The average, seven-day simple yield for the 272 weekly reporting tax-exempt funds was unchanged at 0.07% from the previous week.

The total net assets of the 889 weekly reporting taxable money funds increased $17.31 billion to $2.520 trillion in the week ended July 26, after an outflow of $7.99 billion to $2.502 trillion the prior before.

The average, seven-day simple yield for the taxable money funds remained at 0.11% from the week before.

Overall, the combined total net assets of the 1,161 weekly reporting money funds increased $14.82 billion to $2.706 trillion in the period ended July 26, which followed an outflow of $9.24 billion to $2.691 trillion.