Municipal bonds ended Monday a tad weaker, traders said, as the market waited for the week's new issuance to start hitting screens on Tuesday.

Secondary Market

The yield on the 10-year benchmark muni general obligation rose one basis point to 1.45%, from 1.44% on Friday, while the yield on the 30-year muni was a basis point higher at 2.18%, according to a final read of Municipal Market Data's triple-A scale.

Treasuries were mixed at the close on Monday. The yield on the two-year Treasury was flat at 0.72% from Friday, the 10-year Treasury yield was up to 1.59% from 1.58% and the yield on the 30-year Treasury bond decreased to 2.30% from 2.31%.

On Monday, the 10-year muni to Treasury ratio was calculated at 91.7% compared to 91.1% on Friday, while the 30-year muni to Treasury ratio stood at 94.9% versus 94.0%, according to MMD.

Primary Market

After an expected slow day on Monday with no larger deals pricing, municipal market participants are ready for the week's new issuance to start rolling in.

There are $5.80 billion of negotiated deals set for this week along with $2.05 billion of competitive sales. The action will get started with a bang on Tuesday, as the biggest deal of the week – a $1.21 billion competitive sale from the state of Pennsylvania – arrives.

The Keystone State will be offering up the Second Series of 2016 general obligation bonds, which are rated Aa3 by Moody's Investors Service and AA-minus by S&P Global Ratings and Fitch Ratings.

"Given the strong mutual fund flows into the market, and the positive technical backdrop for the market overall we feel most high quality issuers that come to the market (including Pennsylvania) will see very good demand," said Michael Pietronico, CEO at Miller Tabak Asset Management. "While Friday's employment report may move market yields higher over the next few days, it remains, in our view, a bond market that rewards investors who seek opportunities to invest at lower prices."

In the negotiated sector on Tuesday, Barclays Capital Markets is set to price for retail investors the Regents of the University of California Medical Center's $1.05 billion of Series 2016L bonds and Series 2016M taxables. The deal, which will be priced for institutions on Wednesday, is rated Aa3 by Moody's and AA-minus by S&P.

Raymond James is expected to price the Fort Worth Independent School District, Texas' $374.44 million of unlimited tax refunding and school building bonds. The deal, which is backed by the Permanent School Fund guarantee program, is rated triple-A by Moody's and S&P.

Davidson Securities is set to price Lake Washington School District No. 414, King County, Wash.'s $203.7 million of Series 2016 unlimited tax GO and refunding bonds. The deal is rated Aa1 by Moody's and AA-plus by S&P.

Siebert Brandford Shank is expected to price the Bexar Hospital District, Texas' $190.36 million of Series 2016 limited tax refunding bonds. The deal is rated Aa1 by Moody's and AA-plus by S&P and Fitch.

Wells Fargo Securities is set to price Will County, Ill.'s $175 million of Series 2016 alternative revenue source GOs. The deal is rated triple-A by Moody's and S&P.

Citigroup is expected to price the Lexington County, S.C., Health Service District Inc.'s $171 million of hospital revenue bonds. The deal is rated A1 by Moody's, AA-minus by S&P and AA-plus by Fitch.

