The muni market is prepared and eagerly awaiting the week's issuance to start hitting screens, as it is expected to be a busy day with the largest deal of the week pricing along with a handful of other notable deals.

Secondary Market

Treasuries were mostly stronger on Tuesday morning. The yield on the two-year Treasury was higher at 0.73% from 0.72% on Monday, the 10-year Treasury yield was down to 1.57% from 1.59% and the yield on the 30-year Treasury bond decreased to 2.28% from 2.30%.

Munis were slightly weaker at Monday's close. The yield on the 10-year benchmark muni general obligation rose one basis point to 1.45% from 1.44% on Friday, while the yield on the 30-year muni was a basis point higher at 2.18%, according to a final read of Municipal Market Data's triple-A scale.

On Monday, the 10-year muni to Treasury ratio was calculated at 91.7% compared to 91.1% on Friday, while the 30-year muni to Treasury ratio stood at 94.9% versus 94.0%, according to MMD.

Primary Market

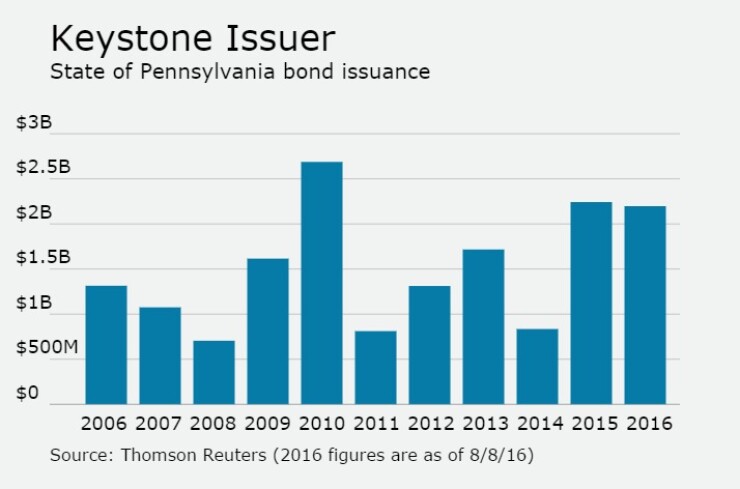

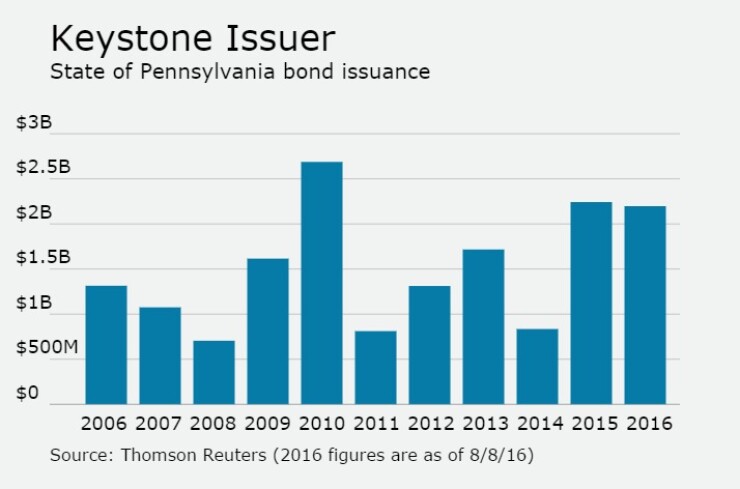

Pennsylvania is set to sell $1.21 billion of general obligation bonds on Tuesday. The second series of 2016 GO bonds are rated Aa3 by Moody's Investors Service and AA-minus by S&P Global Ratings and Fitch Ratings.

Since 2006, the Keystone State has issued $16.51 billion of securities, with the largest issuance coming in 2010 when it sold $2.69 billion. Tuesday's sale will put the state over $2 billion for the year, the second consecutive year it has issued that much. The state has only issued less than $1 billion in a year three times in past decade: in 2008, 2011 and 2014.

In the negotiated sector on Tuesday, Raymond James is expected to price the Fort Worth Independent School District, Texas' $374.44 million of unlimited tax refunding and school building bonds. The deal, which is backed by the Permanent School Fund guarantee program, is rated triple-A by Moody's and S&P.

Davidson Securities is set to price Lake Washington School District No. 414, King County, Wash.'s $203.7 million of Series 2016 unlimited tax GO and refunding bonds. The deal is rated Aa1 by Moody's and AA-plus by S&P.

Siebert Brandford Shank is expected to price the Bexar Hospital District, Texas' $190.36 million of Series 2016 limited tax refunding bonds. The deal is rated Aa1 by Moody's and AA-plus by S&P and Fitch.

Wells Fargo Securities is set to price Will County, Ill.'s $175 million of Series 2016 alternative revenue source GOs. The deal is rated triple-A by Moody's and S&P.

Citigroup is expected to price the Lexington County, S.C., Health Service District Inc.'s $171 million of hospital revenue bonds. The deal is rated A1 by Moody's, AA-minus by S&P and AA-plus by Fitch.

Retail investors will also have a chance to get in on the action, as Barclays Capital Markets is set to price the Regents of the University of California Medical Center's $1.05 billion of Series 2016L bonds and Series 2016M taxable for retail investors. The deal, which will be priced for institutions on Wednesday, is rated Aa3 by Moody's and AA-minus by S&P.

MSRB: Previous Session's Activity

The Municipal Securities Rulemaking Board reported 29,442 trades on Monday on volume of $8.139 billion.

Bond Buyer Visible Supply

The Bond Buyer's 30-day visible supply calendar increased $390.7 million to $11.77 billion on Tuesday. The total is comprised of $3.86 billion of competitive sales and $7.91 billion of negotiated deals.