After a sleepy Monday, which saw no primary action and little secondary action, municipal market participants are ready for the lion's share of what little new issuance is planned this week to hit the market. Munis were steady according to traders.

Secondary Market

U.S. Treasuries were weaker on Tuesday morning. The yield on the two-year Treasury rose to 1.24% from 1.22% on Monday, while the 10-year Treasury yield gained to 2.58% from 2.53%, and the yield on the 30-year Treasury bond increased to 3.16% from 3.11%.

Top-shelf municipal bonds closed out Monday stronger, as the yield on the 10-year benchmark muni general obligation was three basis points lower to 2.45% from 2.48% on Friday, while the yield on the 30-year decreased three basis points to 3.18% from 3.21%, according to a final read of Municipal Market Data's triple-A scale.

The 10-year muni to Treasury ratio was calculated at 96.7% on Monday, compared with 95.4% on Friday, while the 30-year muni to Treasury ratio stood at 102.3%, versus 100.8%, according to MMD.

Primary Market

Volume for this week is forecast by Ipreo to drop to $481 million, from a revised $4.17 billion in the previous week, according data from Thomson Reuters. The calendar is comprised of $210 million of negotiated deals and $271 million of competitive sales.

There are no negotiated deals on the calendar larger than $100 million; in fact, the largest negotiated deal is just $62 million. The bulk of the issuance comes on Tuesday.

The commonwealth of Massachusetts is scheduled to set sell two competitive deals, totaling $188.49 million of general obligation refunding SIFMA index bonds on Tuesday. The sales are broken down into $100 million and $88.49 million. Both parts are rated Aa1 by Moody's Investors Service and AA-plus by S&P Global Ratings and Fitch Ratings.

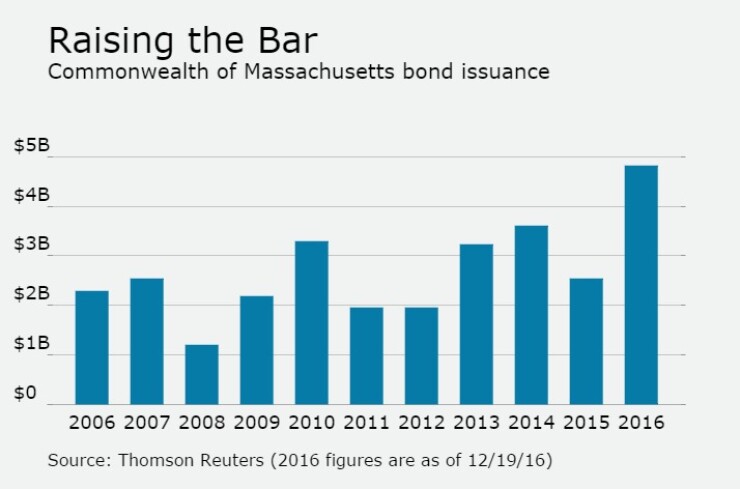

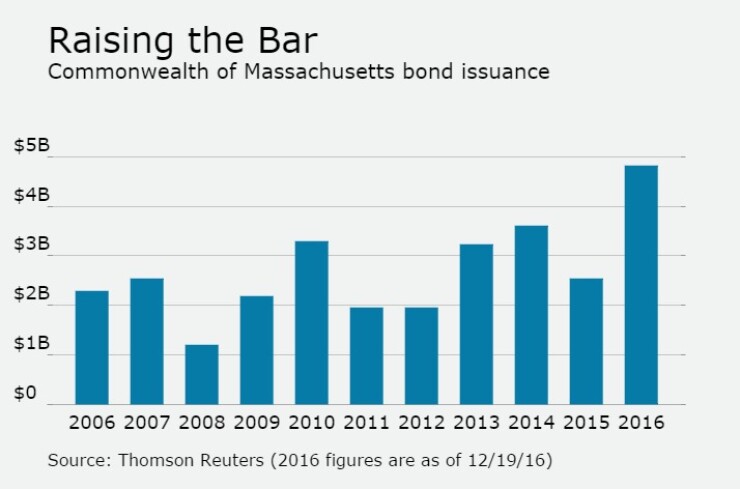

Since 2006, the Bay State has sold roughly $29.64 billion of securities, with the largest issuance before this year occurring in 2014 when it sold $3.6 billion. With Tuesday's sales, it puts the commonwealth at roughly $4.8 billion of issuance this year. Massachusetts has issued over $1 billion in every year since 2006 and saw the lowest issuance in 2008 with $1.2 billion.

George K. Baum and Co. is slated to run the books for the Weld County School District RE-1 Colo.'s $62 million GO bonds. It is expected some maturities will be insured by Assured Guaranty. The deal and is rated Aa2 by Moody's and AA by S&P.

The Florida Board of Governors will be selling $53.725 million of dormitory revenue refunding bonds for Florida Atlantic University. The deal is rated A1 by Moody's, A by S&P and A-plus by Fitch.

Mesirow Financial is expected to price Community High School District No. 28, Ill.'s $51.21 million of taxable GO limited tax school bonds and qualified school construction bonds. The deal is rated Aa3 by Moody's.

MSRB: Previous Session's Activity

The Municipal Securities Rulemaking Board reported 52,825 trades on Monday on volume of $12.858 billion.

Bond Buyer Visible Supply

The Bond Buyer's 30-day visible supply calendar decreased $145.2 million to $5.65 billion on Tuesday. The total is comprised of $1.34 billion of competitive sales and $4.31 billion of negotiated deals.