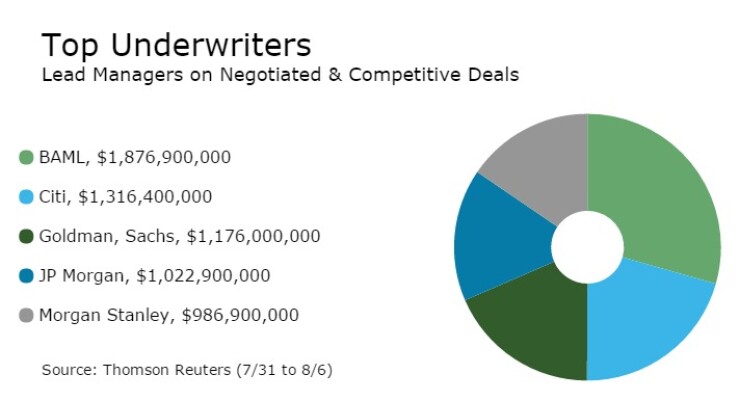

Previous Week's Top Underwriters

The top negotiated and competitive underwriters of last week included Bank of America Merrill Lynch, Citigroup, Goldman, Sachs & Co., JPMorgan Securities and Morgan Stanley, according to Thomson Reuters data. In the week of July 31-Aug. 6, Bank of America Merrill Lynch underwrote $1.88 billion, Citigroup $1.32 billion, Goldman, Sachs & Co. $1.18 billion, JPMorgan Securities $1.02 billion and Morgan Stanley $987 million.

BlackRock's Muni Market Update

The municipal market posted its 13th consecutive month of positive performance, matching a record seen only once since 1992, according to BlackRock's municipal group report released Monday. "July proved that income pays, as the 13th month in a row of positive performance is due to income generation offsetting price losses and boosting total return," according to the report.

"The broad financial markets breathed a post-Brexit sigh of relief in July, with equities and other risk assets benefiting and higher-quality assets lagging as investors assumed a 'risk-on' stance," said the report. "Shifting expectations around the course of Federal Reserve rate normalization created uncertainty. Nevertheless, performance in the muni market highlighted the premium being paid for income-producing assets."

The group said a favorable supply/demand dynamic – specifically, net negative supply – continues to provide support and should help drive munis through the remainder of the summer.

"We remain positive on the asset class given this technical tailwind as well as munis' ability to act as high-quality, low-volatility portfolio diversifiers. Uncertainty over the Fed's path, U.S. economic data and the upcoming election, to name a few, will likely result in a fairly tight trading range. In this environment, we believe opportunities will be found in the primary market and in active trading strategies. We remain constructive and continue to favor the A-rated space, revenue bonds, and the health care and transportation sectors."

Fiscal year 2016 marked the first time state spending, adjusted for inflation, surpassed the pre-recession peak, based on figures from the National Association of State Budget Officers, the report noted. Spending rose 5.5%, while revenue growth was up only 2.8%. Fiscal year 2017 budgets target an average 2.5% spending growth rate, while expected revenue growth is pegged at a fairly modest 3%.

"As revenues lag, fiscal flexibility has been key, with 18 states requiring mid-year budget cuts in fiscal year 2016. This compared to only eight two years ago. While oil-producing states have followed through with substantial cuts, the use of reserves in many other states to close mid-year gaps will be problematic should economic growth slow or fall into recession."

The group also believes that with revenue growth lagging spending growth in critical areas, such as Medicaid and K-12 education, pension funding will also be further constrained, especially in the current low-interest-rate environment. Many local governments may be forced to increase pension contributions and take on riskier investments as competing needs chase scarce resources.

"The S&P Municipal Bond Index returned 0.02% in July, bringing the year-to-date return to 4.37%. On the month, credit and short to intermediate maturities outperformed, as long-dated yields reset from the all-time lows seen in the immediate wake of the Brexit vote. Attractive muni-to- Treasury ratios should continue to support demand for the tax-exempt asset class as the investor search for high-quality income continues."

Bond Buyer Visible Supply

The Bond Buyer's 30-day visible supply calendar increased $390.7 million to $11.77 billion on Tuesday. The total is comprised of $3.86 billion of competitive sales and $7.91 billion of negotiated deals.

Prior Week's Actively Traded Issues

Revenue bonds comprised 51.31% of new issuance in the week ended Aug. 5, up from 51.08% in the previous week,

Some of the most actively traded issues by type were from New York, Texas and Wisconsin issuers. In the GO bond sector, the NYC 4s of 2035 were traded 71 times. In the revenue bond sector, the University of Texas 2s of 2041 were traded 57 times. And in the taxable bond sector, the Wisconsin 3.294s of 2037 were traded 50 times.