Municipal bond issuers from coast to coast priced bonds in competitive deals on Tuesday, led by $700 million in general obligation bonds from Massachusetts and $595 million of GOs from the Los Angeles Unified School District.

Primary Market

Massachusetts (Aa1/AA/AA+), competitively sold $700 million of general obligation bonds in four offerings.

Morgan Stanley won the $400 million of Series 2019C GOs with a true interest cost of 3.726%. BofA Securities won the $100 million of Series 2019D GOs with a TIC of 2.9516%. RBC Capital Markets won the $100 million of Series 2019E GOs with a TIC of 3.5151%. JPMorgan Securities won the $100 million of Series 2019F GOs with a TIC of 1.7421%.

PFM Financial Advisors is the financial advisor; Locke Lord is the bond counsel.

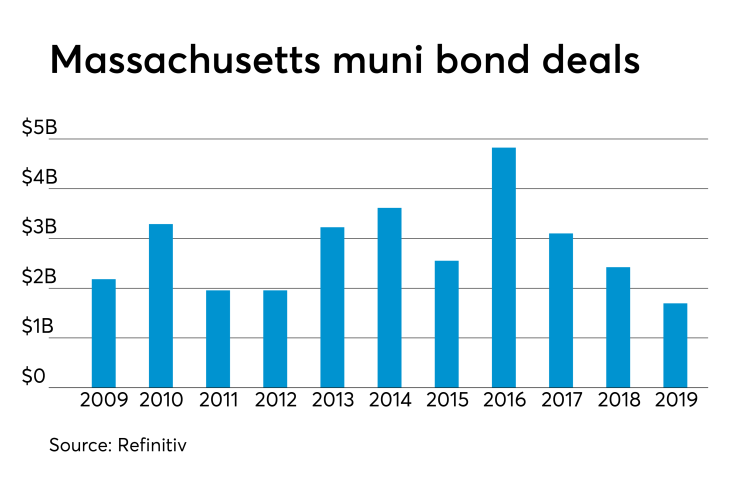

Since 2009, the Bay State has sold over $30 billion of bonds, with the most issuance occurring in 2016 when it issued $4.8 billion. Prior to this year, it sold the least amount of debt in 2011 and 2012 when it issued $1.96 billion in each of those years.

The Los Angeles Unified School District (Aa2/NR/AAA) competitively sold $594.61 million of Series 2019A GOs.

BofA won the issue with a TIC of 2.2175%. The deal was priced to yield from 1.35% in 2019 to 2.93% in 2034.

Proceeds will be used to current refund certain outstanding debt. Fieldman, Rolapp & Associates is the financial advisor; Hawkins Delafield is the bond counsel.

Baltimore, Md., (Aa2/AA/NR) sold $85 million of GO’s in two offerings. Citigroup won the $64.855 million of Series 2019A tax-exempt consolidated public improvement bonds with a TIC of 2.6776% while Robert W. Baird won the $20.145 million of Series 2019B taxable consolidated public improvement bonds with a TIC of 3.3031%.

Proceeds will be used to fund certain capital projects in the city. The financial advisor is PFM Financial Advisor; the bond counsel is McGuireWoods.

Morgan Stanley priced the Board of Regents of the University of Texas System (Aaa/AAA/AAA) $327.24 million of Series 2019A revenue financing system refunding bonds for retail investors ahead of the institutional pricing on Wednesday.

Morgan Stanley priced the Massachusetts Development Finance Agency’s (NR/BBB/NR) $137.69 million of Series 2019A tax-exempt revenue bonds for Atrius Health.

BofA priced Iowa’s (Aa2/AA/NR) $146.34 million of Series 2019A IJobs program special obligation refunding bonds.

UBS Financial Services priced Shreveport, La.’s (AGM: A2/AA/NR) $100 million of Series 2019B junior lien water and sewer revenue bond.

On Wednesday, Citigroup is expected to price the Pennsylvania Commonwealth Financing Authority’s (A1/A/A+) $502 million offering. The deal consists of $389 million of taxable revenue bonds and $113 million of tax-exempt revenue refunding bonds and forward delivery bonds.

Tuesday’s bond sales

Secondary market

Municipals remained stronger along with Treasuries on Tuesday as investors continued to worry about President Donald Trump’s threat to raise tariffs on billions of dollars of goods imported from China. Stock prices remained volatile to the lower side.

Munis were mostly stronger on the

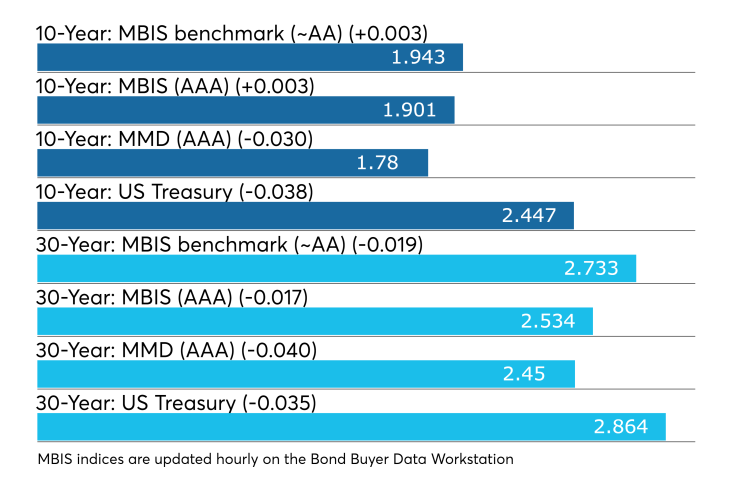

On Refinitiv Municipal Market Data’s AAA benchmark scale, the yield on the 10-year GO fell three basis points while the 30-year muni yield dropped four basis points.

