Munis finished the day unchanged, according to traders, as they worked their way through a busy day of deals, including the largest sale of the week.

"It was a busy day but that is a good thing," said a New York trader. "Deals were getting done and it was business as usual. I expect more of the same tomorrow."

Bank of America Merrill Lynch won Pennsylvania's $1.21 billion of general obligation bonds with a true interest cost of 2.75%. The bonds were priced to yield from 0.67% with a 5% coupon in 2017 to 3.101% with a 3% coupon in 2036.The second series of 2016 GO bonds are rated Aa3 by Moody's Investors Service and AA-minus by S&P Global Ratings and Fitch Ratings, with the exception of the $80.270 million 2033 maturity, which is insured by Assured Guaranty.

Other market sources indicated that the Pennsylvania deal was a "blowout" and that some maturities are trading better than the original pricing.

"It was over[subscribed] by a good amount," the trader said.

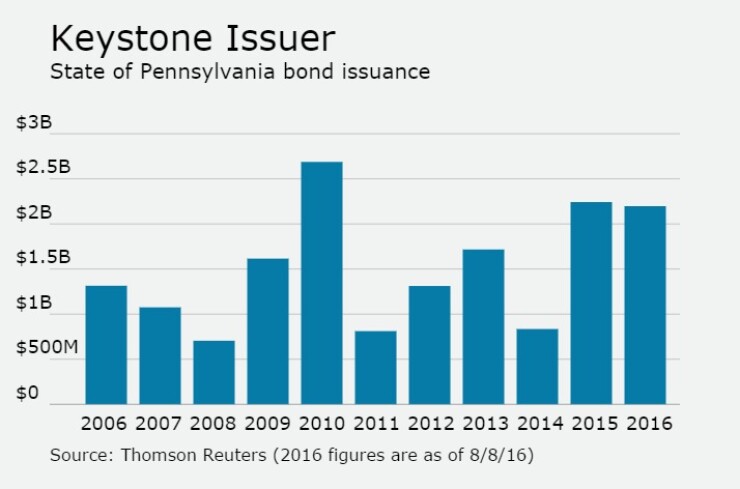

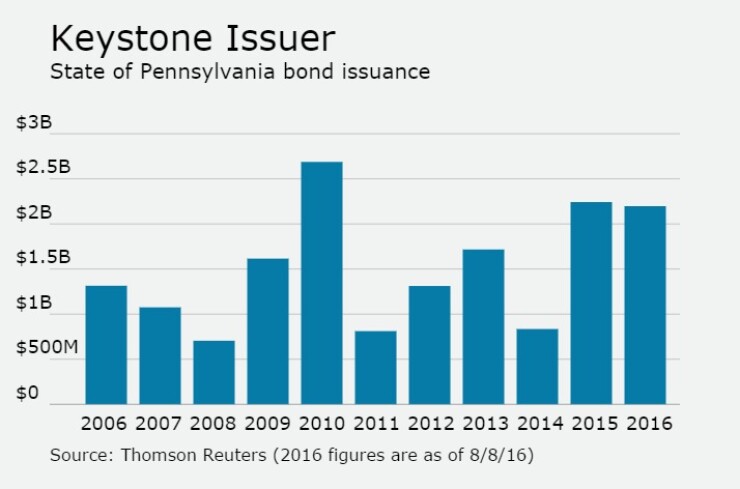

Since 2006, the Keystone State has issued $16.51 billion of securities, with the largest issuance coming in 2010 when it sold $2.69 billion. Tuesday's sale will put the state over $2 billion for the year, the second year in a row it has issued that much. The state has only issued less than $1 billion in a year three times in past decade: in 2008, 2011 and 2014.

Also in the competitive arena, the Louisville/Jefferson County Metropolitan Sewer District sold $150 million. The sewer and drainage system revenue bonds were won by Wells Fargo with a TIC of 3.18%. The bonds were repriced to yield from 0.65% with a 5% coupon in 2018 to 3.20% with a 3% coupon in 2043. A term bond in 2046 was priced to yield 3.18% with a 3% coupon and a term bond in 2047 was priced to yield 3.20% with a 3% coupon.

The district also plan two separate competitive sales Wednesday totaling $102.03 million of sewer and drainage system revenue refunding bonds. The deal is rated Aa3 by Moody's and AA by S&P.

In the negotiated sector on Tuesday, Raymond James priced and then repriced the Fort Worth Independent School District, Texas' $382.525 million of unlimited tax refunding and school building bonds. The bonds were repriced to yield from 0.50% with a 2% coupon in 2017 to 2.61% with a 4% coupon in 2039. A term bond in 2041 was priced to yield 2.64% with a 4% coupon. The deal, which is backed by the permanent school fund guarantee program, is rated triple-A by Moody's and S&P.

