After a busier than usual Monday that featured one institutional pricing, as well as a premarketing and a retail order period, municipal market participants are waiting for more action Tuesday.

Secondary market

U.S. Treasuries were little changed on Tuesday. The yield on the two-year Treasury rose to 1.30% from 1.29% on Monday, while the 10-year Treasury yield was unchanged from 2.34%, and the yield on the 30-year Treasury bond increased to 3.01% from 3.00%.

Top-shelf municipal bonds were flat on Monday, as the yield on the 10-year benchmark muni general obligation was steady at 2.11% from Friday, while the 30-year GO yield was unchanged at 2.98%, according to a final read of Municipal Market Data's triple-A scale.

The 10-year muni to Treasury ratio was calculated at 90.2% on Monday, compared with 90.6% on Friday, while the 30-year muni to Treasury ratio stood at 99.1%, versus 99.6%, according to MMD.

MSRB: Previous session's activity

The Municipal Securities Rulemaking Board reported 37,982 trades on Monday on volume of $8.04 billion.

Primary market

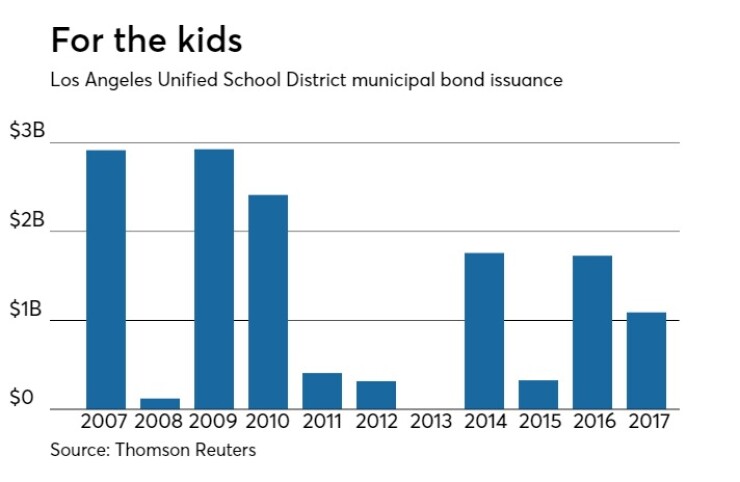

Morgan Stanley is scheduled to price the week’s largest issue, Los Angeles Unified School District’s $1.08 billion of general obligation refunding and dedicated unlimited ad valorem property tax bonds, for institutions on Tuesday.

On Monday, the deal was priced for retail investors, to yield 0.97% with a 5% coupon in 2019 and from 1.25% with a 4% coupon in 2021 to 2.26% with a 4% coupon and 5% coupon in a split 2027 maturity. The 2017 and 2018 maturities were offered as sealed bids. The deal is rated Aa2 by Moody’s Investors Service and AAA by Fitch Ratings.

Wells Fargo plans to price the Dormitory Authority of the State of New York’s $677 million of revenue tax exempt bonds and taxable bonds for New York University on Tuesday following indications of interest Monday.

On Monday, market sources said the $452 million of tax-exempts was pre-marketed to yield from 1.02% with a 4% coupon in 2019 to 3.48% with a 4% coupon in 2040. A term bond in 2043 was pre-marketed to yield 3.51% with a 4% coupon.

According to a market source, a price talk was circulated for the $225 million taxable bond portion, with the 2019 maturity about 30 basis points above the comparable Treasury and the 2034 maturity about 150 basis points above the comparable Treasury. A term bond in 2039 was about 110 basis points above the comparable Treasury and one in 2047 was about 125 basis points above the comparable Treasury. The deal is rated Aa2 by Moody’s and AA-minus by S&P Global Ratings.

Also on Tuesday, Barclays is expected to price the California Health Facilities Authority’s $281.715 million of revenue bonds for the Children's Hospital of Los Angeles. The deal is expected to mature serially from 2030 through 2037 and include terms in 2042, 2047 and 2049 and is rated Baa2 by Moody’s and BBB-plus by S&P.

Barclays is also scheduled to price the Connecticut Health and Educational Facilities Authority’s $200 million of revenue bonds for Yale University. The deal is expected to feature a five-year mandatory PUT and is rated triple-A by Moody’s and S&P.

Citi is slated to price the South Dakota Housing Development Authority’s $166 million of homeownership mortgage bonds, which is anticipated to include taxable, non-alternative minimum tax and non-AMT portions. The deal is rated triple-A by Moody’s and S&P.

In the competitive arena, the largest sale will come from the Phoenix Civic Improvement Corp., when it auctions $215.87 million of subordinate excise tax revenue and refunding bonds Tuesday.

Bond Buyer 30-day visible supply

The Bond Buyer's 30-day visible supply calendar increased $270.2 million to $14.53 billion on Tuesday. The total is comprised of $4.41 billion of competitive sales and $10.12 billion of negotiated deals.