The 10-year muni-to-Treasury ratio was calculated at 72.7% while the 30-year muni-to-Treasury ratio stood at 85.6%, according to MMD.

“The muni market continues to grind higher and flatter with the two-year/10-year ICE Muni Yield Curve spread narrowing to 27 basis points, the tightest since October 2018,” ICE Data Services said in a market comment. “The broader ICE Muni Yield Curve is roughly 1.5 basis points lower for the 10-year and longer dated maturities. High-yield was two basis points lower in the afternoon. Taxable yields were down 3.9 basis points in the 10-year, mirroring strength in Treasuries.”

ICE said Iowa bonds were lower among the smaller new issues being priced on Tuesday.

“Texas municipals are almost one basis points lower in yield,” ICE said. “It was reported that Internet tax legislation could net up to $850 million for Texas. The state’s Senate Finance Committee approved two bills, one for on-line sellers and another ‘market facilitator law,’ that collect taxes from remote sellers. The state is the latest of several taxing on-line sales: one such law in New York will take effect Sept. 1.”

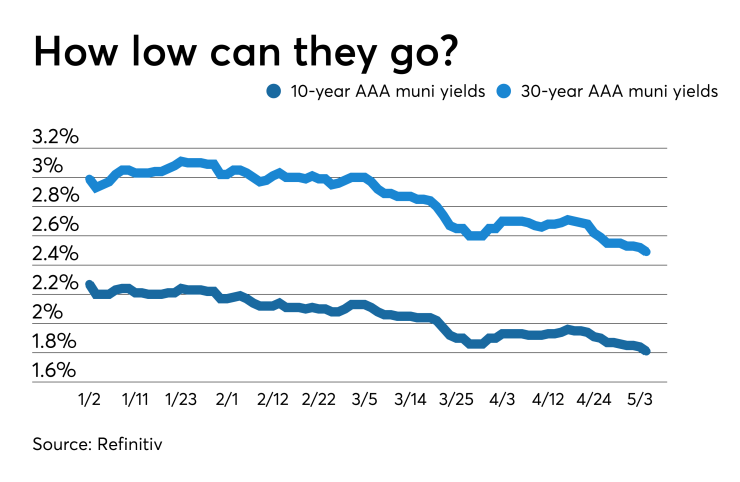

Trending lower

Muni yields have been trending lower all year. From Jan. 2 to May 6, the 10-year muni yield has sunk 46 basis points and the 30-year has dropped 50 basis points.

Jeffrey Lipton, managing director at Oppenheimer, said that he believes muni yields have the potential for further declines, if the supply/demand dynamics become even tighter.

"Long-dated bonds have become noticeably richer as pricier offerings on shorter maturities pushed investors out along the curve to capture better relative value opportunities," he said. "With abating fears of higher interest rates, investors are more comfortable extending duration to lock in more attractive yields."

He added that the muni market will enjoy its position as a safe haven, even though conventional wisdom would argue that the current low ratios should produce a market sell-off.

"Looking at the April volume data, we see further evidence that the supply/demand imbalance is very much alive," said Lipton. "We would think that May would offer more impressive supply figures given the currently low levels of absolute yields, favorable economic recovery data and a relatively benign muni credit backdrop."

Previous session's activity

The MSRB reported 34,713 trades on Monday on volume of $8.4634 billion. The 30-day average trade summary showed on a par amount basis of $12.36 million that customers bought $6.11 million, customers sold $4.07 million and interdealer trades totaled $2.18 million.

California, Texas and New York were most traded, with the Golden State taking 17.907% of the market, the Lone Star State taking 11.853% and the Empire State taking 10.037%.

The most actively traded security was the Puerto Rico Sales Tax Financing Corp.’s Restructured Series A-1 5s of 2058, which traded 61 times on volume of $36.85 million.

Treasury sells $38B 3-year notes

The Treasury Department auctioned $38 billion of three-year notes with a 2 1/8% coupon at a 2.248% high yield, a price of 99.645092. The bid-to-cover ratio was 2.48.

Tenders at the high yield were allotted 74.72%. All competitive tenders at lower yields were accepted in full. The median yield was 2.223%. The low yield was 2.140%.

Treasury to sell $50B 4-week bills

The Treasury Department said it will sell $50 billion of four-week discount bills Thursday. There are currently $34.999 billion of four-week bills outstanding.

Treasury also said it will sell $35 billion of eight-week bills Thursday.

Gary E. Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.