Robert W. Baird & Co. priced the state of Hawaii's $204.835 million of highway revenue bonds. The $103.550 million of series 2016A bonds were priced to yield from 0.52% with a 3% coupon in 2018 to 2.55% with a 4% coupon in 2036. The 2017 maturity was offered as sealed bid.

The $101.285 million of series 2016B bonds were priced to yield from 0.90% with a 4% coupon in 2021 to 1.99% with a 5% coupon in 2030. The 2017 maturity was offered as a sealed bid. The deal is rated Aa2 by Moody's, AA-plus by S&P and AA by Fitch.

Siebert, Brandford Shank & Co. priced the Bexar County Hospital District, Texas's $201.165 million of limited tax refunding bonds. The bonds were priced to yield 0.40% with a 1.50% coupon in 2017 and from 0.72% with a 4% coupon in 2019 to 3.06% with a 3% coupon in 2037. The deal is rated Aa1 by Moody's and AA-plus by S&P and Fitch.

Citi priced the Lexington County Health Services District, S.C.'s $176.58 million of hospital revenue bonds to yield from 3.09% with a 3% coupon in 2033 to 2.68% with a 5% coupon in 2037. A term bond in 2041 was priced to yield 2.73% with a 5% coupon and term bond in 2046 was priced to yield 3.07% with a 4% coupon and 2.77% with a 5% coupon in a split maturity. The deal is rated A1 by Moody's, AA-minus by S&P and A-plus by Fitch.

Wells Fargo priced the County of Will, Ill.'s $175 million of GO bonds. The bonds were priced to yield from 0.66% with a 3% coupon in 2017 to 0.77% with a 4% coupon in 2018. The bonds were also priced to yield from 1.88% with a 5% coupon in 2026 to 2.80% with a 4% coupon in 2036. A term bond in 2041 was priced to yield 2.62% with a 5% coupon and a term bond in 2045 was priced to yield 2.65% with a 5% coupon. The deal is rated Aa1 by Moody's and AA-plus by S&P.

BAML priced Leigh County, Pa's $135.98 million of general purpose authority hospital revenue refunding bonds for the Lehigh Valley Health Network. The bonds were priced to yield from 0.70% with a 5% coupon in 2017 to 2.86% with a 4% coupon in 2033. They were also priced to yield from 2.96% with a 4% coupon in 2033 to 2.96% with a 3% coupon in 2036. A term bond in 2038 was priced to yield 3.18% with a 3.125% coupon. The deal is rated A1 by Moody's and A-plus by S&P.

The action will pick up right where it left off on Wednesday, as deals that are expected to price include the second billion dollar issue of the week.

Barclays Capital Markets is expected to price the Regents of the University of California Medical Center's $1.05 billion of Series 2016L bonds and Series 2016M taxable on Wednesday after a one day retail order period on Tuesday. The deal is rated Aa3 by Moody's and AA-minus by S&P.

Citi is scheduled to price the Utility Debt Securitization of New York's 475 million of restructuring bonds. The deal is rated triple-A by the big three rating agencies.

In the competitive arena, The Louisville/Jefferson County Metropolitan Sewer District will be selling two separate sales totaling $102.03 million of sewer and drainage system revenue refunding bonds. The deal is rated Aa3 by Moody's and AA by S&P.

Citi is also slated to price the city of Port St. Lucie, Fla.'s $210 million of utility system revenue refunding bonds. The deal is rated A-plus by both S&P and Fitch.

Piper Jaffray is expected to price Johnson County, Kan. Unified School District's $191.075 million of GO bonds. The deal is rated Aa2 by Moody's and AA by S&P.

Secondary Market

Munis finished the day unchanged on Tuesday. The yield on the 10-year benchmark muni general obligation was steady at 1.45% from Monday, while the yield on the 30-year muni was flat at 2.18%, according to a final read of Municipal Market Data's triple-A scale.

Treasuries were stronger at Tuesday's close. The yield on the two-year Treasury was lower to 0.71% from 0.72% on Monday, the 10-year Treasury yield was down to 1.56% from 1.59% and the yield on the 30-year Treasury bond decreased to 2.27% from 2.30%.

On Tuesday, the 10-year muni to Treasury ratio was calculated at 93.9% compared to 91.7% on Monday, while the 30-year muni to Treasury ratio stood at 96.6% versus 94.9%, according to MMD.

Bond Buyer Visible Supply

The Bond Buyer's 30-day visible supply calendar decreased $1.933 billion to $9.83 billion on Wednesday. The total is comprised of $3.09 billion of competitive sales and $6.74 billion of negotiated deals.