After a busier-than-usual Monday, municipal bond traders will pick up right where they left off, with New York City and the Port of Seattle among the issuers coming to market.

Secondary market

Treasuries were weaker on Tuesday. The yield on the two-year Treasury gained to 1.37% from 1.36% on Friday, the 10-year Treasury yield rose to 2.29% from 2.25% and the yield on the 30-year Treasury bond increased to 2.88% from 2.83%.

Top-shelf municipal bonds were mostly unchanged to finish Monday, with only the 2020 through 2023 maturities seeing yields lower by a basis point. The yield on the 10-year benchmark muni general obligation was flat at 1.90% from Friday, while the 30-year GO yield was steady at 2.69%, according to a final read of Municipal Market Data's triple-A scale.

The 10-year muni to Treasury ratio was calculated at 84.4% on Monday, compared with 85.1% on Friday, while the 30-year muni to Treasury ratio stood at 95.0% versus 96.0%, according to MMD.

MSRB: Previous session's activity

The Municipal Securities Rulemaking Board reported 33,300 trades on Monday on volume of $5.29 billion.

Primary market

Bank of America Merrill Lynch held a second day of retail orders on New York City’s $820.45 million of Fiscal 2018 Series A general obligation bonds on Tuesday ahead of the institutional pricing on Wednesday.

On Tuesday, the bonds were priced for retail to yield from 0.90% with a 4% coupon in 2018 to 2.26% with a 5% coupon in 2028.

The deal is rated Aa2 by Moody’s Investors Service and AA by S&P Global Ratings and Fitch Ratings. All three rating agencies assign a stable outlook to the bonds.

A market source said that the pre-marketing scale for the $265.99 million of taxable portion of Port of Seattle’s $266 million of Series 2017B taxable intermediate lien revenue and refunding bonds was circulating on Monday.

The source said that the bonds were about 55 basis points above the comparable Treasury in 2019 and about 140 basis points above the comparable Treasury in 2032. A term bond in 2036 was about 95 basis points above the comparable Treasury. The 2017 and 2018 maturities were offered as sealed bids. The deal is rated A1 by Moody’s, A-plus by S&P and AA-minus by Fitch.

On Tuesday, Citi is set to price the other two pieces of the sale: $17.33 million of Series 2017A bonds and $324.8 million of Series 2017C alternative-minimum tax bonds.

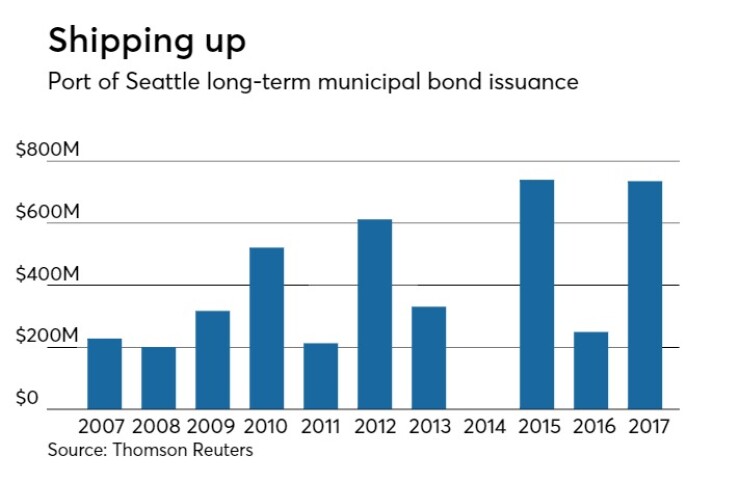

Since 2007, the port as it is commonly referred to, has sold $4.15 billion of securities with the largest issuance occurring in 2015. when it sold $739 million. It did not come to market in 2014, but with Tuesday’s sale it will be the 2017 total as the second highest yearly issuance in a decade.

Barclays is scheduled to price Philadelphia’s $152.855 million of water and wastewater bonds on Tuesday. The deal is rated A1 by Moody’s and A-plus by S&P and Fitch.

JPMorgan is expected to price Belton Independent School District, Texas' $114.365 million of unlimited tax school building bonds on Tuesday. The deal is backed by the Permanent School Fund Guarantee Program and is rated triple-A by S&P and Fitch.

In the competitive arena, the largest sale of the week is scheduled to take place on Tuesday when Alexandria, Va., sells $94.93 million of general obligation capital improvement bonds. The deal is rated triple-A by Moody's and S&P.

Bond Buyer reports 30-day visible supply

The Bond Buyer's 30-day visible supply calendar increased $148.1 million to $6.72 billion on Tuesday. The total is comprised of $2.07 billion of competitive sales and $4.65 billion of negotiated deals.