New York State lawmakers packaged revenue, social justice, market positioning and political muscle when they passed a legalized marijuana bill separate from the fiscal 2022 state budget.

The state is also taking a step into the great unknown, given the volatility of weed as a funding source — even more so than traditional sin taxes such as alcohol, tobacco and gambling.

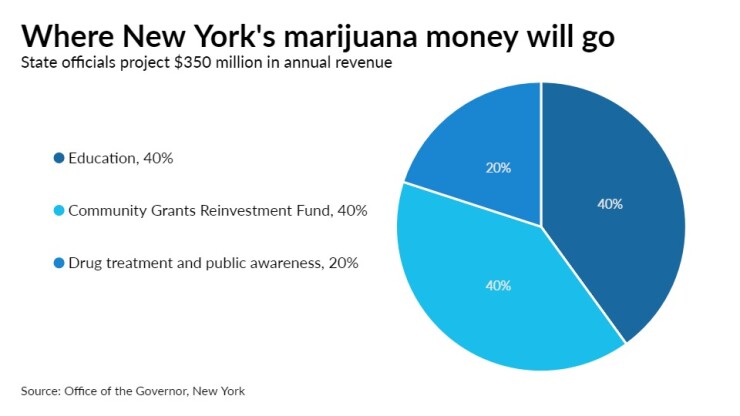

Gov. Andrew Cuomo’s administration has projected about $350 million annually from the

Lawmakers and Cuomo’s administration on Thursday were hashing out details to the nearly $200 billion FY22 budget, which is now late. New York, with the nation’s earliest budget deadline, operates on an April 1 fiscal year. Talks could extend into the weekend or even next week.

"We have quite a few budget bills remaining to get done," Senate finance committee chairwoman Liz Krueger, D-Manhattan, said on the floor Wednesday night in Albany.

Taxation and school aid appear to be the sticking points. The legislature is proposing $7 billion in new taxes on corporations and wealthy people — even with the state in store for $12.6 billion under the American Rescue Plan — along with $4 billion more in school aid. That contrasts with Cuomo’s more moderate offerings.

Cuomo’s diminished political strength amid multiple scandals enabled the legislature to move more assertively on marijuana, with Krueger, the bill’s prime sponsor, running point.

“That was very, very big,” said Anthony Figliola, vice president at government-relations firm Empire Government Strategies. “Typically, during the budget cycle the governor builds in matters unrelated to the budget. This time, the legislature pushed back. They wanted a separate bill before they passed the budget.”

That didn't stop Cuomo from touting the marijuana bill as a win as he seeks cover. Multiple women have accused him of sexual misconduct. Separately, he faces an FBI investigation over charges that his administration falsified COVID-19 related nursing home deaths. In addition, a legislative impeachment inquiry is under way.

Reports have also surfaced about a cover-up of structural deficiencies on the Gov. Mario M. Cuomo/Tappan Zee Bridge, which bears the name of the governor's father.

Lawmakers stripped Cuomo of his COVID-19 emergency powers as the scandals mushroomed, but his budgetary emergency powers remain intact. Delays in the weed bill past Thursday could have enabled Cuomo to force a take-it-or-leave it package as part of the budget bill, according to Figliola.

Under the pot bill, 40% of the revenue will go to the State Lottery Fund for public education, 40% for so-called equity programs in communities harmed by prior drug laws and 20% for drug treatment and prevention programs. It creates an office of cannabis management to implement the program, with half the licenses dedicated to equity applicants.

It enables persons aged 21 and older to legally possess up to three ounces. Social consumption sites, or “lounges” could open next year at the earliest, after the regulatory framework is in place. Meanwhile, people with marijuana-related convictions for offenses that are now legal will have their records expunged.

The tax structure that will replace a weight-based tax with a tax per milligram of THC — the main the main psychoactive compound in cannabis — at the distributor level with different rates depending on final product type. The state-level excise tax will be 9% with the local levy at 4%.

While municipalities are in line for 75% of the local retail tax revenue, counties will get 25%.

