The majority of municipal market participants have already started their long holiday weekends. The market is open for an abbreviated trading session, with a 2 p.m. close on Friday.

Secondary Market

U.S. Treasuries were mostly stronger on Friday morning. The yield on the two-year Treasury was flat at 1.19% from Thursday, while the 10-year Treasury yield dipped to 2.53% from 2.55%, and the yield on the 30-year Treasury bond fell to 3.11% from 3.13%.

The 10-year benchmark muni general obligation yield dropped two basis points to 2.41% on Thursday from 2.43% on Wednesday, while the yield on the 30-year GO decreased by two basis points to 3.13%, from 3.15%, according to a final read of Municipal Market Data's triple-A scale.

The 10-year muni to Treasury ratio was calculated at 94.5% on Thursday, compared with 95.7% on Wednesday, while the 30-year muni to Treasury ratio stood at 100.0%, versus 101.0%, according to MMD.

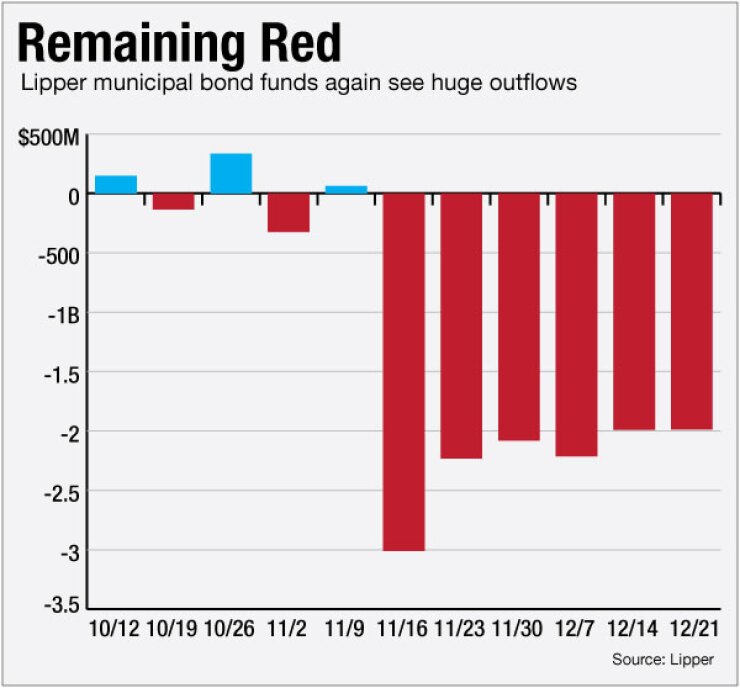

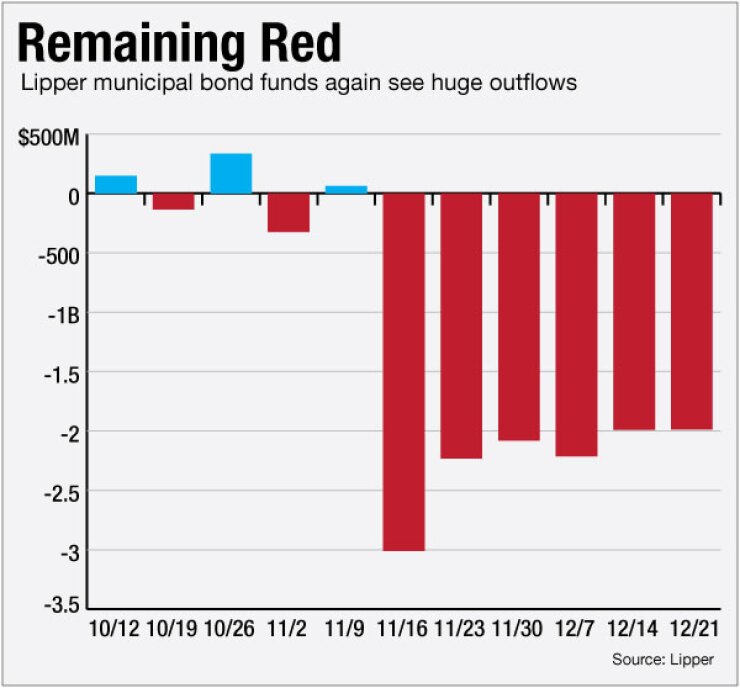

Lipper: Muni Bond Funds Report Outflows

Municipal bond funds experienced outflows as investors continued to pull cash out of the market, according to Lipper data released late Thursday.

The weekly reporters saw $1.989 billion of outflows in the week ended Dec. 21, after outflows of $1.990 billion in the previous week.

The four-week moving average remained in the red at negative $2.068 billion after being negative $2.129 million in the previous week. A moving average is an analytical tool used to smooth out price changes by filtering out fluctuations.

Long-term muni bond funds had outflows, losing $1.020 billion in the latest week after shedding $771.676 million in the previous week. Intermediate-term funds had outflows of $841.292 million on top of outflows of $798.693 million in the prior week.

National funds had outflows of $1.580 billion after outflows of $1.414 billion in the previous week. High-yield muni funds reported outflows of $346.048 million in the latest reporting week, after outflows of $147.676 million the previous week.

Exchange traded funds saw inflows of $547.797 million, after inflows of $154.871 million in the previous week.

MSRB: Previous Session's Activity

The Municipal Securities Rulemaking Board reported 47,868 trades on Thursday on volume of $13.563 billion.

Bond Buyer Visible Supply

The Bond Buyer's 30-day visible supply calendar increased $474.6 million to $6.39 billion on Friday. The total is comprised of $1.27 billion of competitive sales and $5.12 billion of negotiated deals.

Primary Market

There are no deals larger than $100 million scheduled for the rest of the calendar year. This past week saw very little action in the primary, as municipal bond issuers have pretty much packed it in for the remainder of the year. Issuance is not expected to reach normal levels again until 2017.

With that being said, there were just a few, albeit smaller deals that did price this past week.

The commonwealth of Massachusetts sold two competitive deals, totaling $188.49 million on Tuesday. The $100 million of general obligation refunding SIFMA index bonds series A were won by Morgan Stanley with a true interest cost of 1.22%. The $88.49 million of GO refunding SIFMA index bonds series B were won by RBC Capital Markets with a TIC of 1.31%.

The Florida Board of Governors competitively sold $53.04 million of dormitory revenue refunding bonds for Florida Atlantic University, which were won by Janney with a TIC of 3.47%