Municipal bond traders are anxiously waiting the week’s first wave of issuance.

Secondary market

U.S. Treasuries were little changed on Wednesday morning. The yield on the two-year Treasury was flat from 1.28% on Tuesday as the 10-year Treasury yield was unchanged from 2.21% while the yield on the 30-year Treasury bond was steady from 2.88%.

On Tuesday, top-shelf municipal bonds were stronger. The yield on the 10-year benchmark muni general obligation fell two basis points to 1.93% from 1.95% on Friday, while the 30-year GO yield dropped three basis points to 2.77% from 2.80%, according to the final read of Municipal Market Data's triple-A scale.

On Tuesday, the 10-year muni to Treasury ratio was calculated at 87.2%, compared with 86.8% on Friday, while the 30-year muni to Treasury ratio stood at 96.0%, versus 96.1%, according to MMD.

Primary market

On Wednesday, two Connecticut issuers will be coming to market with over $600 million of bond deals.

Morgan Stanley is set to price Connecticut’s $370 million of state revolving fund general revenue bonds for retail investors ahead of the institutional pricing on Thursday. The deal consists of Series 2017A SRF green bonds and Series 2017B refunding bonds. It is rated triple-A by Moody’s, S&P and Fitch Ratings.

Barclays Capital is set to price the Connecticut Health and Educational Facilities Authority’s $250 million of Series 2017B revenue bonds for Yale University. The deal is rated triple-A by Moody’s and S&P.

Bank of America Merrill Lynch is expected to price the Louisiana Local Government Environmental Facilities and Community Development Authority’s $250.89 million of Series 2017A tax-exempt and Series 2017B taxable hospital refunding revenue bonds for the Women’s Hospital Foundation. The deal is rated A2 by Moody’s and A by S&P.

Piper Jaffray is set to price the Austin Independent School District, Texas’ $216.73 million of Series 2017 unlimited tax refunding bonds. The deal is rated triple-A by Moody’s.

Citigroup is expected to price Clark County, Nev.’s $148 million of Series 2017C airport system junior subordinate lien revenue notes subject to the alternative minimum tax. The deal is rated A1 by Moody’s and A-plus by S&P.

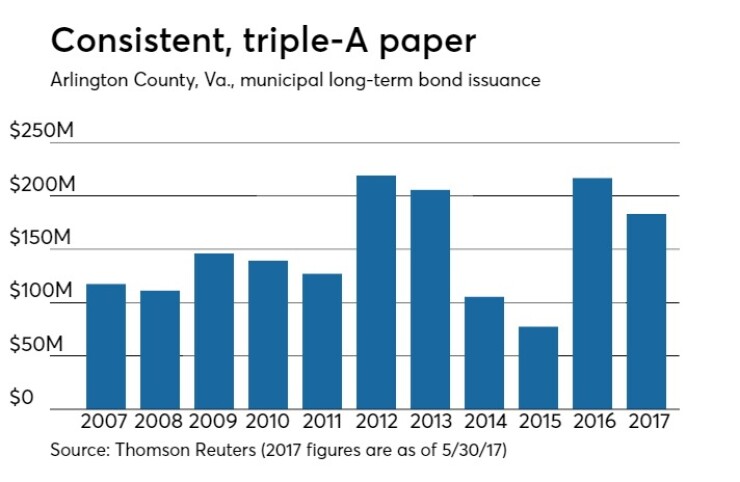

In the competitive arena, Arlington County, Va., is selling $185.1 million of Series 2017 general obligation public improvement bonds on Wednesday. The deal is rated triple-A by Moody’s, S&P and Fitch.

Since 2007, the county of Arlington has issued roughly $1.75 billion of securities, with the most issuance occurring in 2010 when it sold $219 million. The county has been consistent the past decade, always selling between $100 and $220 million each year - with the exception of 2015 when it issued just $77.4 million.

MSRB: Previous session's activity

The Municipal Securities Rulemaking Board reported 38,659 trades on Tuesday on volume of $8.30 billion.

Bond Buyer 30-day visible supply

The Bond Buyer's 30-day visible supply calendar increased $203.1 million to $12.54 billion on Wednesday. The total is comprised of $5.61 billion of competitive sales and $6.93 billion of negotiated deals.