BRADENTON, Fla. - Westinghouse's bankruptcy could have a material impact on the Municipal Electric Authority of Georgia's financial condition, said the public agency that has issued billions in debt for two new Westinghouse nuclear units.

At this time, however, MEAG said insufficient information is available to quantify the effect of last week's Chapter 11 filing by Westinghouse, the engineering, procurement, and construction contractor for the units under construction at Plant Vogtle.

"MEAG Power intends to work with [Georgia Power Co.] and the other co-owners to determine future actions related to Vogtle Units 3&4," it said in a

According to the notice, Westinghouse could decide whether to reject or accept its EPC contract for Vogtle by the time an interim assessment agreement with Georgia Power and the other owners terminates on April 28.

U.S. Bankruptcy Judge Michael E. Wiles approved the interim assessment agreement on Thursday, a day after Toshiba Corp.-owned Westinghouse filed for bankruptcy protection in the Southern District of New York.

The agreement provides a 30-day transition period during which Georgia Power will pay to ensure work continues at Vogtle, while undertaking "a full-scale schedule and cost-to-complete assessment" of the effect of Westinghouse's bankruptcy on the new Vogtle units, MEAG's notice said.

Some $2.1 billion remains to be spent by the owners to complete the project under the current contract with Westinghouse, an amount that could increase due to losses from cost overruns.

MEAG owns a 22.7% interest in the two nuclear units, and has entered agreements to sell 69% of its generating capacity to JEA of Florida and PowerSouth Energy Cooperative in Alabama.

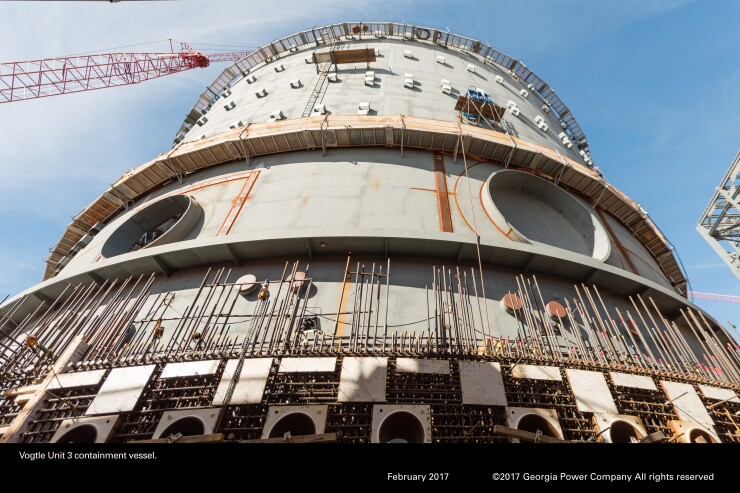

To finance its ownership share, MEAG issued $2.85 billion of M, J, and P nuclear project bonds for the Plant Vogtle construction, which is to use first-of-its-kind Westinghouse AP1000 nuclear reactor technology.

The financial stress at Westinghouse led Fitch Ratings, Moody's Investors Service, and S&P Global Ratings to place negative outlooks on MEAG's bonds, as well as those issued by other owners of the project.

MEAG's bonds are rated A-plus by Fitch and S&P, while Moody's assigns ratings of Baa2 and A2.

Westinghouse has said it lost billions from cost overruns on the Georgia nuclear project and a similar one in South Carolina, which pushed it and 29 related debtors to file for bankruptcy on March 29.

The bankruptcy petitions are being jointly administered under case number 17-10751.