“The counties are involved because of crime, driving … police activity,” Figliola said.

Officials cited revenue gains in other states. Colorado usually collects more than $20 million a month, and California collects more than $50 million a month. In fiscal 2019, Washington state collected a total of $395.5 million in legal marijuana income and licensing fees.

The $350 million revenue estimate begs the question of whether that projection is overly rosy.

“I’ve known Albany for many years and they tend to throw numbers out there,” Figliola said. “Case in point was the casino. It was supposed to be the biggest thing and pre-pandemic, it was a flop.”

Other states face the same open question, said Adam Levin, a principal associate with the state fiscal health project at Pew Charitable Trusts.

Tax revenue from marijuana, uncertain even in normal times, could be even harder to gauge given pandemic-driven economic disruptions and consumer behavior shifts.

“It’s brand-new with no history for budget forecasters, unlike tobacco or marijuana,” he said. “New York’s a big state, obviously. It will be very interesting. The pandemic recession is one thing to look at.

“There’s definitely a revenue bump in the beginning, but inevitably the growth in revenue begins to slow,” Levin said. “It’s hard to predict.”

According to Levin, states should not rely in sin-tax revenue alone to fund matters that need recurring revenue sources. “They may need to supplement it,” he said.

Communities can opt out from having adult-use dispensaries or lounges The mayors of Freeport and Rockport Center, both on Long Island, have already said they would. They cited public-safety concerns, including impaired driving.

New York Mayor Bill de Blasio said the plusses outweigh the minuses.

“Like every other challenge in society, bring it out in the open and address it,” he told reporters. “That’s a hell of a lot better than having a shadow economy and thinking it will work for us.”

In what amounts to a game of northeast money chase similar to the sports betting phenomenon, New York is joining northeast neighbors Massachusetts, New Jersey and Vermont in legalizing cannabis. New Jersey, where voters approved legalization last fall, firmed up its mechanism last month.

Connecticut could be next. Its legislature is tweaking Gov. Ned Lamont’s bill to add social-justice provisions.

“The Connecticut General Assembly should follow New York's lead and take immediate action to protect Connecticut consumers and end its failed policy,” said DeVaughn Ward, director of the Connecticut Coalition to Regulate Marijuana and senior legislative counsel at the Marijuana Policy Project.

The marijuana bill and the Cuomo scandals have eclipsed nuts-and-bolts discussion over the budget, which include worries by corporate leaders that high taxation levels could hinder the state and New York City in their comeback efforts and foster an image of the state as inhospitable for business.

“Miami Beach is welcoming 4,000 New Yorkers. Starwood Capital is moving down there,” Figliola said. “Hedge funds are going down there.”

This comes amid a leftward drift in the legislature, with factions eyeballing the governor’s office if a Cuomo resignation or impeachment materializes.

“For better or worse, the pandemic has demonstrated that our workforce is more mobile than we ever imagined,” a group of 250 business leaders said in a letter to Cuomo. “This is not about companies threatening to leave the state; this is simply about our people voting with their feet. … This is what happened to New York during the 1970s, when we lost half our Fortune 500 companies, and it took 30 years to recover.”

The group included Jane Fraser, chief executive of Citi; Jeffrey Barker, president of Bank of America New York; and Kathryn Wylde, president of the Partnership for New York City.

“There is a tipping point. We don't know exactly what that is,” said Robert Mujica, Cuomo’s budget director. “We know a lot of New Yorkers have left New York. We know that the unemployment rate right now is relatively high.

“Whatever we do on the tax side, we want to make sure, right, that we're striking that balance with funding the items for the recovery, but at the same time, not discouraging job growth and not discouraging those jobs from coming back to New York."

Moody’s Investors Service rates the state’s general obligation bonds Aa2 with a stable outlook. S&P Global Ratings and Fitch Ratings each assign AA-plus ratings with negative outlooks.

With a $3.5 billion commitment in the budget, the state has fully repaid $4.5 billion it borrowed last year after the federal government pushed the income tax payment by three months to July. The state had already made a $1 billion payment in December.