Municipals spent Thursday following the unexpected rally in Treasuries, with new issues dominating. Meanwhile the municipal market took a strong turn, following through on Wednesday's rally.

“The focus continues to be on the primary as even the smaller deals pricing today were oversubscribed and repriced lower in yield,” said Dan Urbanowicz, director of fixed income at Ziegler Capital.

Record inflows continued and the market seemed to come to agreement that the recent increase in rates may have been exaggerated, he added. Lipper reported $1.28 billion of inflows today.

"The market is getting more issuer friendly, with yields dropping even more today," said a New York trader. "It would seem as though there is no better time to issue muni bond debt."

Meanwhile, the secondary saw a little better bidding.

“Our bid side is better, but not as much as Treasuries,” a New York trader said. “There was a strong bid for the Wisconsin deal, which did well.”

He said the calendar remains strong for next week.

New issues continue to hit the market and remain in high demand, according to Bill Walsh, president of Hennion & Walsh in Parsippany, N.J.

“With this, [before the past two days] we’ve seen a slight rise in yields, which has resulted in increased investor demand,” he explained.

Investors are holding cash and looking to spend it with the prospect of new supply entering the market.

“With new issuance expected to remain high, we see these deals being received well,” he said. "With demand higher, especially in the retail sector, we’ve seen trading in the secondary market pick up as well,” Walsh said, adding that he expects this trend to continue through year-end.

Primary market

RBC Capital Markets received the verbal award on Texas Transportation Commission’s (Aaa/AAA/AAA) $702.55 million of state highway improvement general obligation taxable refunding bonds.

Citi priced San Diego County Regional Airport Authority’s $466.90 million of subordinate airport revenue bonds.

Wells Fargo priced Metro Wastewater Reclamation District, Colorado’s (Aa1/AAA/NR) $332.77 million of federally taxable sewer refunding bonds.

Barclays priced State of New York Mortgage Agency’s (Aa1/ / ) $162.610 million of homeowner mortgage revenue non-alternative minimum tax bonds.

Well Fargo priced Clark County, Nevada’s (Aa3/A+/NR/AA-) $369.07 million of passenger facility charge refunding revenue non-AMT bonds for Las Vegas-McCarran International Airport.

Wisconsin sold $267.245 million of general obligation bonds competitively, which were won by JP Morgan with a true interest cost of 2.8789%.

According to Dave Erdman, capital finance director, the state received 13 bids in total, with the cover bid submitted by Wells Fargo Bank, National Association with TIC of 2.8938%. The bids were in a "very tight" range of 2.8789% to 2.9334%, on a TIC basis.

"The state is very happy with the interest and the results; we haven’t completed our complete evaluation, but it appears the market is still very receptive to shorter call structures that the State and other issuers have used and will continue to use in the immediate future," Erdman said.

Citi priced the Commonwealth of Massachusetts’ (Aa1/AA+/NR) $200 million of transportation fund revenue bonds for the rail enhancement and accelerated bride programs.

Secondary market

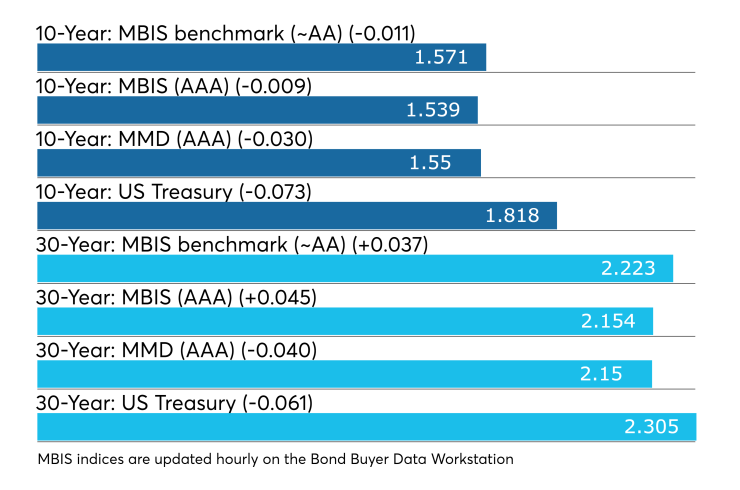

Munis were mixed on the MBIS benchmark scale, with yields falling by one basis point in the 10-year and rising by three basis points in the 30-year maturity. High-grades were also mixed, with yields on MBIS AAA scale decreasing by less than a basis point in the 10-year and increasing by four basis points in the 30-year maturity.

