Bond yields at a glance Processing Content | ||||

MBIS benchmark (~AA) | MBIS AAA | MMD AAA | U.S. Treasuries | |

10 year | 2.573 | 2.464 | 2.34 | 2.71 |

30 year | 3.025 | 2.905 | 2.87 | 2.95 |

|

MBIS indices are updated hourly on the Bond Buyer Data Workstation. | ||||

Municipal bond market participants who were looking to President Trump’s State of the Union address for some details on his infrastructure plan came away disappointed.

The president on Tuesday night called for Congress to produce a bill that generates at least $1.5 trillion for new infrastructure investment, but he provided no details on how to fund it.

The market will now be waiting for any further word from the White House on what form the financing and funding for this huge program could take.

Primary market

Morgan Stanley is set to price Kansas City, Mo.’s $210 million of Series 2018A sanitary sewer system improvement revenue bonds and Series 2018B forward delivery refunding revenue bonds.

The deal is rated Aa2 by Moody’s Investors Service and AA by S&P Global Ratings.

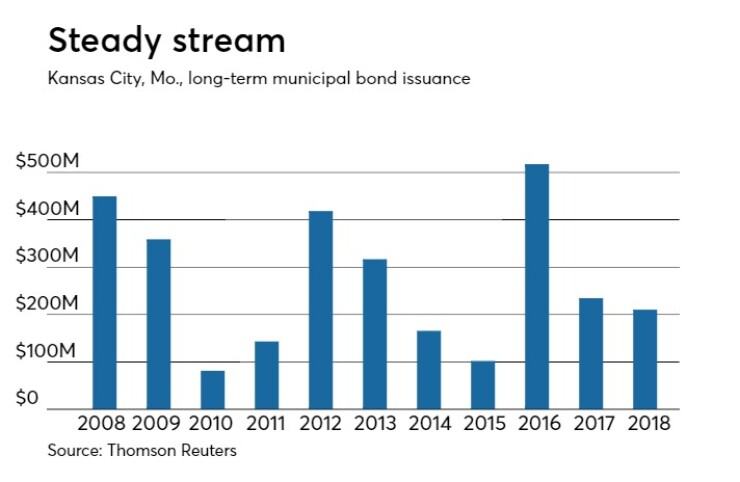

Since 2008, Kansas City has sold about $2.99 billion of bonds, with the most issuance occurring in 2016 when it sold $517 million and the least amount in 2010 when it sold $81 million.

RBC Capital Markets is expected to price the Mesa County Valley School District No. 51, Colo.’s $118.5 million of Series 2018 general obligation bonds.

The deal is insured by the Colorado state intercept program and rated Aa2 by Moody’s and AA-minus by S&P.

There are no competitive sales of $100 million or above slated for the week.

On Tuesday, JPMorgan Securities priced the Arizona Board of Regents $108 million of system revenue bonds.

The deal is rated Aa2 by Moody’s and AA-minus by S&P.

Bank of America Merrill Lynch priced the Upper Arlington City School District, Ohio’s $230 million of Series 2018A school facilities construction and improvement GOs.

The deal is rated Aa1 by Moody’s and AAA by S&P.

Bond Buyer 30-day visible supply at $5.07B

The Bond Buyer's 30-day visible supply calendar decreased $2.06 billion to $5.07 billion on Wednesday. The total is comprised of $1.37 billion of competitive sales and $3.69 billion of negotiated deals.

MSRB: Previous session's activity

The Municipal Securities Rulemaking Board reported 45,113 trades on Tuesday on volume of $10.87 billion.

California, New York and Texas were the three states with the most trades on Tuesday, with the Golden State taking 15.119% of the market, the Empire State taking 11.668% and the Lone Star State taking 11.056%.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.