Minnesota’s grim warnings over the summer of a projected $7 billion pandemic-driven deficit through fiscal 2023 took a dramatic turn this week with a surplus now expected this year and just a $1.27 billion hole to plug in the next two-year budget.

Higher general fund revenues and lower expected spending will leave the state with a projected surplus of $641 million when the current fiscal biennium ends June 30, according

That’s a far cry from Minnesota Management and Budget’s previous projections of a $2.4 billion gap in the current budget cycle with another $4.7 billion gap looming in the next two-year budget as the toll was expected to mount from the COVID-19-induced economic shutdown and recession.

State officials said the pandemic’s impact on sales taxes based on consumer spending and other revenues including income taxes has been difficult to predict and cautioned that the rosier predictions also carry some risk because the current economic challenges are vastly different from previous recessions, making forecasting harder.

“I think the important thing here is we’re dealing with really unprecedented situations,” MMB Commissioner Jim Schowalter said. "We still have challenges ahead. But this budget and revenue forecast brings a bit of good news to the state.”

The state in May had offered an interim budget projection warning the pandemic’s economic impact had erased a $1.5 billion expected surplus in the current biennium leaving the projected $2.4 billion hole.

The state had not previously said how it might close the projected deficit this year but it intended to use a portion of a nearly $2.4 billion rainy day fund built up from years of surpluses. The state also maintains a $350 million cash flow fund. The new forecast calls for the balance to be drawn to $1.89 billion as permitted to deal with the 2022-2023 gap. The cash flow fund will remain intact.

In August, the state warned of a $4.7 billion hole in the next budget cycle. Formal revenue predictions are offered at the start of March and the start of December and they are used to craft and adjust budgets.

The new forecast raised individual income tax projections for the current fiscal year by $500 million and sales taxes by $800 million from August.

Revenues for the next biennium were raised by $2.97 billion or 6.4% from August. Total general fund revenues are now estimated at $49.5 billion for fiscal 2022-2023 while expenses were revised downward leaving the state with the projected 1.3 billion deficit.

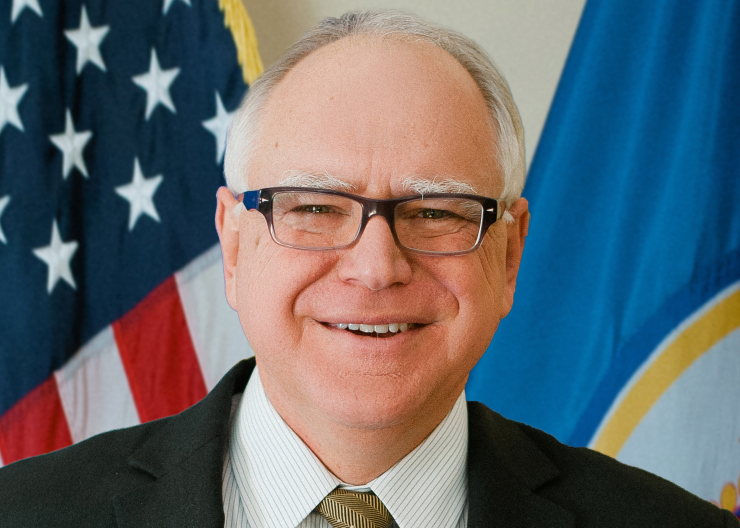

Walz said the latest forecast should pave the way for a special session and passage of a local relief package to aid businesses and employees of shuttered businesses. The governor, who is a member of the Democratic-Farmer-Labor Party, and legislative leaders have all laid out their own versions of an aid deal. The DFL controls the House and the GOP holds a Senate majority.

“Our picture might have improved some” but “there are families and businesses on the brink,” Walz said. “The good news of the day is we have the resources and capacity and fiscal stability and strength to be able to make a real difference” and encouraged the legislature to act.

The projections don’t count on future federal relief for pandemic costs or to make up for lost revenue. Walz said at a news conference he could accept a smaller package of relief in favor of healthier aid to support struggling businesses. The projections take into account current restrictions on restaurant, bar and gym operations that expire Dec. 18 but don’t assume an impact should those restrictions be extended.

Ahead of a $1.2 billion August bond sale, Fitch Ratings affirmed the state’s AAA GO rating and Moody’s Investors Service affirmed its Aa1 rating. Both assign a stable outlook.

S&P Global Ratings affirmed the state’s AAA rating but moved the outlook to negative from stable saying it believed the state would “likely significantly rely on one-time measures and reserves, rather than structural adjustments, to address its structural deficit” which was based on the prior forecast. The state received $2.2 billion in direct aid for COVID-19 costs in the CARES Act.