On Refinitiv Municipal Market Data’s AAA benchmark scale, the yield on 10- year was lower by three basis points to 1.55% and the 30-year GO was down four basis points to 2.15%.

The 10-year muni-to-Treasury ratio was calculated at 85.2% while the 30-year muni-to-Treasury ratio stood at 93.2%, according to MMD.

Treasuries were lower and stocks were mixed with the S&P 500 the only index in the green. The Treasury three-month was down and yielding 1.577%, the two-year was down and yielding 1.598%, the five-year was down and yielding 1.623%, the 10-year was down and yielding 1.813% and the 30-year was down and yielding 2.294%.

Muni money market funds see outflow

Tax-exempt municipal money market fund assets fell $634 million, lowering their total net assets to $137.86 billion in the week ended Nov. 11, according to the Money Fund Report, a publication of Informa Financial Intelligence.

The average seven-day simple yield for the 188 tax-free and municipal money-market funds fell to 0.73% from 0.78% from the previous week.

Taxable money-fund assets were up $12.61 billion in the week ended Nov. 12, bringing total net assets to $3.379 trillion. The average, seven-day simple yield for the 807 taxable reporting funds was slipped to 1.34% from 1.40% from the prior week.

Overall, the combined total net assets of the 995 reporting money funds increased $11.98 billion to $3.516 trillion in the week ended Nov. 12. The weekly combined total was the highest since the week ending Aug. 25, 2009, when assets stood at $3.534 trillion.

Previous session's activity

The MSRB reported 35,621 trades Wednesday on volume of $9.94 billion. The 30-day average trade summary showed on a par amount basis of $10.33 million that customers bought $5.74 million, customers sold $2.76 million and interdealer trades totaled $1.83 million.

New York, California and Texas were most traded, with the Empire State taking 12.595% of the market, the Lone Star State taking 10.959% and the Golden State taking 10.908%.

The most actively traded securities were Massachusetts State Special Obligation Dedicated Tax revenue refundings, 5.5s of 2034 traded 6 times on volume of $29 million.

Bond Buyer yield indexes fall, BB40 plummets

The weekly average yield to maturity of the Bond Buyer Municipal Bond Index, which is based on 40 long-term bond prices, sank 22 basis points to 3.41% from 3.63% the previous week.

The Bond Buyer's 20-bond GO Index of 20-year general obligation yields was slightly lower by one basis point to 2.85% from 2.86% from the week before.

The 11-bond GO Index of higher-grade 11-year GOs dipped one basis point to 2.39% from 2.40% the prior week.

The Bond Buyer's Revenue Bond Index slipped one basis point to 3.33% from 3.34% last week.

The yield on the U.S. Treasury's 10-year note lowered to 1.82% from 1.92% the week before, while the yield on the 30-year Treasury decreased to 2.31% from 2.40%.

Treasury auctions bills

The Treasury Department Thursday auctioned $55 billion of four-week bills at a 1.5650% high yield, a price of 99.878278.

The coupon equivalent was 1.593%. The bid-to-cover ratio was 2.52.

Tenders at the high rate were allotted 20.82%. The median rate was 1.520%. The low rate was 1.490%.

Treasury also auctioned $40 billion of eight-week bills at a 1.520% high yield, a price of 99.763556.

The coupon equivalent was 1.549%. The bid-to-cover ratio was 3.20.

Tenders at the high rate were allotted 91.86%. The median rate was 1.500%. The low rate was 1.485%.

Treasury bill announcements

The Treasury Department said Thursday it will auction $45 billion 91-day bills and $42 billion 182-day discount bills Monday.

The 91s settle Nov. 21, and are due Feb. 20, 2020, and the 182s settle Nov. 21, and are due May 21, 2020.

Currently, there are $41.999 billion 91-days outstanding and $25.999 billion 182s.

Treasury also announced a $12 billion 9-year 8-month ¼% TIP note auction selling Nov. 21, settling Nov. 29 and maturing July 15, 2029.

Christine Albano and Gary E. Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.