DALLAS -- Wayne County, Michigan's outlook is now stable, according to Moody's Investors Service, which revised the outlook on its junk-level rating upward from negative in recognition of the county's success in making substantial cuts to its retirement liabilities and other operating expenses.

"Revision of the outlook to stable from negative reflects diminished near-term fiscal challenges," Moody's said in the action, published Friday.

The rating agency affirmed the county's Ba3 general obligation limited tax debt rating. The county has a total of $518 million of long-term GOLT debt outstanding, of which $336 million is rated by Moody's.

An additional $300 million of short-term GOLT delinquent tax anticipation notes are outstanding, but are not rated by Moody's.

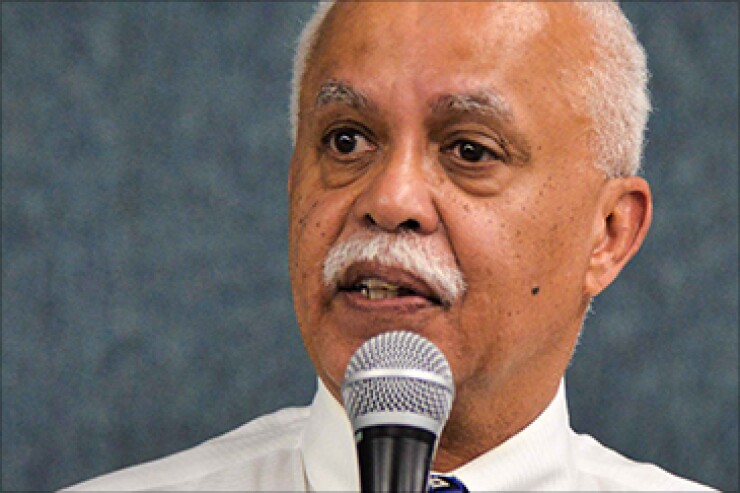

"Moody's decision to upgrade our credit outlook to stable is a step in the right direction," County Executive Warren Evans said in a statement. "Our successes last year in eliminating the structural deficit and reducing unfunded health care liabilities were definitely noteworthy, but, we aren't resting on those successes. My administration continues to work to restore long term fiscal stability to Wayne County."

Wayne, home to recently bankrupt Detroit, has trimmed nearly $50 million in spending, achieved with elimination or modification of retirement benefits, a contraction of payroll, and other operating efficiencies over the last six months.

Earlier this month the county announced that it is expecting $23 million in fiscal 2016 budget relief from cuts in retiree healthcare benefits that trimmed $850 million from its unfunded liabilities. The annual savings are expected to grow.

The county had cited its post-employment benefit liabilities as one of the factors driving a growing deficit that raised concerns over a future Chapter 9.

"The restructuring of the county retiree healthcare was the single largest contributor to restoring solvency," Evans said.

The county reduced its actuarial accrued OPEB liability by 65% in 2015, lowering it to $471 million from $1.32 billion, according to an actuarial analysis from Nyhart Actuary & Employment Benefits that accompanied the county's announcement. The restructuring will bring the county's pay-as-you-go contribution this year down to $17.6 million from $40.4 million.

The county, because of its financial distress, is operating under a consent agreement with the state. Among other things, the 12-page agreement broadens the county's power over labor contracts and allows it try to restructure some of its debt or reach settlements with creditors and the county isn't allowed to issue more bonds without state permission.

"Enhanced control over expenditures was key to addressing the county's fiscal concerns given limited options to raise revenue," said Moody's.

Wayne County carries across-the-board junk-level ratings. It has ratings of BB-plus from Standard & Poor's and B from Fitch Ratings. S&P and Fitch both assign negative outlooks.

Although the county has no plans to issue long-term debt, it is still considering how to fund the completion of a new jail and court facility in downtown. In 2010 the county sold $200 million of bonds to finance the project but cost overruns caused it to halt construction in 2013. Payment on the 2010 bonds is supported by a federal interest subsidy.

The county has not yet decided whether to complete construction of the new facility or abandon the partially completed project and relocate its jail to a vacant state facility. Either option could result in an additional burden to the county while it continues to pay debt service on the existing 2010 jail bonds.